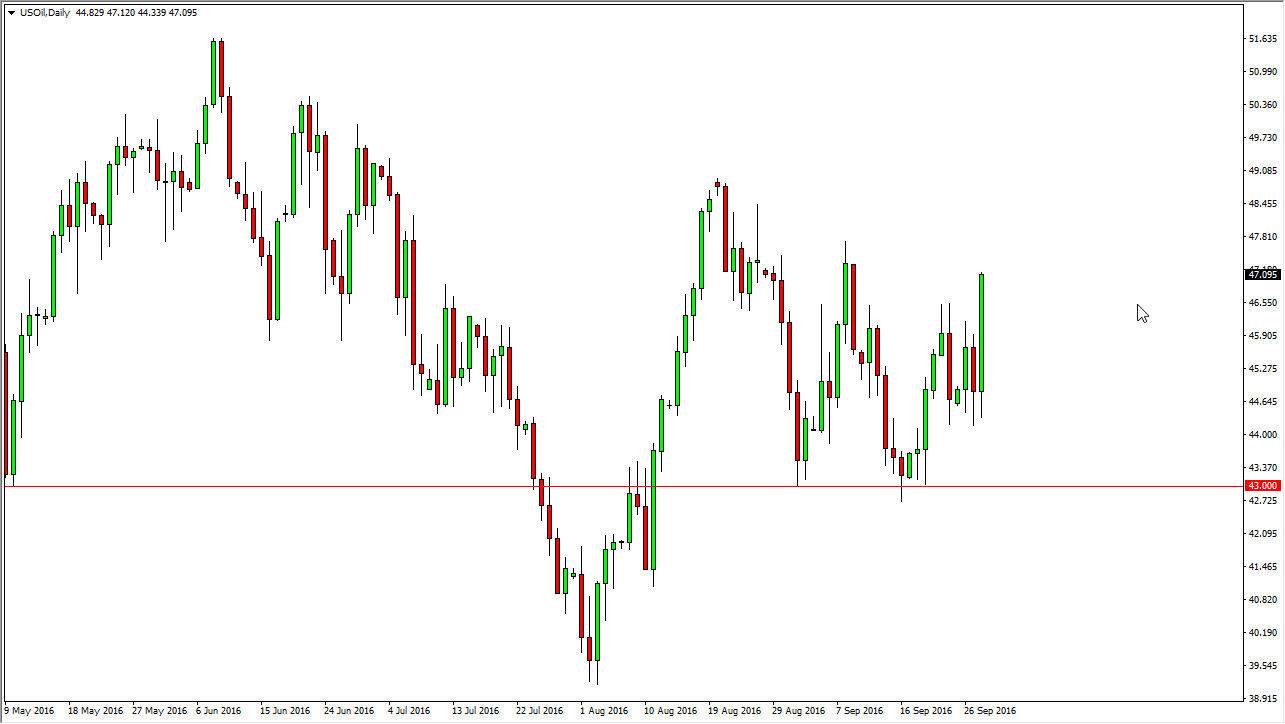

WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Wednesday, but turned right back around to form a massive positive candle. That being the case, looks as if we are going to try to go higher but I see a tone of resistance above. Ultimately, I think it’s only a matter time before he for some type of exhaustive candle, and with that being the case I am simply sitting on the sidelines at this point in time.

This is a market that will have to do with the oversupply, even though we got extraordinarily bullish inventory numbers today. That’s what most of this reaction has been, a knee-jerk reaction to that announcement. Because of this, it’s only a matter time before the sellers get involved as output should continue to be very high.

Natural Gas

The natural gas markets went back and forth during the course of the session on Wednesday, but ultimately ended up forming a hammer. That’s not a huge surprise, we are seeing quite a bit of support here recently and the hammer suggests that the buyers are starting to become a little bit more aggressive again. If we can break above the top of that hammer, I believe that the market then goes to the $3.10 level above, which of course was the most recent high that this market has seen. I also believe that we will go much higher than that, perhaps as high as the $3.40 level over the next several weeks or even months.

A break down below the $2.90 level starts to show weakness that we may have to pay attention to. If we can get below the $2.85 level below, I believe that the market then breaks down significantly, and perhaps changes the trend overall. At this point in time though, it appears that the buyers are getting the upper hand.