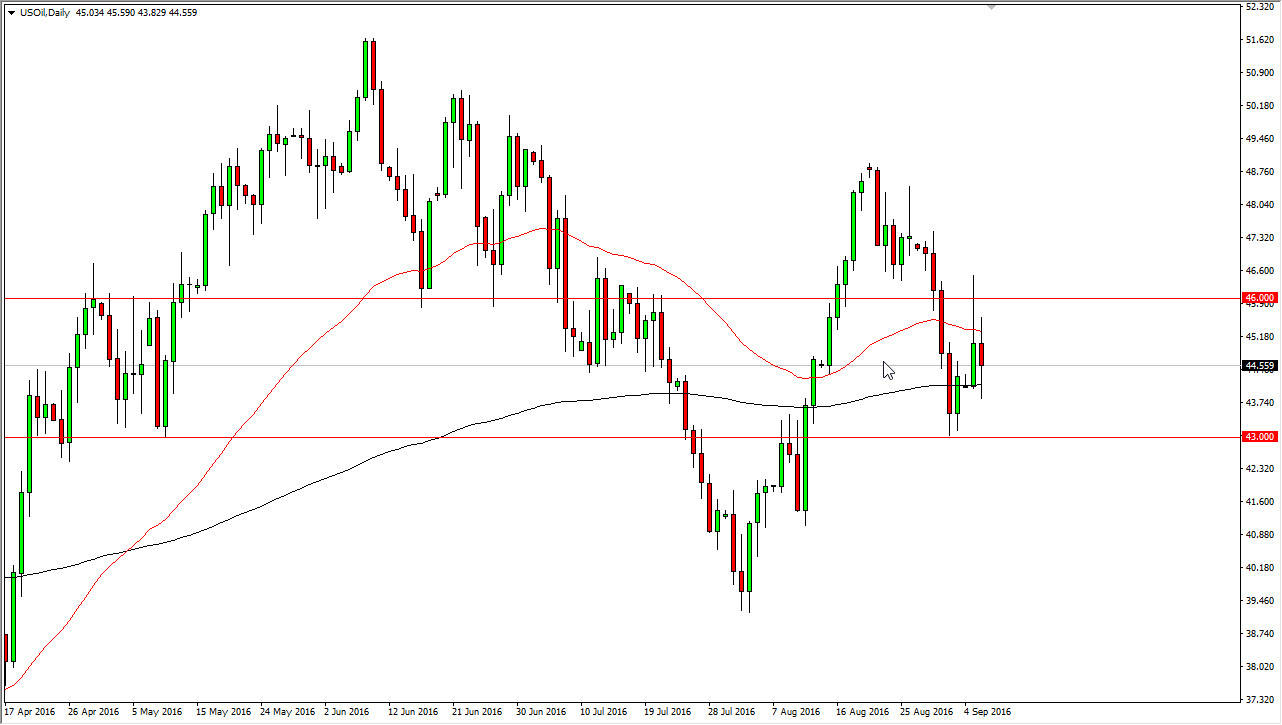

WTI Crude Oil

The WTI Crude Oil market went back and forth during the course of the day on Tuesday, as we continue to see quite a bit of volatility. The resulting candle was very neutral and hand two long wicks, which tells me just how confused the market is at this point in time. I believe that we’re going to continue to consolidate between the $43 level on the bottom, and the $46 level on the top. With this being the case, I think short-term trading continues to be the only way to handle this market, as volumes are just now starting to pick up from the summer season. With that being the case, I think that you will have to look to the range bound systems in order to make money in this market.

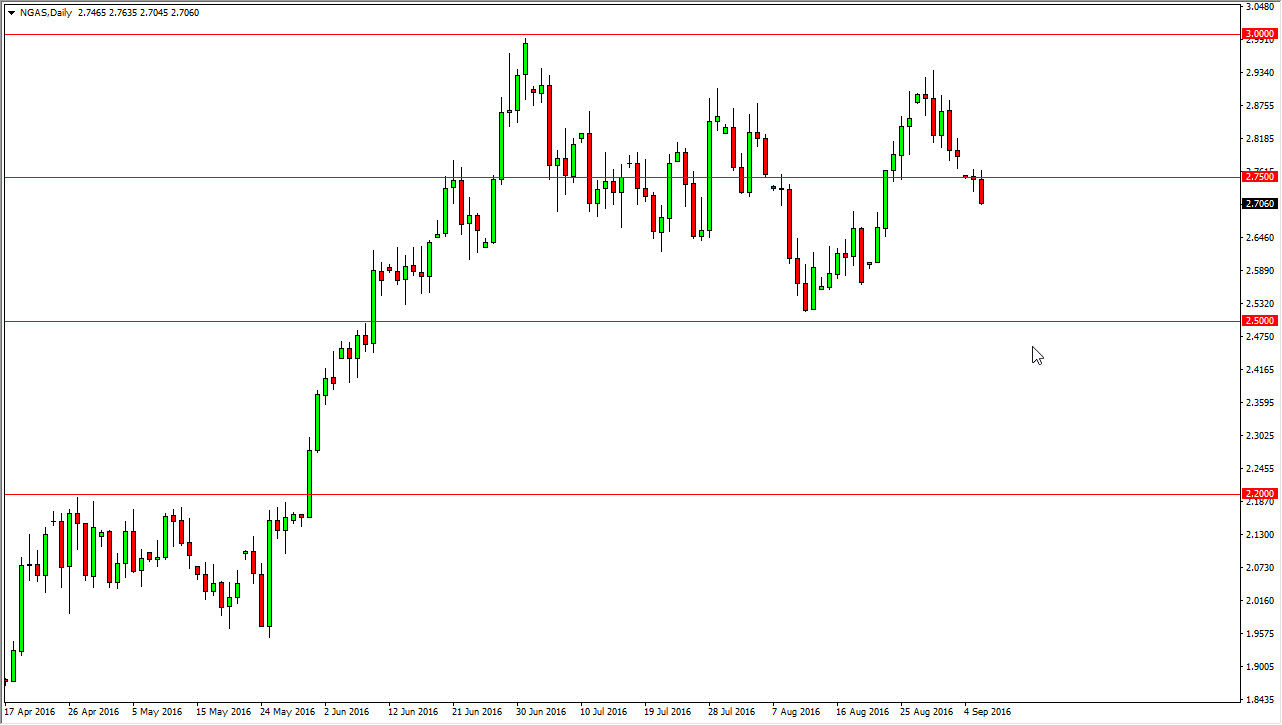

Natural Gas

The natural gas markets broke down during the day on Tuesday, breaking the bottom of the hammer from the Monday session. This of course is a very negative sign and I feel that we are going to reach down to the $2.65 level, and then possibly the $2.50 level below there. I think at this time, it’s very likely that any rally will be sold off, as it makes quite a bit of sense due to the fact that we gapped lower on Monday, and of course the storms that people were so worried about in the Gulf of Mexico are now gone. With that, there should be much in the way of supply disruption, and of course summertime cooling season is starting to come to an end in the northeastern part of the United States. With that, I remain negative, and I believe that rallies offer selling opportunities on signs of exhaustion.

In fact, this point in time you don’t really have an interest in buying until we form a longer-term signal, as I see so much in the way of resistance above. Having said that though, natural gas markets tend to be extraordinarily volatile.