Today’s CAD/JPY Signal

Risk 0.66%

Trade can be taken during either European or North American hours

Short Trade 1

Sell the CAD/JPY pair at 77.90

Set stop loss at 78.60

Take profit at 76.00

Be aware of Crude Oil Inventories

CAD/JPY Analysis

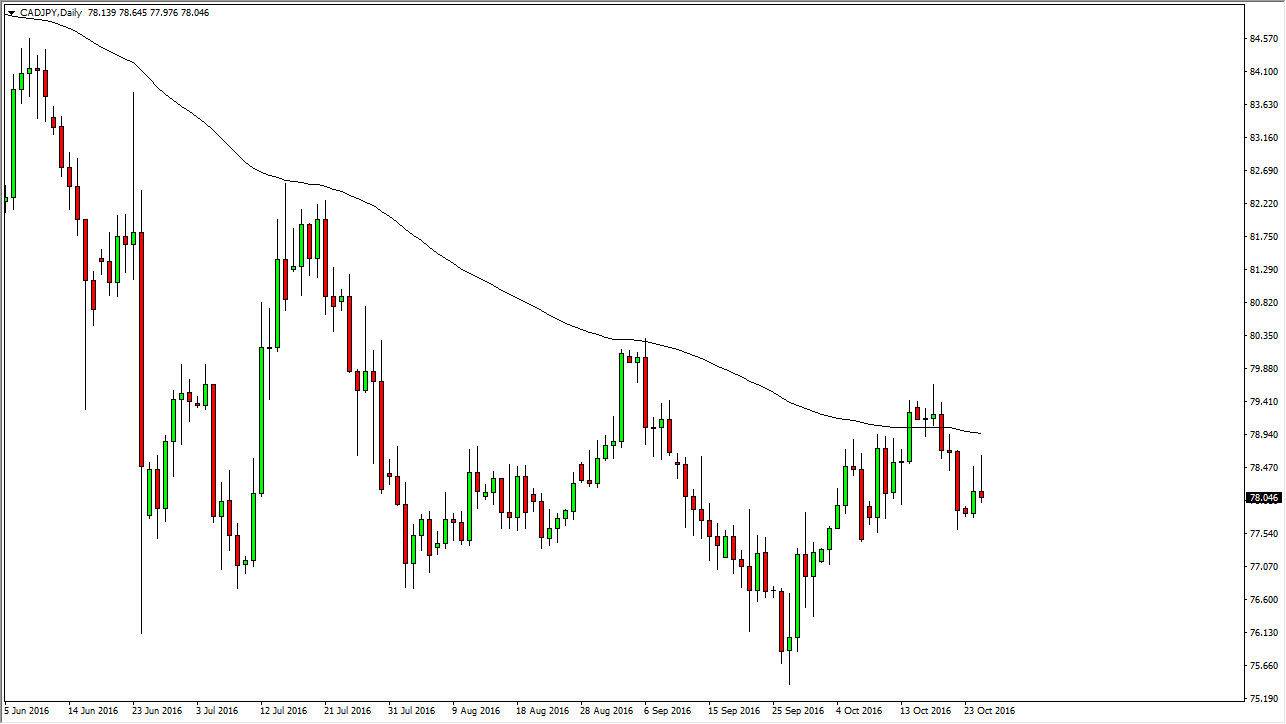

The CAD/JPY pair initially tried to rally during the day on Tuesday but continues to find quite a bit of resistance near the 100-day exponential moving average. With this, it looks like the downtrend is ready to continue and if we can break below the bottom of the shooting star that form during the day on Tuesday, that of course is a very bearish sign. The 76 handle below should continue to be a fairly significant level, and as a result that is our target. As this trade is with the trend we don’t necessarily feel the need to move stop losses to break even very quickly.

The Crude Oil Inventories announcement comes out at 2:30 PM GMT. This announcement typically moves the Canadian dollar as it is considered to be a proxy for oil. A lower than expected number is strong for oil and therefore strong for the Canadian dollar, while the exact opposite is true on higher numbers.