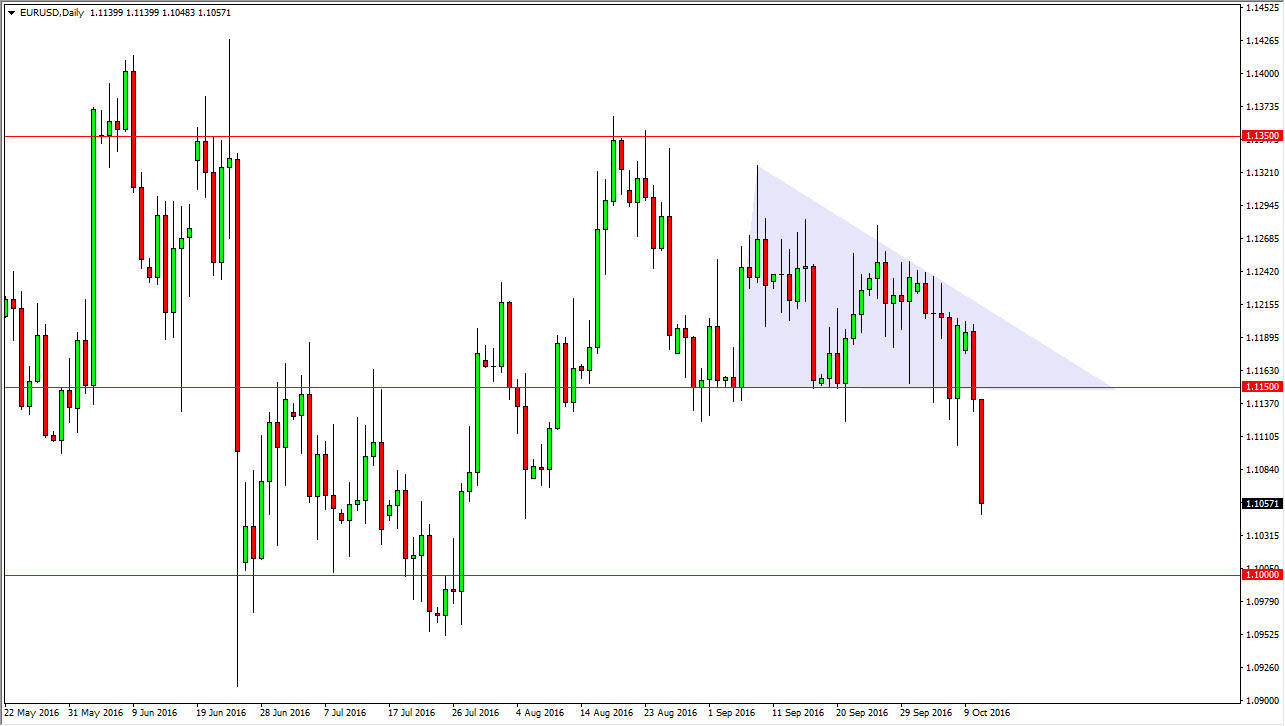

EUR/USD

The Euro broke down significantly during the course of the day on Tuesday, as we have cleared all of the support that extended down to the 1.11 handle, and now are starting to head towards the 1.10 level below that. You can see that on the chart I have a descending triangle market, and yesterday I suggested that if we broke down now that would be very bearish sign. I also suggested that rallies could be sold as the downward pressure seems to be continuing, and at this point time I think that the Federal Reserve is likely to still be in focus, and with the FOMC Meeting Minutes coming out during the day today, we could get a bit of volatility when it comes to the US dollar in general. Rallies at this point in time should continue to see the 1.1150 level as a bit of a “ceiling” in this market.

GBP/USD

The GBP/USD pair broke down during the day on Tuesday as well, slicing through the bottom of the hammer from a couple of sessions ago, and it now looks like it’s free to go down to the 1.20 level below. This is an area that offered quite a bit of support during the flash crash, but I think it’s only matter time before we clear out all of that support. I recognize that we could bounce from there, so I would prefer to see some type of exhausted short-term candle after rallying in order to get involved. On the other hand though, if we break down below the 1.20 level for significant amount of time, I would have to start shorting there as well as we continue to punish the British pound for the exit vote when it comes to leaving the European Union. I have no interest whatsoever in buying this pair at this point in time.