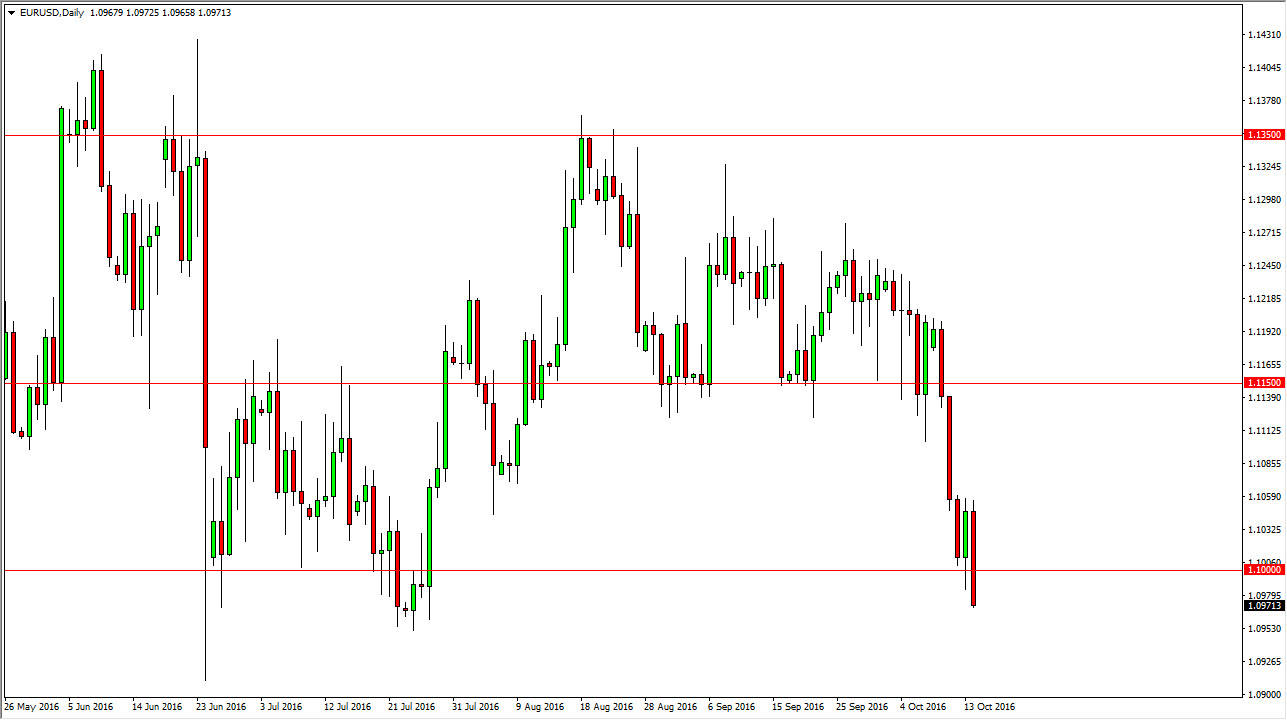

EUR/USD

The EUR/USD pair fell rather hard on Friday, closing below the 1.10 level for the first time in several months. The very bearish candle that printed for the day broke down below significant support from the previous session, so it makes sense that we would continue to go much lower. I think at this point in time, if we can break down below the 1.0950 level, we will continue down to the 1.08 level, and then perhaps even down to the 1.05 level. With the recent action in the Euro, you have to believe that any rally at this point in time will be a selling opportunity and therefore I don’t have any interest whatsoever in buying this pair at the moment.

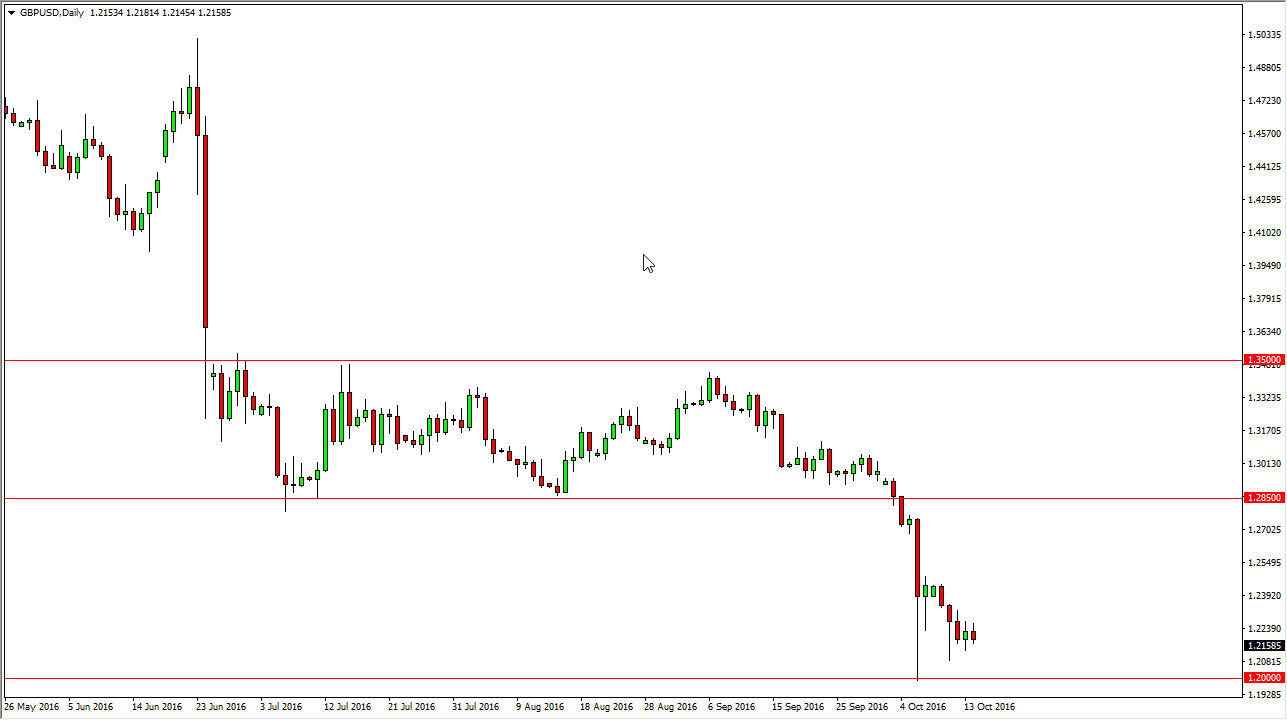

GBP/USD

The British pound had a much more stable session on Friday, as we continue to grind slightly lower, and I believe at this point in time we are trying to form some type of base. I think the 1.20 level will be very supportive, and with science it’s only a matter of time before we bounce in this general vicinity. I think if you are going to sell the British pound, and quite frankly I wouldn’t be bothered buying it, you have to keep in mind that you will probably have to take profits quite often and most certainly earlier than usual.

However, if we got a bit of a bounce off of the 1.20 level, I would be very interested in selling exhaustion, even if it was on short-term charts. As long as you don’t over leverage yourself, it’s very likely that the market will carry in your favor and you will be able to deal with the certain volatility that we will get over the next several weeks. I don’t know whether or not we can break down below the 1.20 level anytime soon, but it seems as if the market most certainly wants to try.