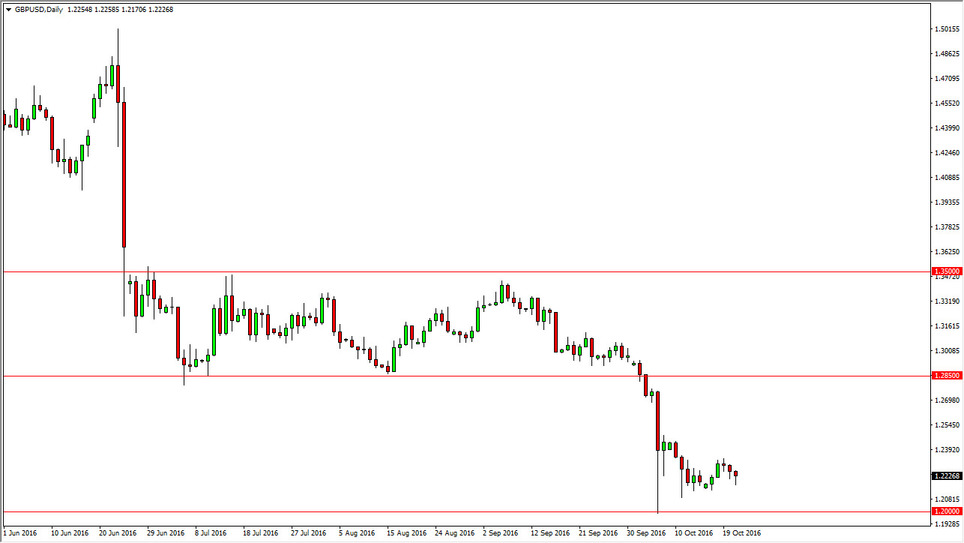

EUR/USD

The EUR/USD pair fell during the day on Friday, breaking down below the 1.09 level for the first time in ages. Because of this, looks as if we rally at this point in time there will more than likely be selling pressure. With that being the case, it’s likely that the markets will begin to go even lower, and that short-term rallies will offer exhaustive candles at you can to advantage of. Because of this, I think that the 1.10 level will now be a bit of a ceiling in the market, and I think that we are heading to the 1.05 level below. I have no interest in buying this market, I think that there are far too many reasons the think that we will continue to go lower. In general, the US dollars being used as a safety currency at the moment, and with the ECB recently stated that they aren’t even going to discuss tapering off of quantitative easing until December, there’s no reason to think that the Euro will strengthen.

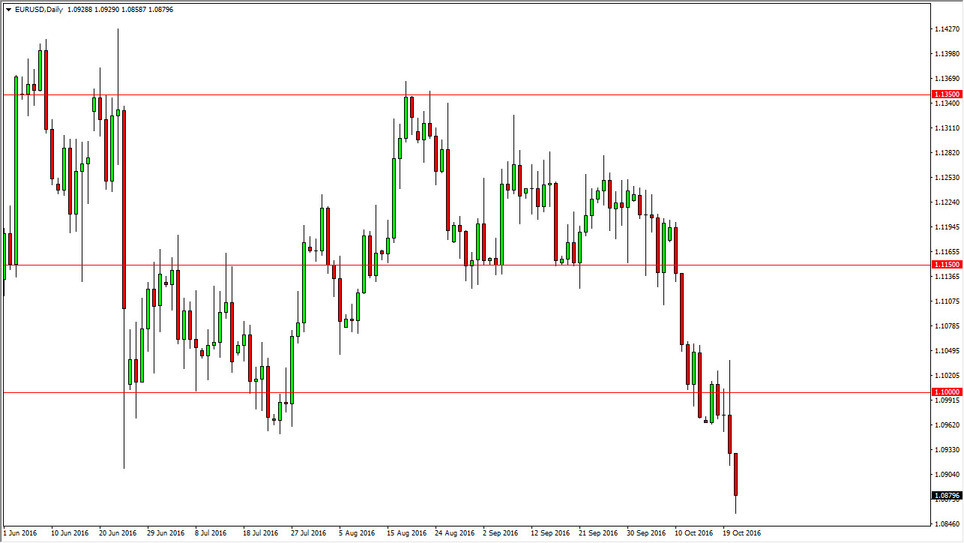

GBP/USD

The British pound fell during the course of the day on Friday again, but did bounce enough to form a bit of a hammer. With this in mind, the market looks as if it is ready to go higher, but only for the short-term at best in my estimation. After all, there is a lot of resistance to be found near the 1.24 level, and I certainly cannot argue with anyone that would state that this is a serious downtrend. I think that the 1.20 level below of course is massively supportive, and will continue to be a bit of a “floor” in this market, so having said that it’s probably only a matter of time before we test that area again and again. I do think eventually we will break down below it, but it’s going to take several attempts.