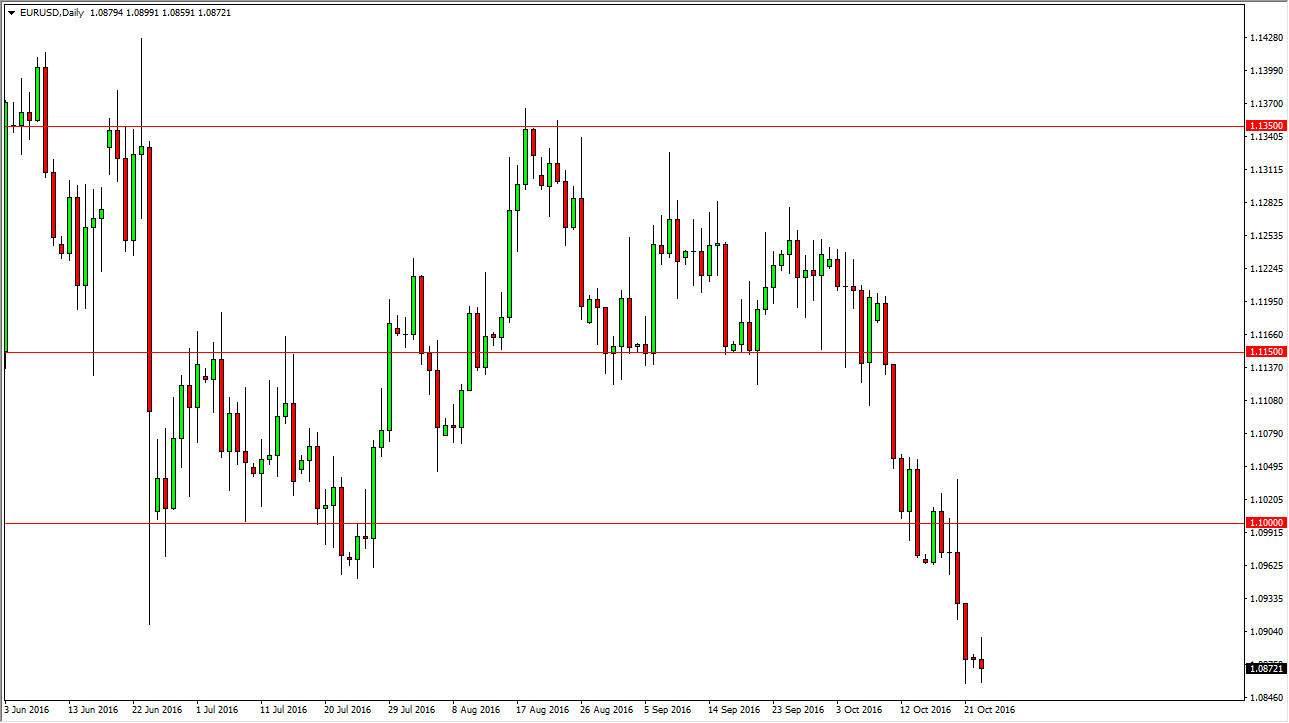

EUR/USD

The Euro initially tried to rally during the day on Monday, but went back and forth and ended up forming a bit of a neutral candle, if not a shooting star. A break down below the bottom of the candle would of course be negative, and that would signal to me that we are reaching down to the 1.05 level given enough time. I think even if we break above the top of the candle for the session on Monday, there is still plenty of resistance above and with that I think that the 1.10 level will continue to be massively resistive. The markets continue to show quite a bit of negativity overall, and with this it’s likely that the situation remain bearish and as a result I have no interest whatsoever in buying this pair.

GBP/USD

The GBP/USD pair went back and forth during the day on Monday essentially doing nothing. Ultimately, this is a market that continues to go back and forth, so I think we are trying to build a bit of a base for a bounce. A bounce that show signs of exhaustion would of course be selling opportunities as far as I can see, and I do think that eventually we will test the 1.20 level below again. The 1.2850 level above is should offer resistance and essentially a “ceiling” as far as this market is concerned, so no matter what happens, I have no interest in buying until we get well above there. On the other hand, if we can break down below the 1.20 level, the market should then go down to the 1.15 level which has been a massive support level on the monthly chart. No matter what happens, I believe that we will continue to punish the British pound for the exit vote, but most certainly the biggest moves to the downside have already happened.