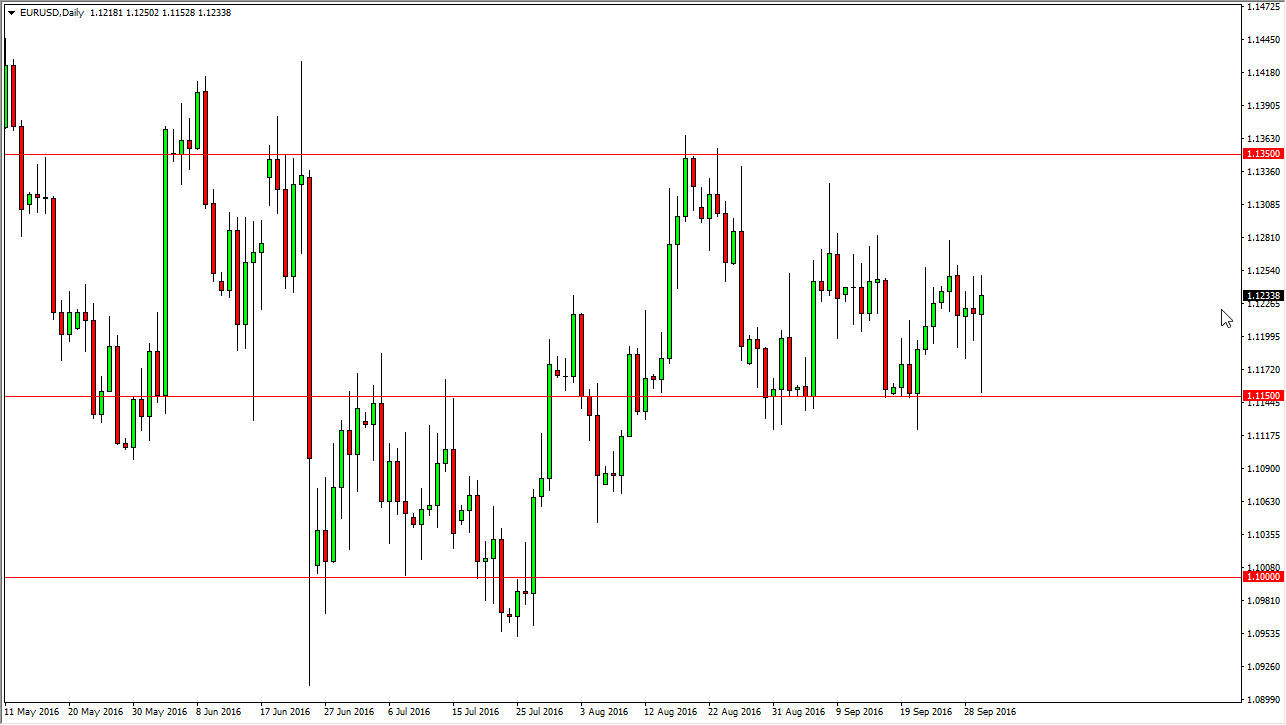

EUR/USD

The Euro initially fell during the course of the day on Friday, but found enough support near the 1.1150 level to turn back around and form a hammer. The hammer of course is a very bullish sign, and as a result if we break above the top is hammer I think of this market might try to grind its way higher but I expect quite a bit of volatility between here and the 1.1350 level above. Pulling back, the market should find plenty of support though, so this point in time I think it’s probably an exercise in futility to try to make any serious money in this market, and with that being the case I am standing on the sidelines as this market looks like it’s going to continue to be very choppy again and again.

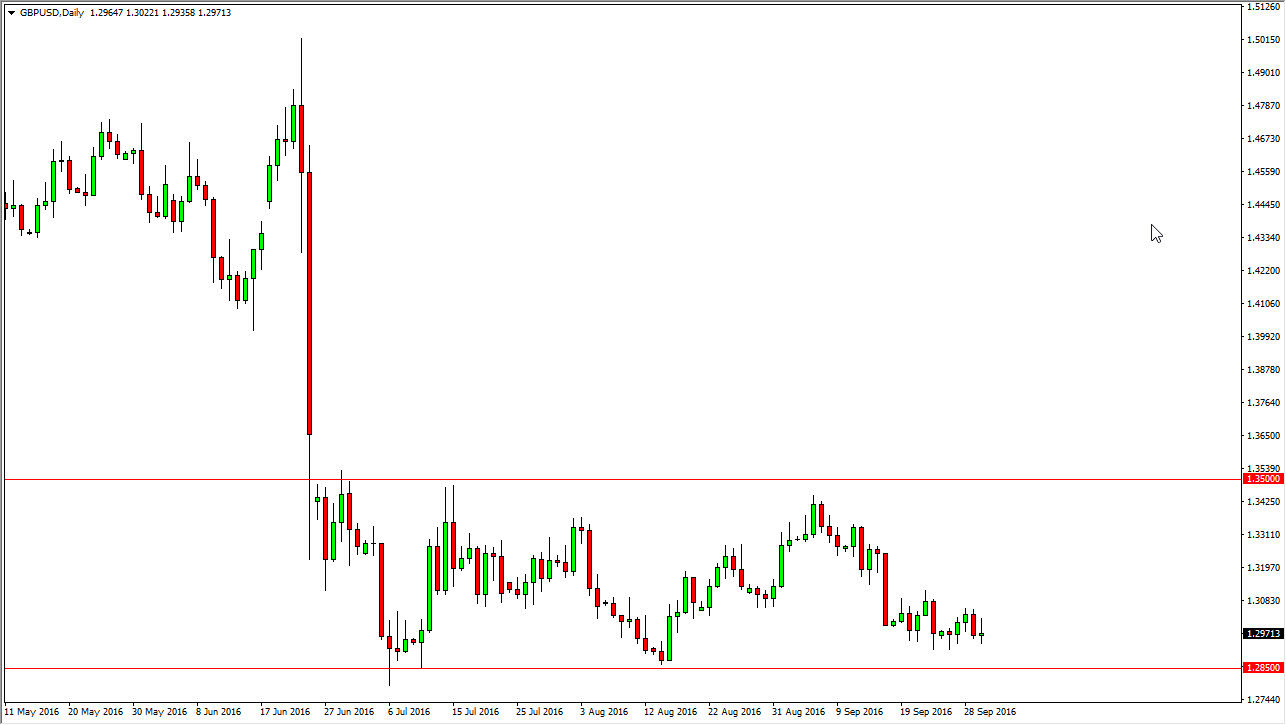

GBP/USD

The British pound went back and forth during the course of the session on Friday, as we continue to see a lot of volatility. I believe that the 1.2850 level below is massively supportive, and as a result I think that the market will try to get through there as it’s only a matter of time before we get down to the 1.25 handle. Ultimately, any type of rally at this point in time should find some type of exhaustive candle in order to start selling as well. With this being the case, I feel that the only thing you can do is sell this market as we continue to punish the British pound for the exit vote. Ultimately, this market will find a reason to go short, and with this being the case I have no interest in buying as I think it would be easy to turn around any bullish move.

h this being the case, eventually I believe that buying the British pound will be one of the best trades you can make, but we are nowhere near that at this point in time, so I continue to sell short-term rallies that show signs of exhaustion and of course some type of break down.