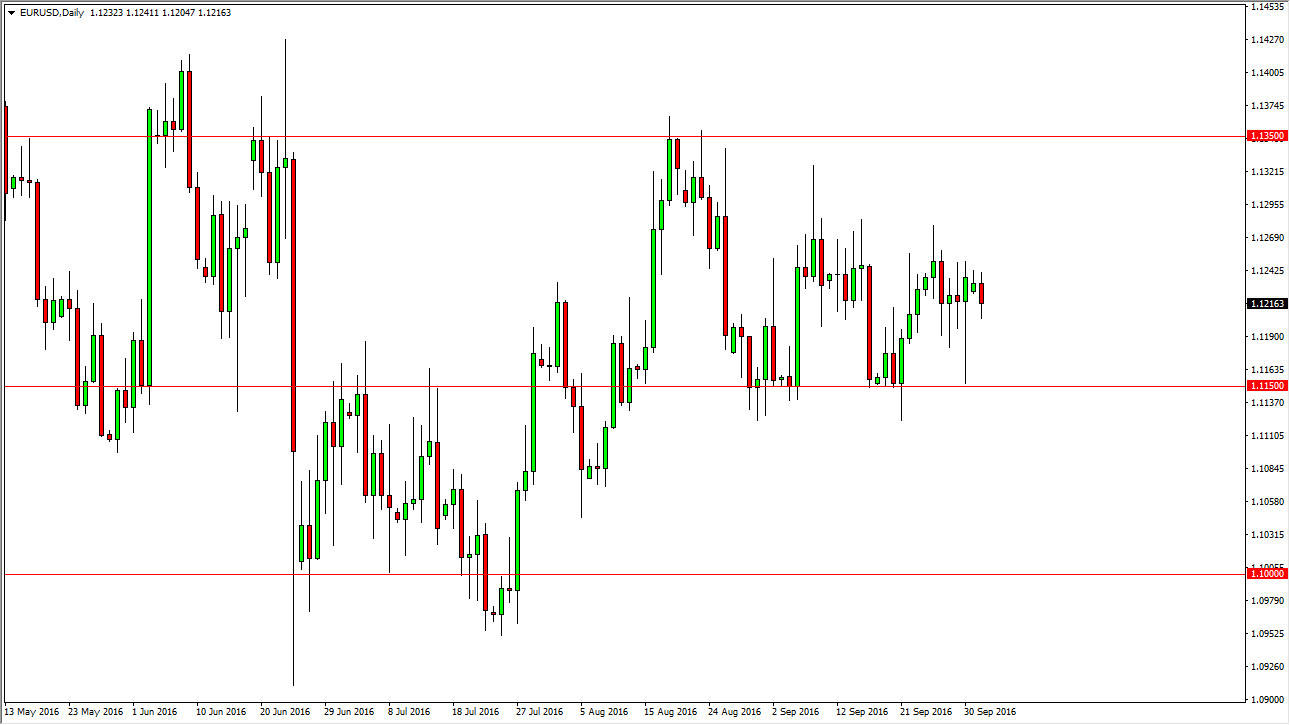

EUR/USD

The Euro initially tried to rally during the day on Monday, but turned around to fall slightly and reach towards the 1.12 level. Ultimately, this is a market that I think has quite a bit of support below, especially near the 1.1150 level. You could make an argument for a potential descending triangle, and if that’s the case I think the breakdown below the 1.1150 level would certainly be a very negative sign. I have no interest in buying this market, it seems be one that is going to grind much lower. Nonetheless, it is a market that has been choppy for some time, so I don’t necessarily feel like putting money into this market. Ultimately, I have more of a negative bias than anything else but I feel perfectly comfortable on the sidelines.

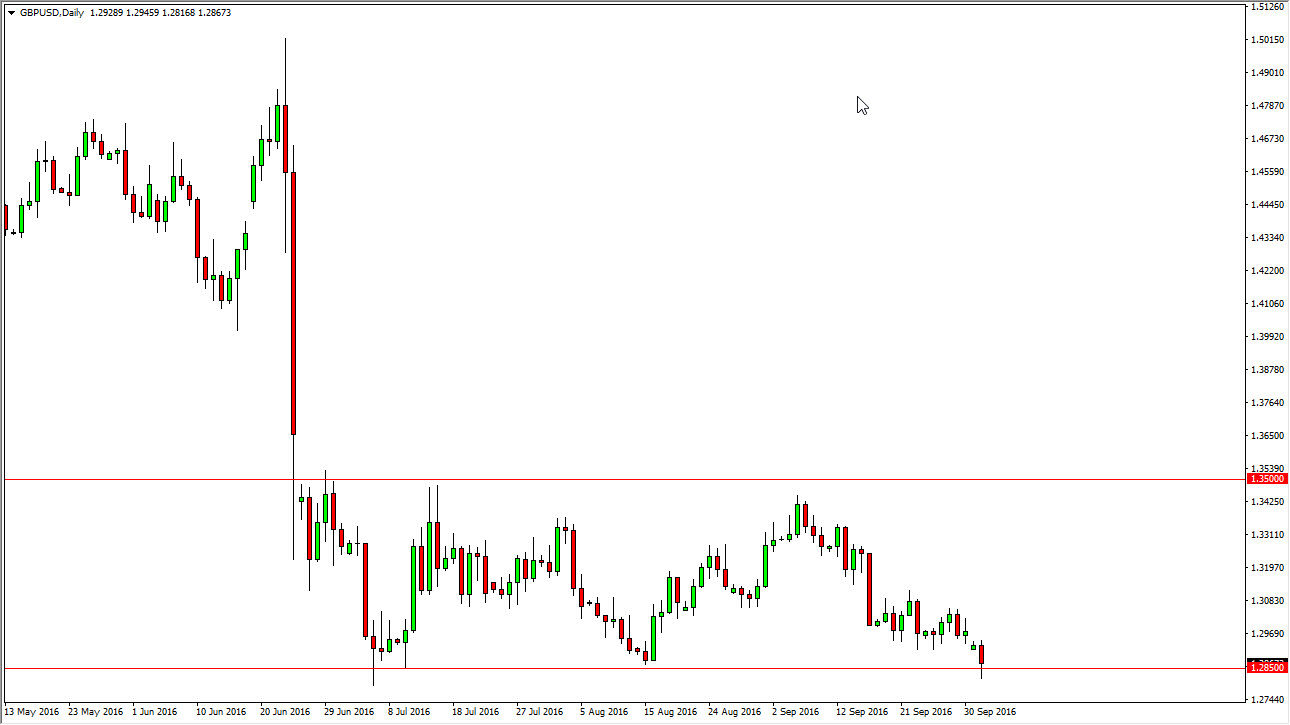

GBP/USD

The British pound initially tried to rally during the course of the day on Monday, but then turned around to break below the 1.2850 level. We did bounce back above the 1.2850 level, and as a result it looks as if we aren’t quite ready to break down yet. However, if we break down below the bottom of the range for the day on Monday, that would be a potential move to the 1.25 level below. Any rally at this point in time will more than likely continue to find sellers above, and signs of exhaustion will certainly be an opportunity to punish the British pound yet again for the exit vote.

I think that we will continue to see bearish pressure going forward, and most certainly the British pound is probably one of the least favored currency in the Forex world right now, as I think we continue to see a move towards the US dollar as not only are we punishing the Pound, but the Federal Reserve is one of the few central banks in the world talking about a potential interest-rate hike.