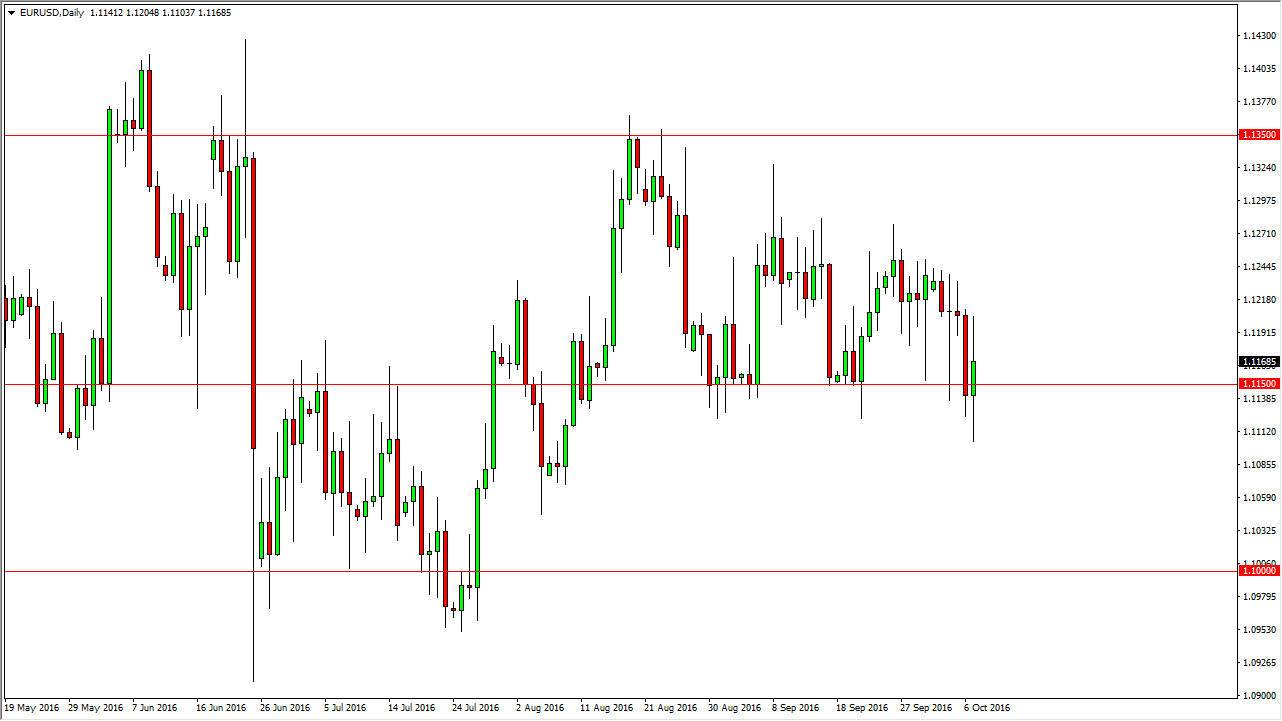

EUR/USD

The EUR/USD pair had a very violent session during the day on Friday after the less than anticipated jobs number. Ultimately, I think that we are in a larger descending triangle, and as a result I feel that the market should continue to go much lower. A break down below the bottom of the candle during the session on Friday would be a very negative sign and as a result the market should reach down to the 1.10 level below. I feel that every time the market rallies from here, there will be sellers above and signs of exhaustion will be reason enough to start shorting again and again. With this, I feel that the market should continue to be one that will be difficult to buy and I think that most trades that your involved in will be very short-term at best.

GBP/USD

The GBP/USD pair fell initially during the course of the session on Thursday, but found enough support to turn things back around and form a bit of a hammer. Because of this I feel that the market will eventually try to rally from here but will more than likely try to find resistance above as the 1.2850 level should continue to be resistive due to the previous support that we had seen there. I have no interest whatsoever in buying this market, and I believe that this rally should be an opportunity to sell on signs of exhaustion as the market has sliced right through the massive support that we had previously had. On the other hand, we break down below the bottom of a hammer that’s reason enough to start selling as well, as I feel the market will eventually try to reach down to the 1.20 level of the bottom of the chart which served as support after the short-term meltdown.