The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 23rd October 2016

Last week I predicted that the best trade for this week was likely to be short GBP/USD. This trade made a small loss of 0.39%.

The market seems easier to forecast this week, as there are several currency pairs beginning to break in-line with a more strongly bullish USD trend.

For this reason, I suggest that the best trades this week are likely to be short EUR/USD and long USD/CAD. Trading short GBP/USD and long USD/CHF are also options.

Fundamental Analysis & Market Sentiment

Fundamental analysis is of some use right now. Slightly better-than-expected U.S. economic data has been boosting the greenback over recent weeks, as well as the increasing lead of Hillary Clinton in the Presidential election opinion polls. There is also an expectation of a rate hike in December and at least one further rate hike during 2017. There is no other major global currency whose central bank is expected to raise rates any time soon.

The British Pound has dived sharply since the British Government announced it is going to being proceedings to leave the European Union next year, with a “hard Brexit” seemingly the exit route, i.e. without the U.K. remaining part of the single market.

The Euro just made its lowest weekly close against the U.S. Dollar since January after the ECB stated there would be no tapering of its quantitative easing program. This is also weakening the Swiss Franc which is highly positively correlated with the Euro.

The Canadian Dollar is suffering from a poorer than expected retail sales data release last week.

Technical Analysis

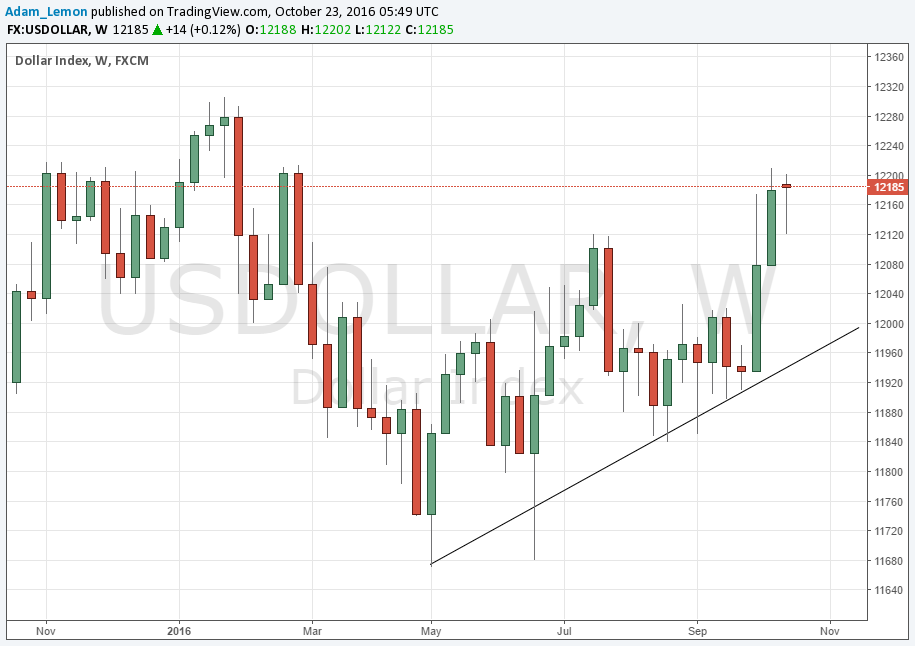

USDX

The U.S. Dollar has a new bullish trend, being above its historical prices from both 13 and 26 weeks ago. Last week’s candle was less long and bullish and in fact, it is an inside candle. The situation is looking increasingly bullish although there may be resistance in play at 12200.

EUR/USD

Last week saw a very strongly bearish candle which closed hard on its low price, and this has been followed this week by another bearish candle which made the lowest close since last January. There has finally been a break below the long-term lower range limit and the very key support level of 1.0961. The formation is suggestive of a further fall to at least 1.0771.

USD/CAD

The price has been coiling bullishly for many week now, but finally last week we got a high close above the long-term range, formed by a very bullish outside candle that closed near its high price. This is the highest close since March and it looks technically as if the price is very likely to rise higher still.

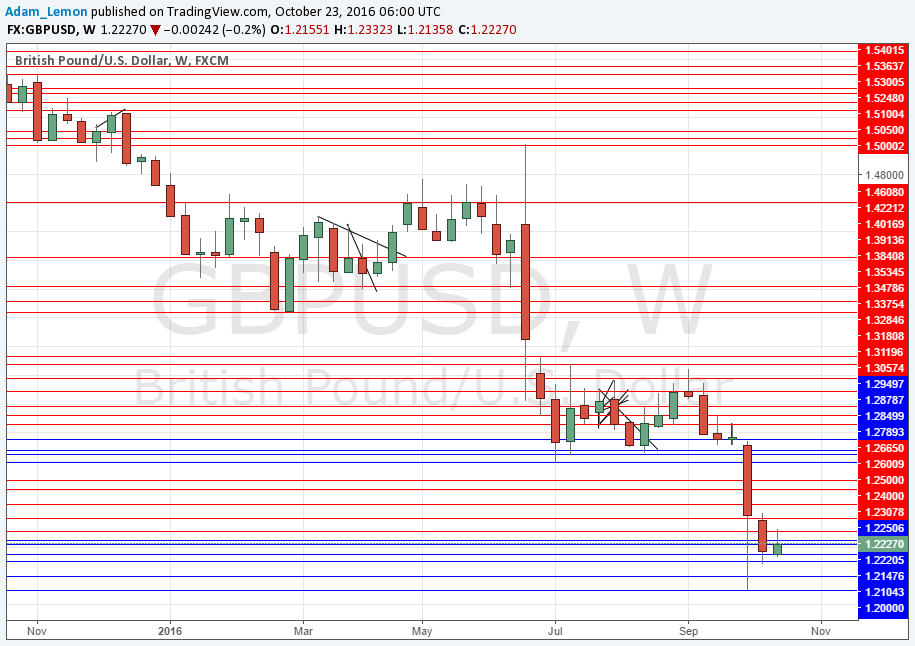

GBP/USD

Last week saw a second inside candle, and this one was very slightly bullish. This shows that what is happening is a contraction of volatility following the big price shock of three weeks ago which occurred when the British government announced its plan to trigger an exit from the European Union next year. The price has been consolidating between 1.2300 and 1.2100. It may not fall much further in the immediate short-term, but a look at the chart below confirms there is a strong long-term bearish trend.

USD/CHF

The chart below shows although recent candles have been bullish, the upper limit of the range which has been established since last March is about 0.9950 and it has still not been properly broken. The long-term action is still in something of a range, suggesting only a cautious bullishness. However, a breakout looks as if it could produce a strong move to the upside.

Conclusion

Bullish on the USD, bearish on the EUR, CAD and GBP and CHF to a lesser extent.