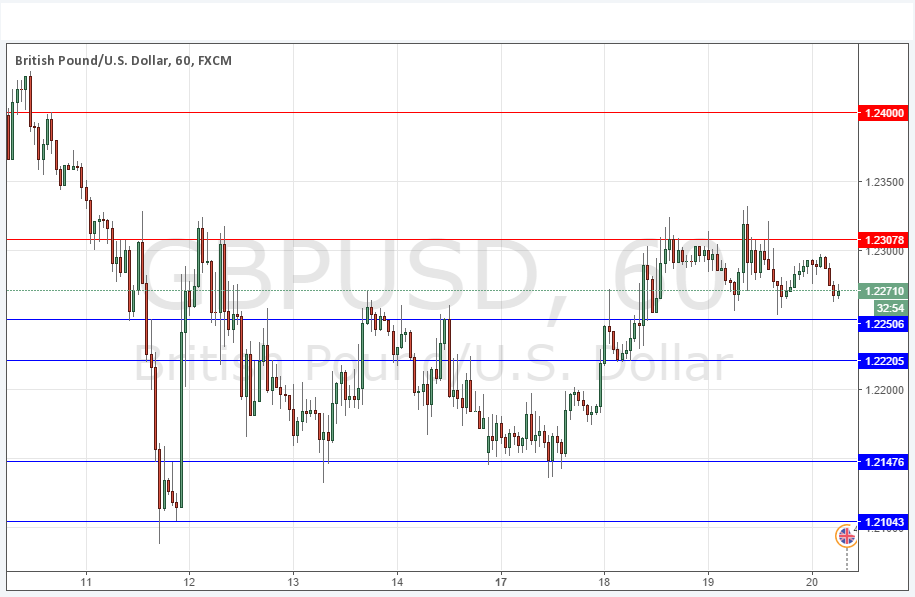

GBP/USD Signal Update

Yesterday’s signals were not triggered as the bearish price action took place a little above the identified resistance level at 1.2308.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be entered between 8am and 5pm London time today.

Long Trades

Long entry following a convincing bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2250 or 1.2221.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Short Trades

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2308 or 1.2400.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

I wrote yesterday that so far we are continuing with a consolidation between 1.2300 and 1.2100. This is essentially still going on, with the price trying and failing to get above the support yesterday at 1.2308. Logically it would seem the pair is due a move down, in line with the long-term trend. However, the price still has a somewhat bullish feel to it, with key support levels holding, most notable 1.2250. Nevertheless, a move down could be quite strong so it could be worth the risk of going short even though the price is a little stiff.

There is data due today for both sides of this pair which might provide some volatility.

There is still a long-term strongly bearish trend in force.

Regarding the GBP, there will be a release of Retail Sales data at 9:30am London time. Concerning the USD, there will be a release of Philly Fed Manufacturing Index and Unemployment Claims data at 1:30pm.