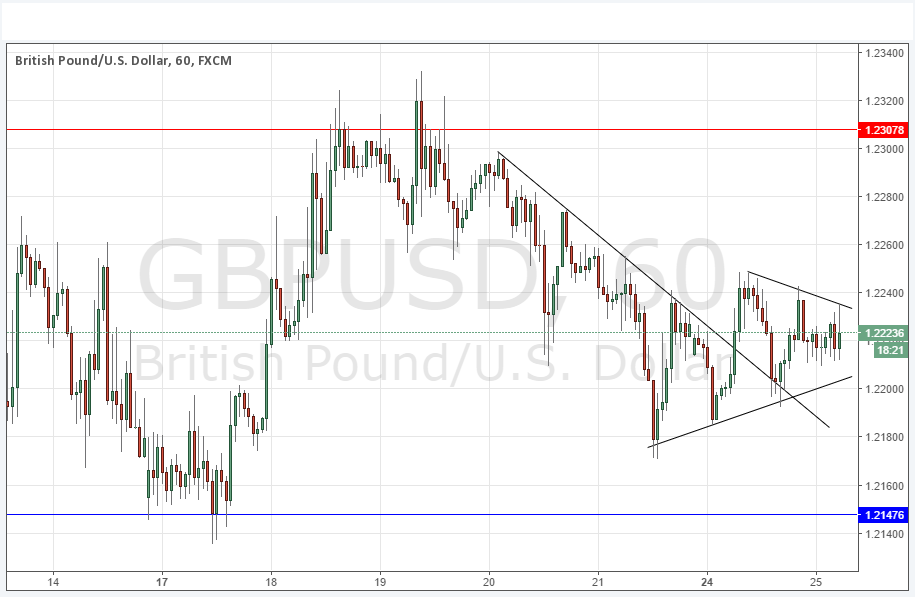

GBP/USD Signal Update

Last Thursday’s signals gave a profitable long trade following the bullish inside candle rejecting the identified support level at 1.2221, although it was only good for 20 pips.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today only.

Long Trade 1

Go long following a convincing bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2148.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2308.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

GBP/USD Analysis

The consolidation between 1.2300 and 1.2100 continues. The price is now flattening out and forming a consolidating triangle more or less at the middle of the consolidation zone. The market will be awaiting the testimony of the Governor of the Bank of England on the economic consequences of Brexit due later today, and the price might well go sideways until that time. There are no key support or resistance levels in either direction quite a way away from the current price as at the time of writing.

There is still a long-term strongly bearish trend in force.

Regarding the GBP, the Governor of the Bank of England will be testifying before Parliament concerning Brexit at 3:35pm London time. Concerning the USD, there will be a release of CB Consumer Confidence data earlier at 3pm.