Gold prices rose for a second consecutive week but ended the month with a loss of 3.2%. The XAU/USD pair initially broke down below the $1307/4 area as investors flocked to the greenback on expectations of tighter monetary policy in the U.S. and retreated to the $1250/43 region before finding enough support. Improvements in economic conditions has led many in the market to believe that the Fed will remain focused on lifting interest rates before the end of the year. The U.S. central bank will be in focus again this week as a two-day meeting of its policy-setting committee kicks off Tuesday.

Although concerns over an interest-rate increase weighed on prices, it seems that the market has priced in a December rate hike. The fact that Federal Reserve officials are likely to stand pat at their November policy meeting and fresh political uncertainty in the U.S. could be supportive in the short term. The metal saw some safe-haven bids last week after FBI director James Comey said the FBI was reviewing additional emails pertinent to previous investigations into Hillary Clinton's use of a private server. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 196980 contracts, from 179618 a week earlier.

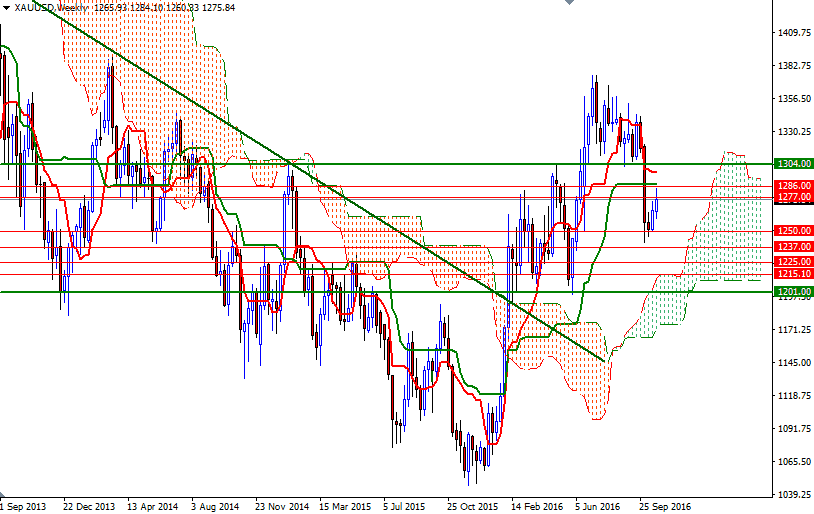

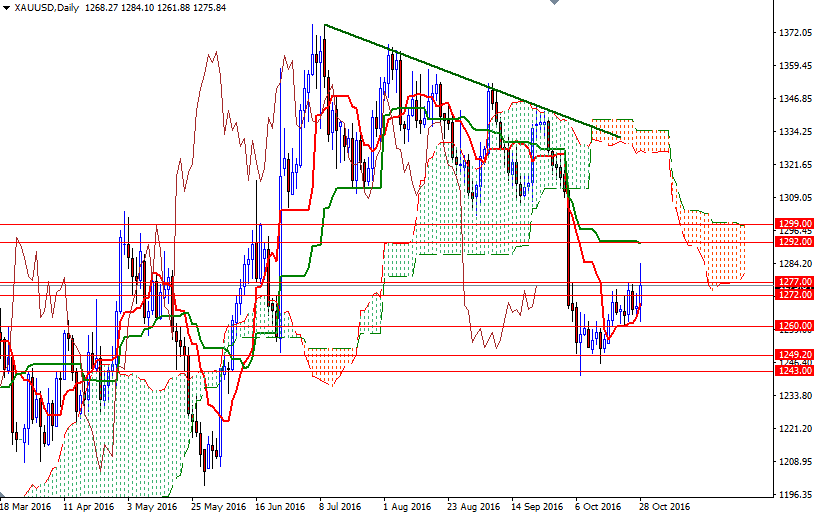

From a technical perspective, there are two things catch my attention at first glance. Firstly, prices are located in the opposite sides of the Ichimoku clouds on the weekly and daily charts - XAU/USD is above the weekly but below the daily cloud. This outlook suggests that lower prices will lure buyers back into the market as the market will have a tendency to go higher over the long term. However, this picture also implies that the downside risks exist as long as XAU/USD resides below the daily cloud. With these in mind, I expect the market to stay within the 1307/4-1243/0 range. The shorter term charts suggest that a retest of 1286 is likely if prices anchor above the 1277 level. A break above 1286 would be a positive signal and open a path to 1294/2. Beyond that, expect significant resistance in 1300-1299 and 1307/4. To the downside, keep an eye on the area occupied by the 4-hourly cloud (1266/4 and 1260) because that is where prices are likely to return if the market fails to hold above the 1272/0 zone. Breaching that support would me think that the market is going to revisit 1250-1249.20. The bears will have to capture this strategic camp if they intend to challenge the bulls on the 1243/0 battlefield. Once below that, look for further downside with 1225 and 1215 as targets.