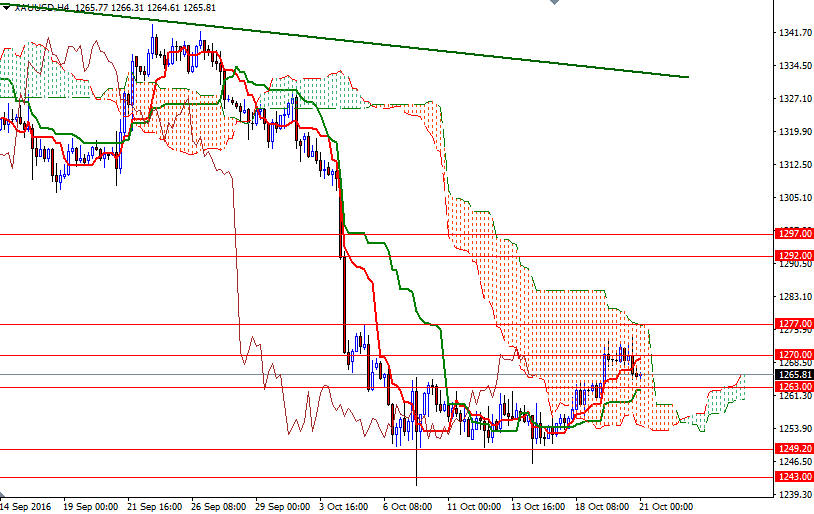

Gold fell for the first time in four sessions, giving up a portion of the gains made earlier in the week, as the dollar recovered after the European Central Bank quashed any speculation of tapering its stimulus. XAU/USD initially rose during Friday's session, at one point traded as high as $1274.37 an ounce, but the inability to sustain a push above 1270 weighed on the market. As a result, prices returned to the $1265/3 zone.

The market is currently hovering just above the 1265 level but trading within the 4-hourly Ichimoku cloud suggests that there is an intense battle going on. In other words, XAU/USD will be range bound over the short-term. If the market falls below 1265/3, then it is likely that we will visit the 1260/58 region where the daily Tenkan-Sen (nine-period moving average, red line) sits. The bears have to capture this camp if they intend to drag prices back to the bottom of the cloud at 1253.50.

To the upside, there are hurdles such as 1270 and 1277. The bulls will need to push prices above the Ichimoku cloud on the H4 time frame in order to gain momentum to challenge the bears on the next battlefield at 1285. Closing beyond 1285 on a daily basis paves the way towards 1292.