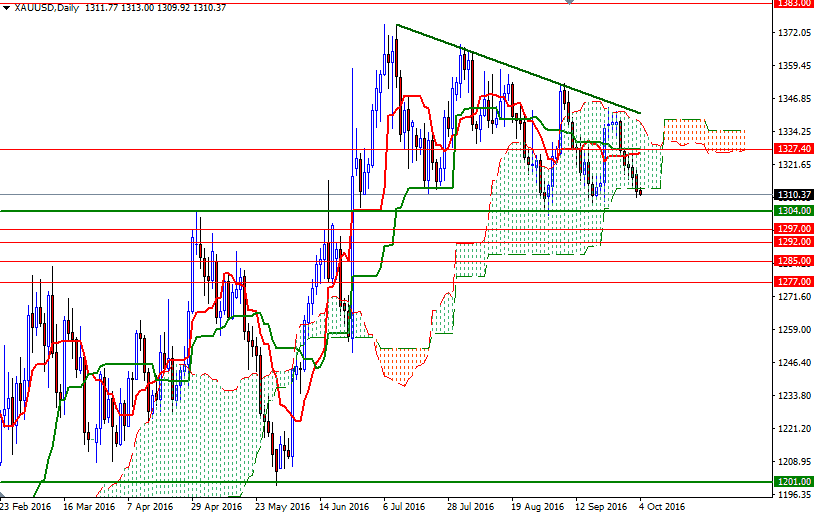

Gold prices ended Monday's session down $6.59, extending their losses to a fifth straight session, as lower safe haven demand and heightened expectations for a Fed rate increase in December fueled downside momentum. The XAU/USD pair retreated to the $1310 level after the $1316 support was broken. In economic news on Monday, The ISM's manufacturing index came in at 51.5, up from the previous month's 49.4 and above expectations for a reading of 50.4.

Yesterday's price action which brought the market below the daily Ichimoku cloud weakens the technical outlook but there is an anticipated support zone that stretches from 1307.50 to 1300. Therefore, we might see some short-side profit taking in that area. While a failed assault on this support could trigger a bounce up towards the broken support at around 1316, a successful drop would make me think that the market will be aiming for 1297 and 1292.

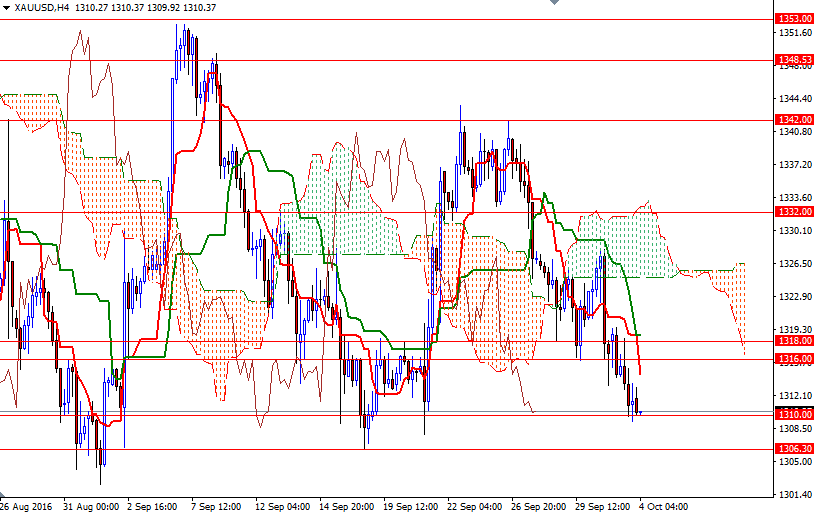

To the upside, the initial resistance sits in the 1313.50-1312.74 area, followed by 1318/6. If XAU/USD breaks through this area occupied by the Ichimoku cloud on the hourly chart (1318/6), then 1321.55 and 1327.40-1324 may be the next targets. Only a daily close beyond 1327.40 could give the bulls a chance to approach the 1334/2 area.