Gold ended the week down $5.25 at $1251.80 an ounce as the greenback rose on expectations that the Federal Reserve was moving closer to raising interest rates. The minutes of the Fed's September policy meeting didn't reveal when the next rate hike might come but better than expected unemployment claims, retail sales and producer prices data supported the dollar's gains. Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 195219 contracts, from 245508 a week earlier.

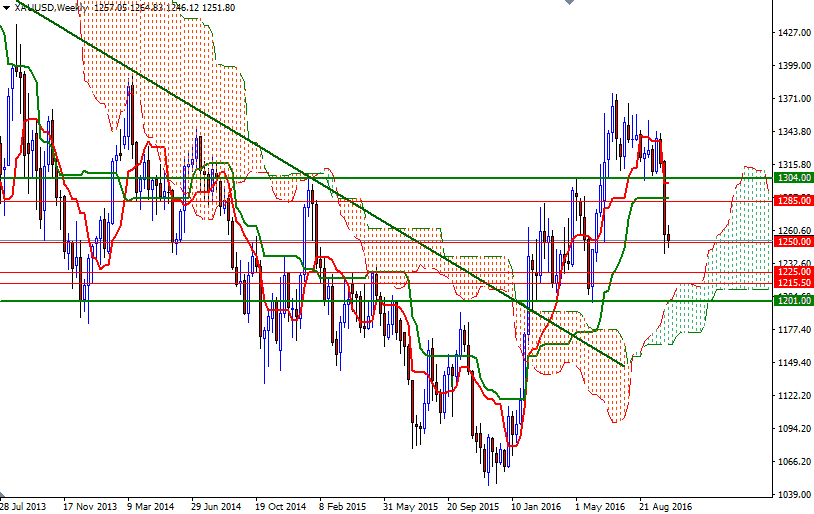

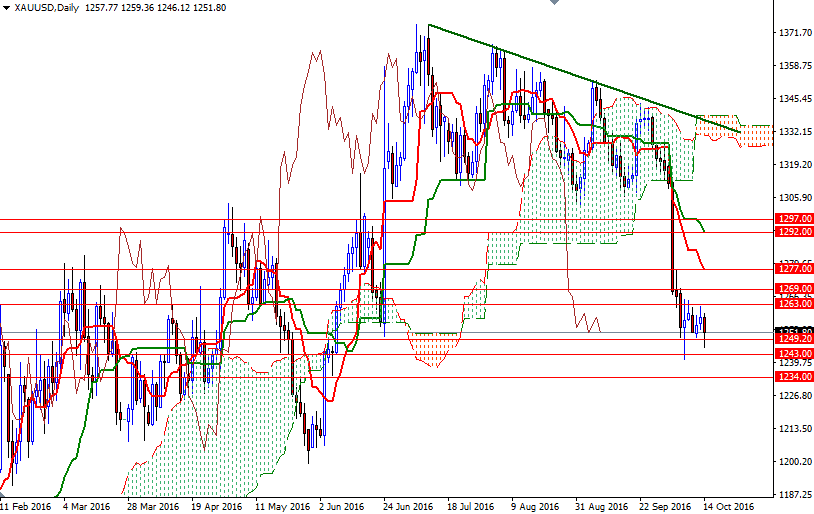

While mounting speculation that the Fed will tighten policy before the end of the year contributes further pressure on gold, holding above the 1250/49 area suggests that these expectations are somewhat priced in. From a technical perspective, the XAU/USD pair is vulnerable to the downside as long as it trades below the Ichimoku clouds on the daily and 4-hour charts In other words, the path of least resistance appears lower, for now.

However, until the market confidently break below 1243/0 gold's downside potential may be limited. If the market dives below 1240, then 1234/1 could be the next stop. Breaking down below 1231 could add to pressure on prices and eventually drag XAU/USD to the 1225 support. Once below 1225, the bears will be aiming for 1221.40 and 1215.50-1213, where the top of the weekly cloud resides. On the other hand, if the XAU/USD pair manages to hold the aforementioned key support, we might see a push up to the daily Tenkan-Sen (nine-period moving average, red line) at 1277. But of course, in order to reach there, the bulls have clear nearby resistances such as 1265/3 and 1270/69. 1277 will be the key level for the bulls to pass in order to challenge the bears on the next battle field at 1285. A failed assault on this resistance could be a good place to seek a short trade.