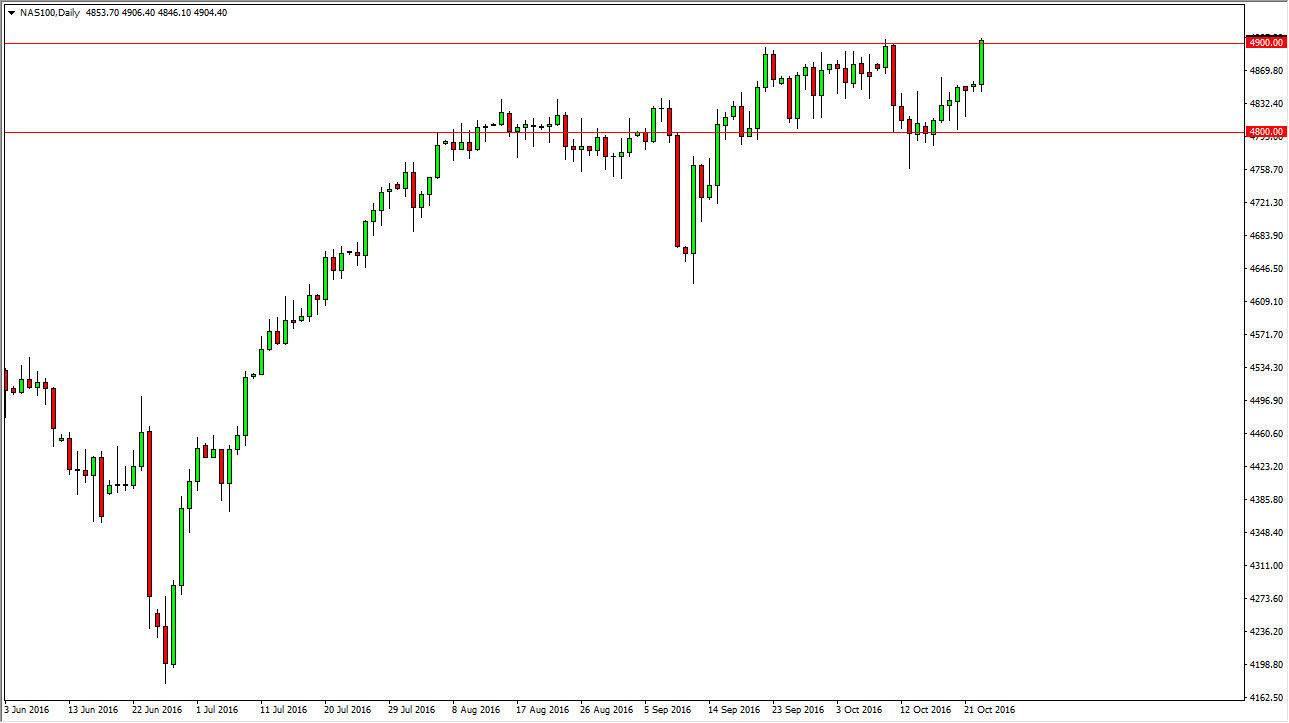

NASDAQ 100 Signal

Risk 0.75%

Trade can be taking anytime during US trading hours

Long trade 1

On a break above the highs from the Monday session go long the NASDAQ 100

Stop loss should be placed that 4875

Take profit is just short of the 5000 level

NASDAQ 100 Analysis

The NASDAQ 100 exploded to the upside during the day on Monday, slicing through the 4900 level. This has been resistance as of late, and as a result it’s very likely that we will continue to go higher as the resistance seem to be giving way. Ultimately, even if we pullback we will more than likely try to break out to the upside. With the strength of the NASDAQ 100 recently, there’s almost no opportunity to sell, and of course with the longer-term interest-rate outlook in the United States be a fairly soft, it’s likely that the NASDAQ 100 should continue to see significant bullish pressure.

There continues to be plenty of headlines coming out from Federal Reserve presidents that move the markets. Ultimately though, it does look as if the uptrend continues.