Risk 0.5%

Trade can be taken during late European hours, until 9 PM GMT

Long Trade 1

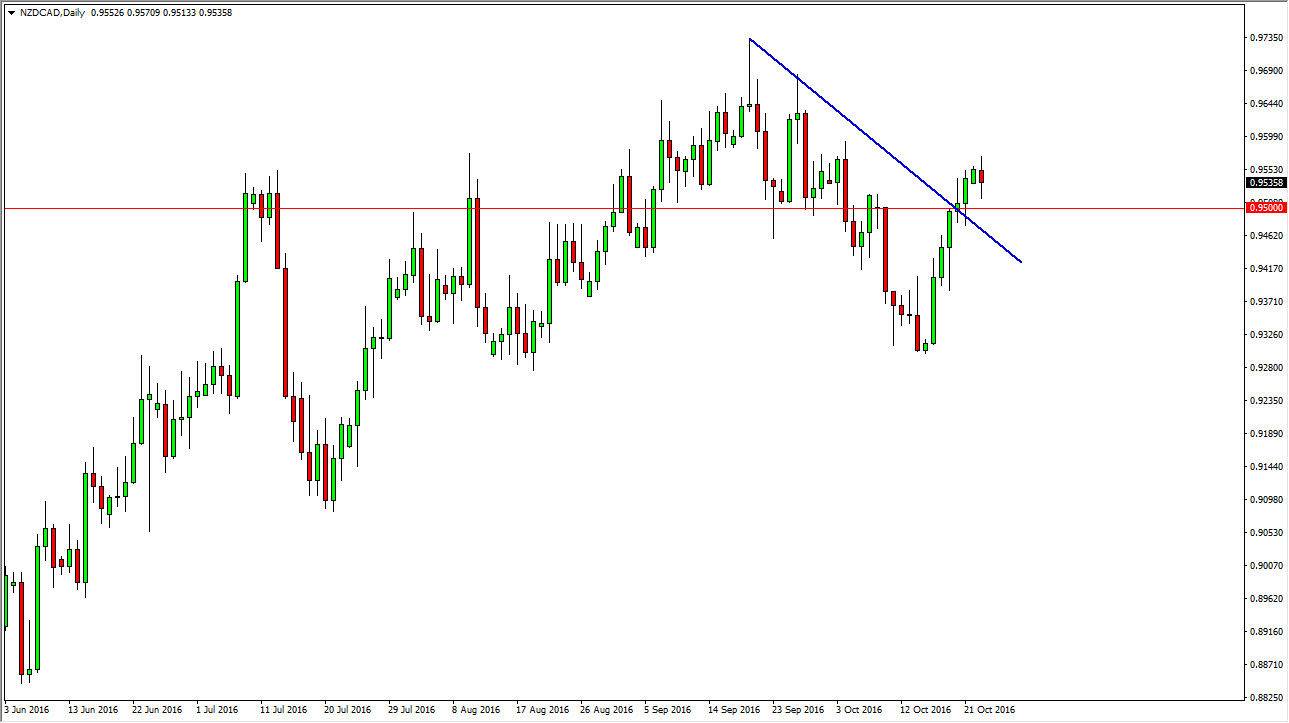

Buy NZD/CAD at the 0.9575 handle

Set stop loss at 0.9490

Take profit at 0.9700

NZD/CAD Analysis

The NZD/CAD pair has had a volatile session on Monday, but it is proven that the 0.95 level is trying to offer support. With this, and a breaking of the downtrend line, I believe at this point in time the market will continue to grind higher. This is a market that should continue to see bullish pressure, but you will have to keep an eye on the WTI Crude Oil market. If it’s falling, this typically puts more pressure on the Canadian dollar as well, and we could continue to go higher. Ultimately though, both of these are commodity currencies, so if most commodities or falling, this could be a slow mover.

There are no scheduled announcements that should affect this pair today.