NZD/USD Signal Update

Yesterday’s signals were not triggered as none of the key levels were ever reached.

Today’s NZD/USD Signals

Risk 0.75%

Trades must be taken from 8am New York time to 5pm Tokyo time, during the next 24-hour period only.

Long Trade 1

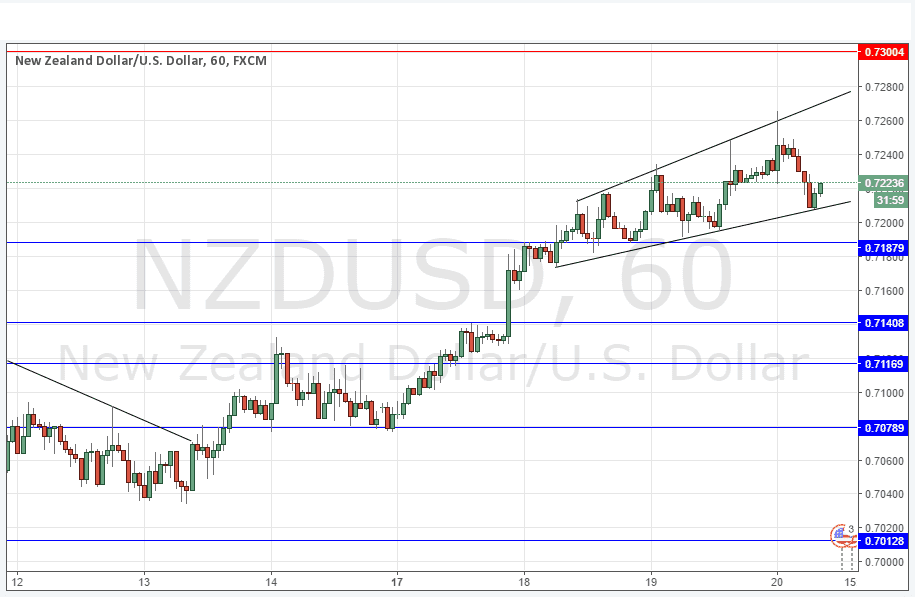

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7188.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7300.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

NZD/USD Analysis

The picture actually looks very bullish, with the NZD seemingly taking over from the AUD as most bullish currency against the USD. The price remains above the key 0.7200 and the support level near there has emerged more clearly, at 0.7188. there is a short-term supportive trend line and widening bullish wedge formation, which can be seen in the chart below.

There is also a long-term bullish trend which, in spite of having weakened considerably, seems to be surviving.

There is nothing due today regarding the NZD. Concerning the USD, there will be a release of Philly Fed Manufacturing Index and Unemployment Claims data at 1:30pm London time.