By: DailyForex.com

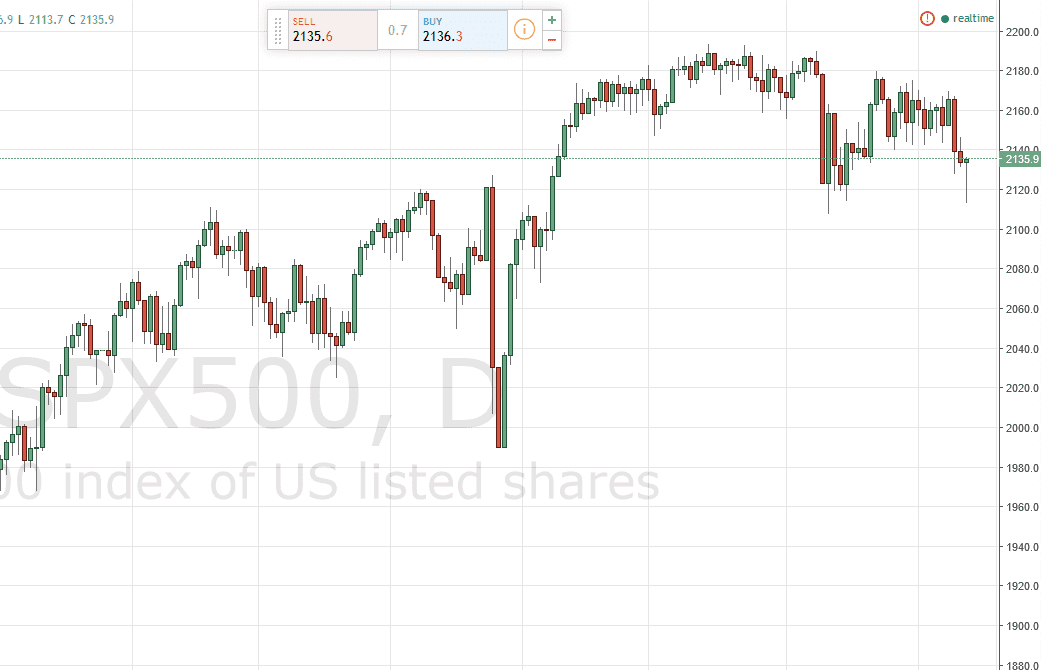

S&P 500

The S&P 500 initially had a very tough day on Thursday, testing the 2120 level, and even breaking down below there at one point in time. However, we fast enough to form a bit of a hammer and I believe at this point in time if we can break back above the 2140 level, this market very well could go to the 2170 handle. This is a market that continues to show resiliency, and with the low interest rate environment I believe that we are still very much in, it’s difficult to imagine that this market is going to break down with any sincerity. I also believe that the 2100 level below is massively supportive, and as a result I think that if we get down to that area, the buyers will come in rather rapidly.

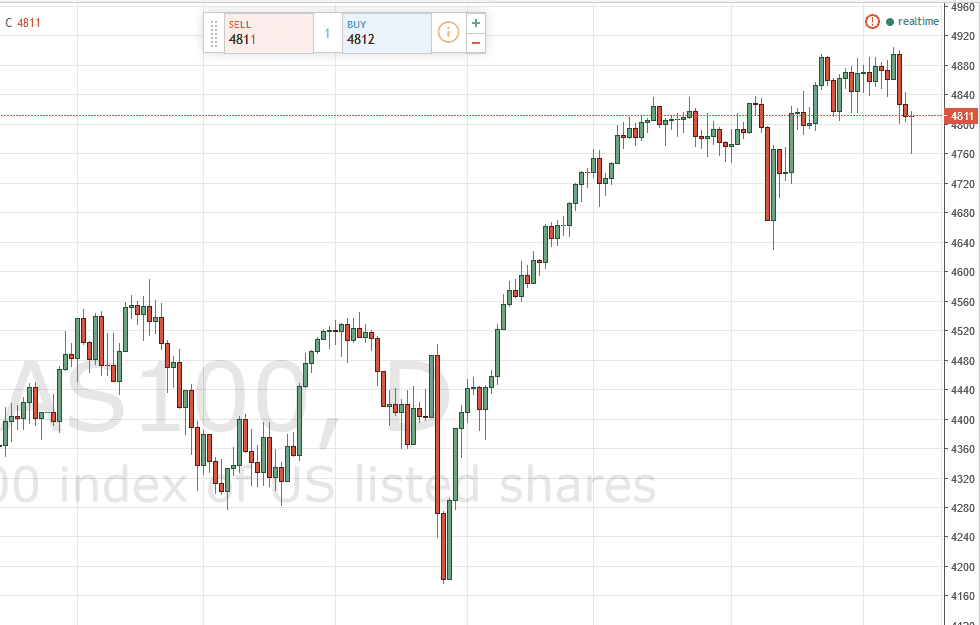

NASDAQ 100

The NASDAQ 100 of course did very much the same thing as the S&P 500 did, finding support of the 4760 level. This level is crucial, as you have seen quite a bit of supporting pressure during the month of August at this handle. With this being the case, it makes sense that we bounced and formed a hammer and I believe that a break above the top of the range for the session on Thursday could very well send this market looking for the 4900 level again. A break above the air, which I think will happen given enough time, signifies that we’re going to start reaching towards my longer-term target of 5000 in this market.

Ultimately, I think continue to offer quite a bit of value in a market that I think is going to lead the rest of the US indices. Because of this, given enough time I feel that the buyers will return again and again, and that selling really isn’t much of a thought at this point in time.