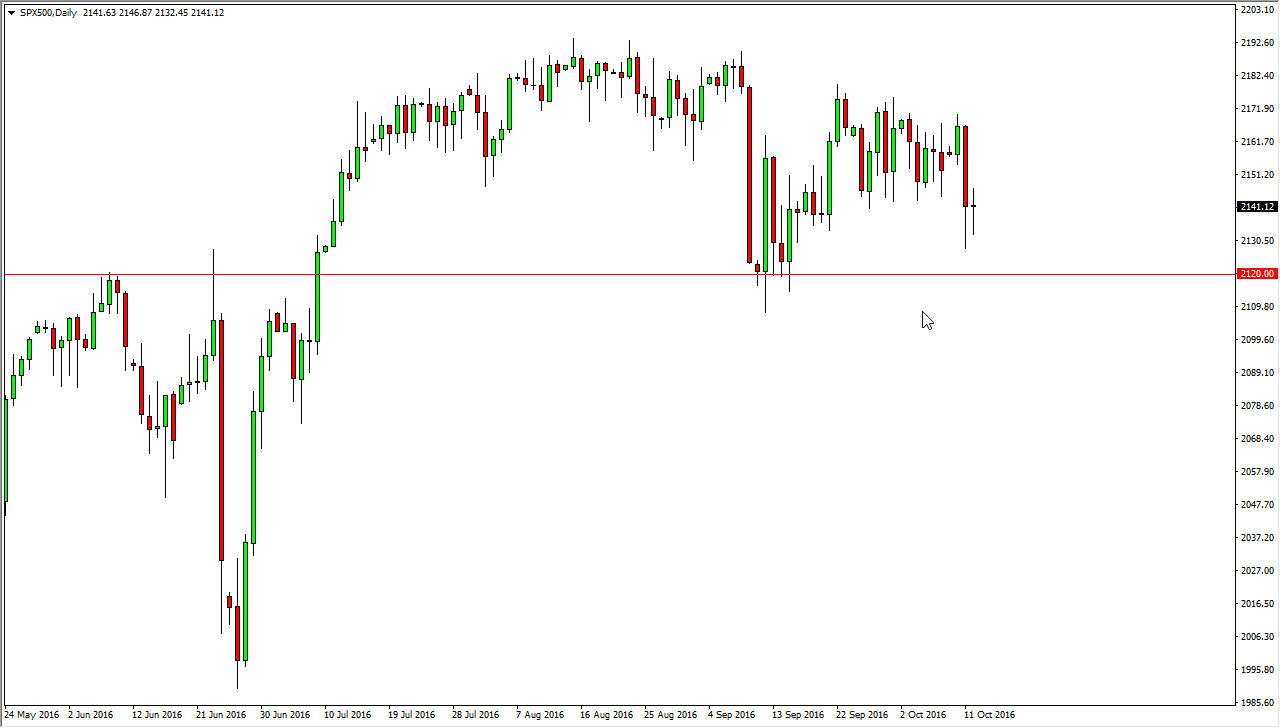

S&P 500

The S&P 500 went back and forth during the day on Wednesday, as we continue to find support just below. The 2140 level offered quite a bit of support, and that support extends all the way down to the 2120 handle. By forming a bit of a hammer, it looks as if we are going to continue to go higher given enough time, and a break above the top of the hammer would be reason enough to go long as far as I can see. I have no interest whatsoever in selling, and I believe that the 2120 level will continue to bring buyers into this market again and again. In fact, I believe that support extends all the way down to the 2000 handle below. Given enough time, I feel that we reach back towards the 2200 level.

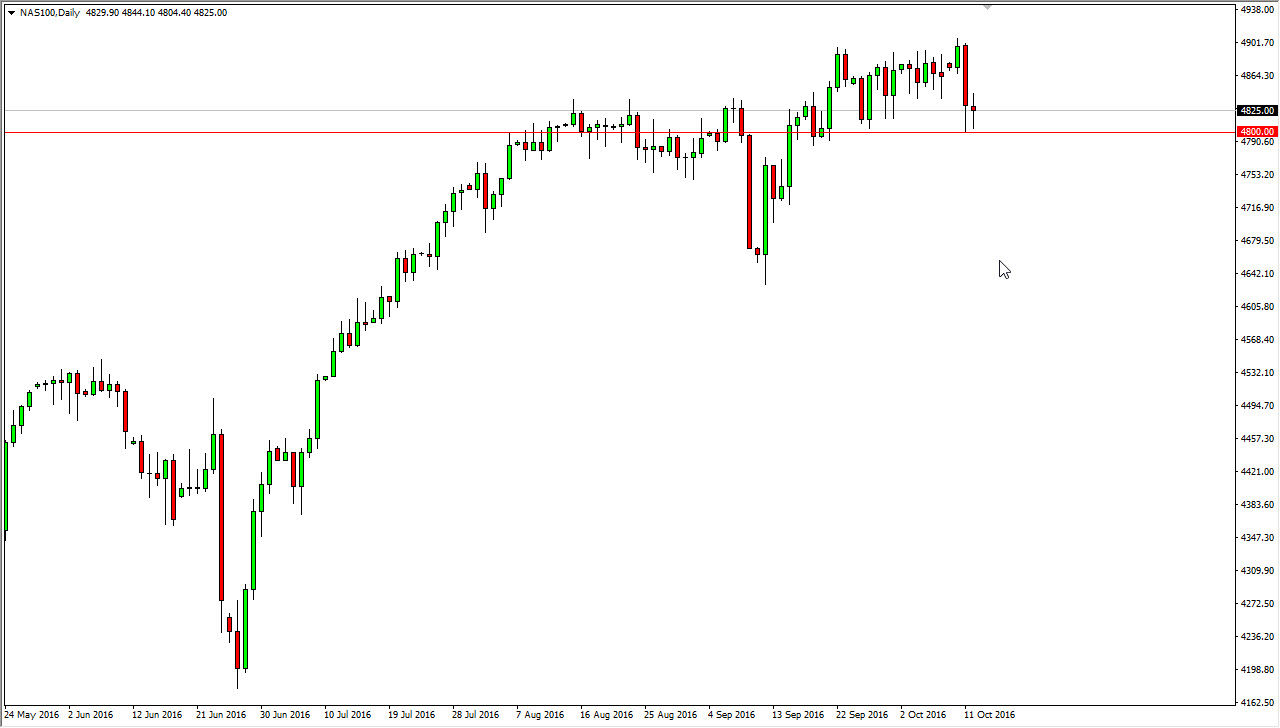

NASDAQ 100

The NASDAQ 100 went back and forth during the course of the session on Wednesday, as we bounced off of the 4800 level below. That is an area that had previously attracted a lot of attention, and I think it will continue to do so going forward. A break above the top the hammer for the day sends this market looking for the 4900 level, and then eventually I believe the 5000 level which is my longer-term target overall. Also, you have to keep in mind that the interest-rate environment it finds itself in is very low, and even if we did get an interest-rate hike, it’s very unlikely that we will get to. With that in mind, I believe that the NASDAQ 100 will continue to strengthen over the longer term and as a result, I have no interest whatsoever in selling this market as there is plenty of buying pressure all the way down to at least the 4750 handle.