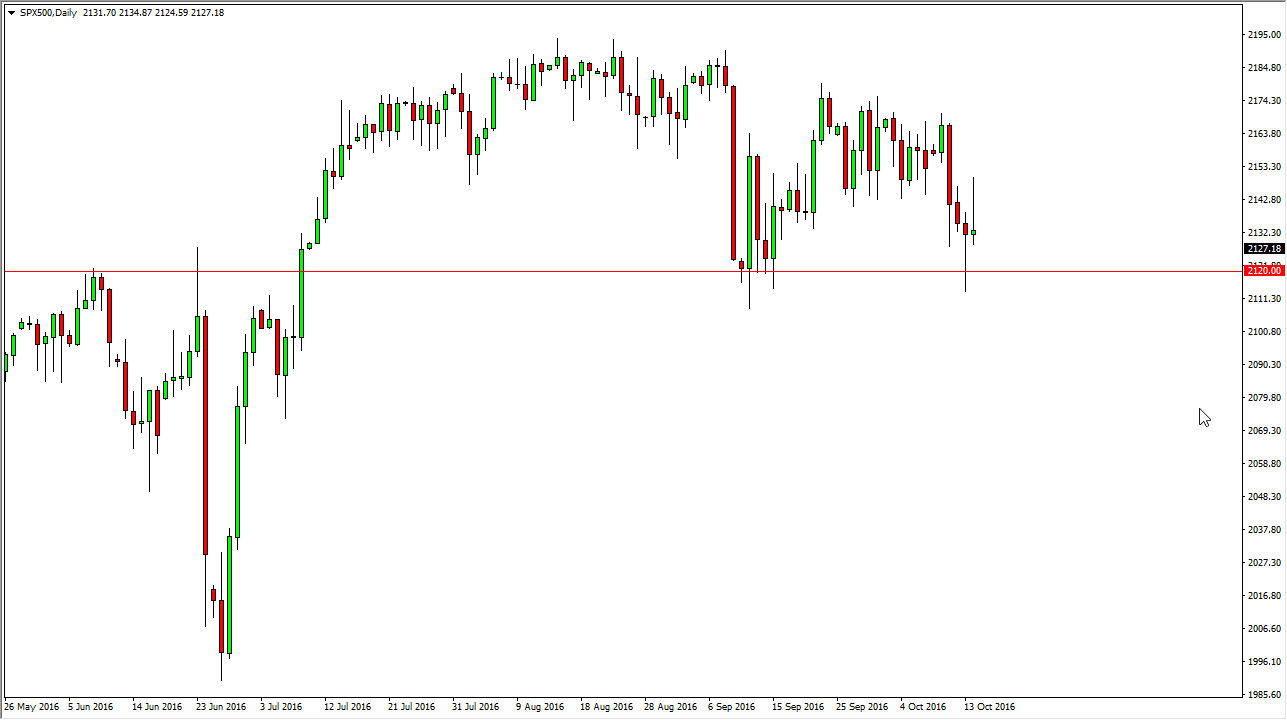

S&P 500

The S&P 500 initially tried to rally during the day on Friday, but found enough resistance of the 2150 level to turn things around and form a pretty massive shooting star. Still see a significant amount of support near the 2120 handle, and most certainly at the 2100 handle though. With this being the case, I think we are simply going to have a bit of a grind lower, I’m not looking for any type of massive breakdown. I think that sooner or later the buyers will return, and on the first signs of support or some type of impulsive bounce, I’m willing to buy this market but I recognize that it will probably be very bumpy all the way back towards the top, which I do think we revisit again. Alternately, if we break down below 2100 think we will have to test 2000.

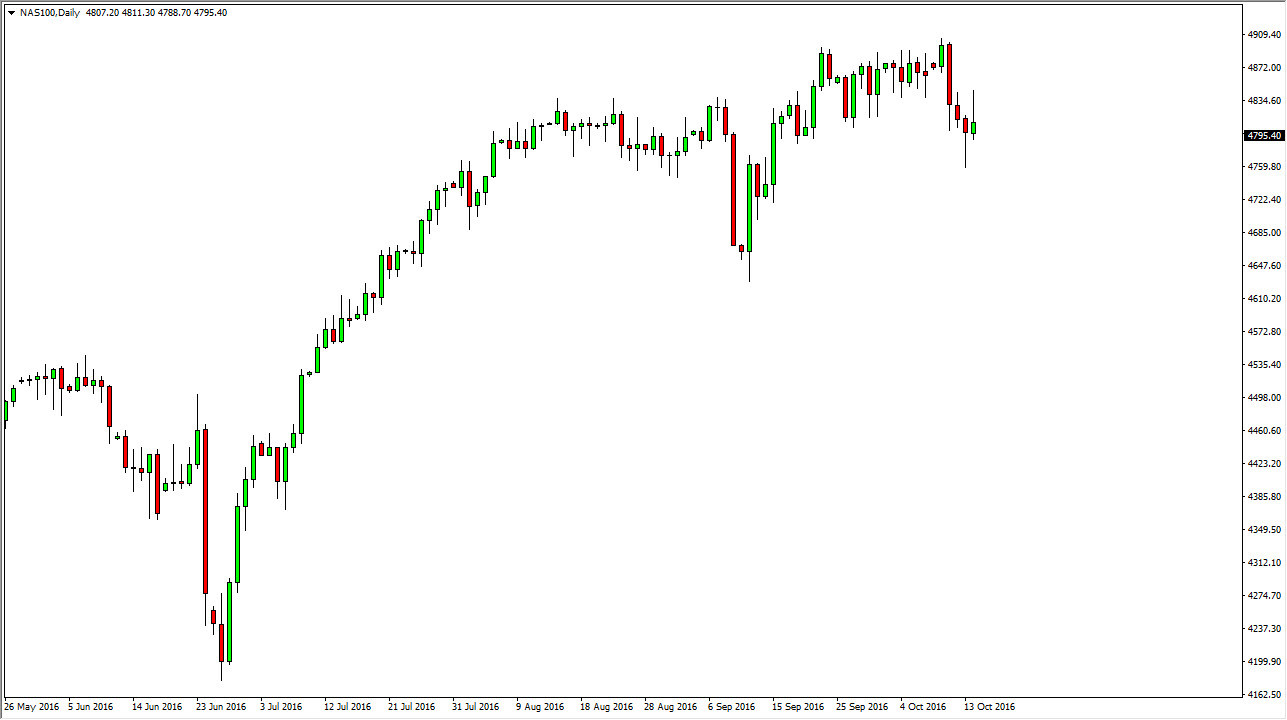

NASDAQ 100

The NASDAQ 100 did very much same type of thing during the session on Friday, testing the 4850 handle for resistance. We found enough there, and just like in the S&P 500, we ended up forming a shooting star. I believe that there is quite a bit of support all the way down to about 4750, and is not until we break down below there, which is extensively breaking down below the bottom of the Thursday hammer, that I’m willing to start selling. I think at this point in time, we will probably have fairly tight consolidation is the markets tried to figure out where they want to go next.

I’m more apt to buy supportive candles and I am trying to sell resistive ones, because quite frankly the longer-term trend had been so strong. The interest rate environment should continue to be very low, and that of course benefits the stock markets in general.