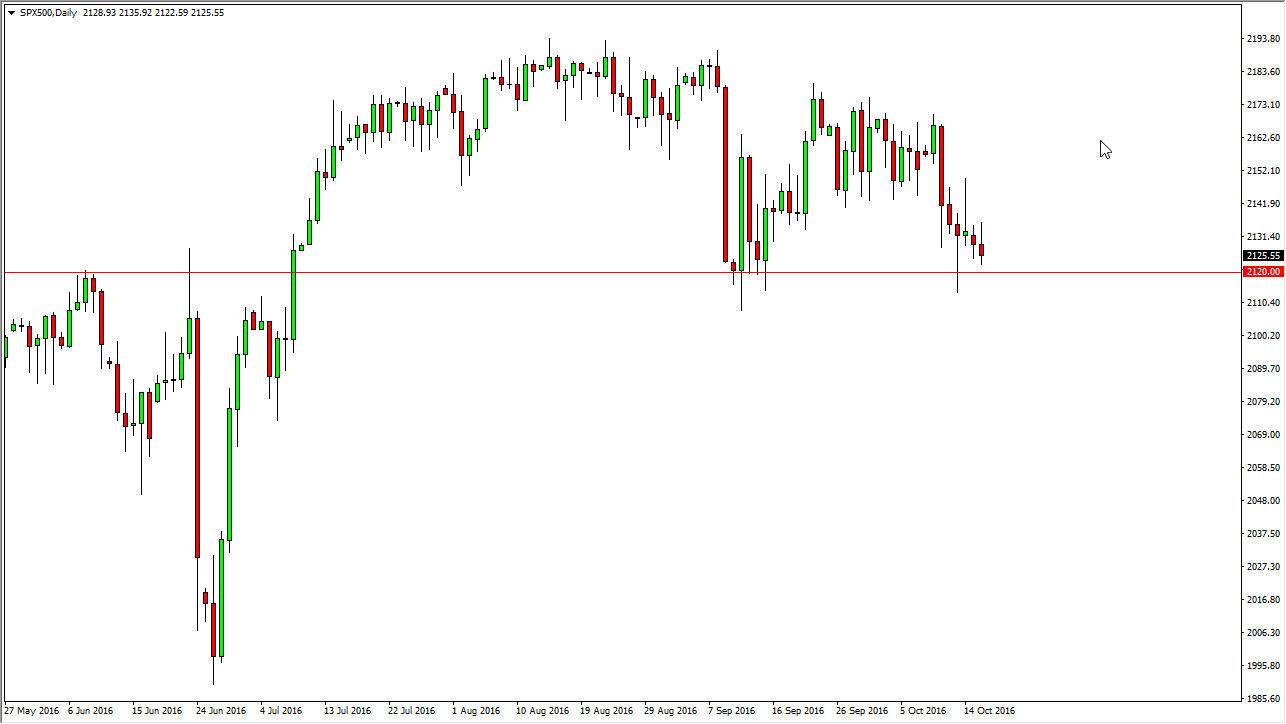

S&P 500

The S&P 500 went back and forth during the course of the session on Monday, as we bounced off of the 2120 handle below. This is a neutral candle, and it suggests that we are trying to find some type of momentum building in order to bounce from here and go higher. I believe that the market will eventually break out to the upside but right now I think we probably have more sideways action than anything else going on. I also recognize that there is support all the way down to the 2100 level at this point, so I don’t really look at selling opportunities at the moment. A supportive candle or an impulsive green candle is reason enough to go long as far as I can see in this market.

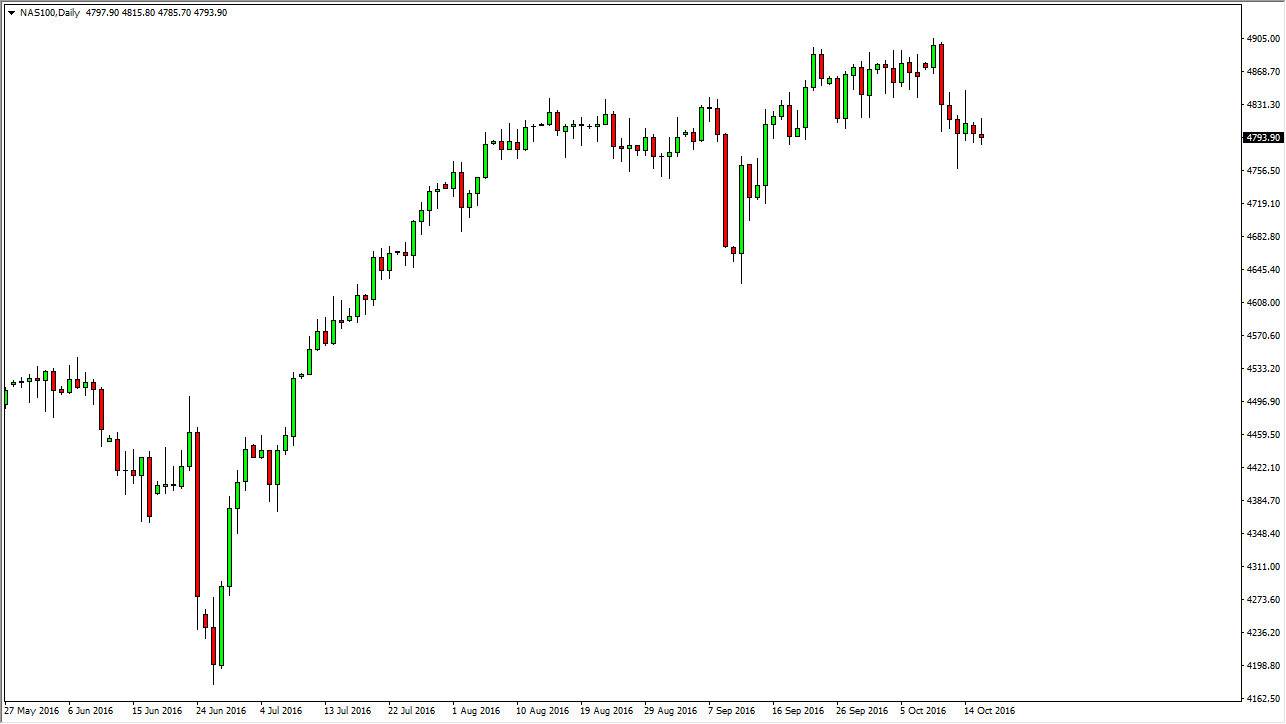

NASDAQ 100

The NASDAQ 100 went back and forth during the course of the session on Monday as well, as we continue to hang about the 4800 level. This is a market that I think is going to continue to go much higher, but in the meantime we will probably have to consolidate in order to build up enough momentum in order to go higher. I believe a break above the top of the shooting star from the previous week should send this market going much higher, perhaps reaching towards the 4900 level. If we can get above there, then we should then go towards the 5000 level above which has been my longer-term target for quite some time. I have no interest in selling the NASDAQ 100, as we have more than enough support below and of course have seen quite a significant amount of reactive support near the 4750 level over the course of the last several months. With this, I’m buying on dips after we break out, and going to add to my position again and again.