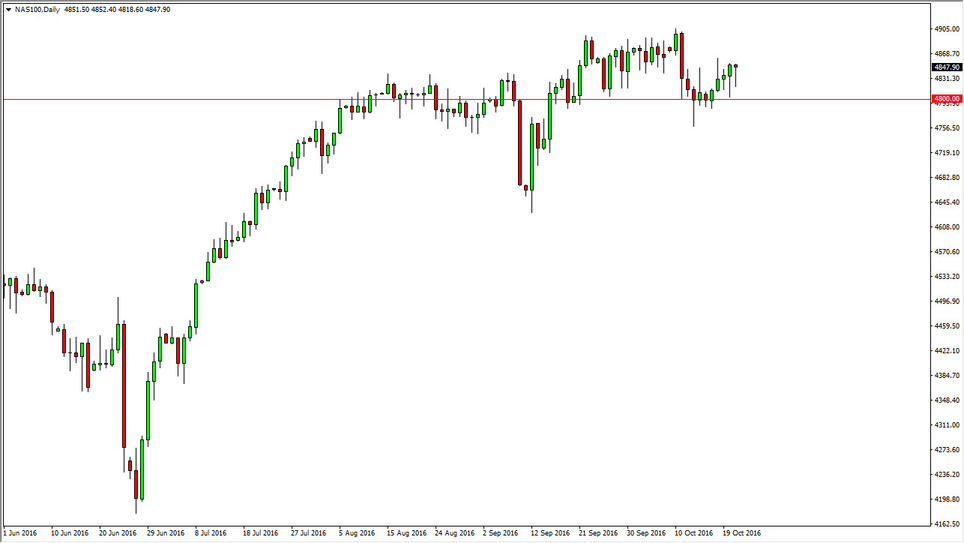

S&P 500

Initially, the S&P 500 fell during the day on Friday but found support yet again just above the 2120 handle. By finding that support, we bounced enough to form a nice-looking hammer, and of course that means that we are probably ready to bounce yet again. A break above the top of the hammer is a buying opportunity as far as I can see, and I think that the market is going to return to the 2175 handle. If we pullback from here, I anticipate that the 2120 level will continue to offer plenty of support so therefore I look at pullbacks as buying opportunities based upon short-term supportive candles. I have no interest in selling, at least until we break down below the 2100 level, which I see as the very bottom of the support at this point in time.

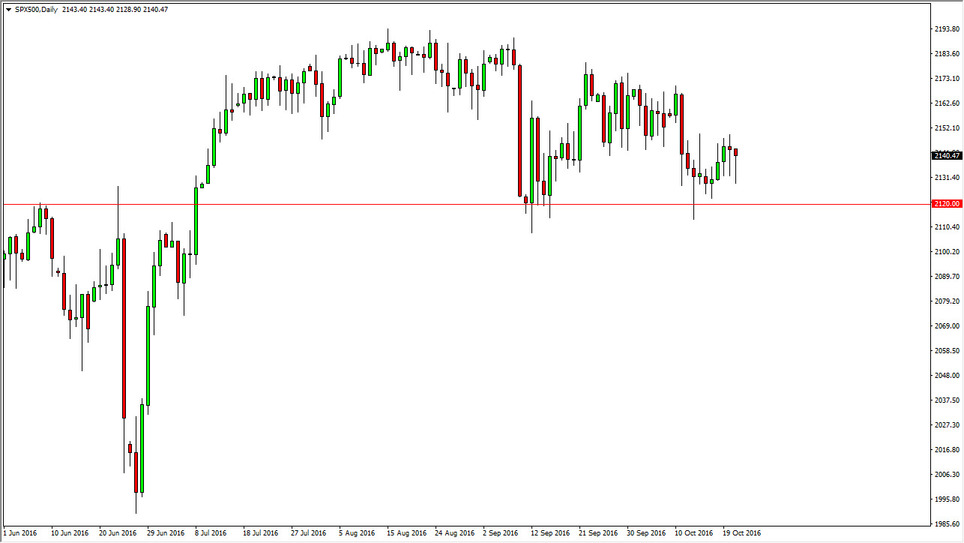

NASDAQ 100

The NASDAQ 100 fell as well, but just as the S&P 500 did, it also bounced enough to form a hammer. By doing so, it ends oh looking very bullish as the 4800 level has held as a floor for some time. I think that the 4900 level will be targeted next, and once we break above there we can probably anticipate a move to the 5000 level after that. This is a market that should continue to find buyers every time it dips, and I believe that the support runs all the way down to the 4750 handle, which has been supportive in the past. I think that it’s only a matter of time before buyers return every time we fall, and although I do have a target of 5000 in the long run, I think that it is going to be a lot of choppiness back and forth that we can expect between now and then. With this, I still have quite a bit of bullish bias to this market but I also recognize it won’t be easy.