S&P 500

The S&P 500 rallied during the day on Monday, as we continue to see quite a bit of bullish pressure. Ultimately, I believe that we will continue to grind higher, perhaps reaching towards the 2175 handle. I think pullbacks will continue to have plenty of support, and as a result I am a buyer only in this market, as I think the 2120 handle below continues to be the absolute “floor” in this market. Ultimately, I think that the floor extends all the way down to the 2100 level, so I’m not even thinking about selling. I think eventually we will break above the 2175 handle, and then perhaps reach much higher than that. Given enough time, I think that the low interest rate environment will continue to lift the S&P 500 as money has nowhere else to go.

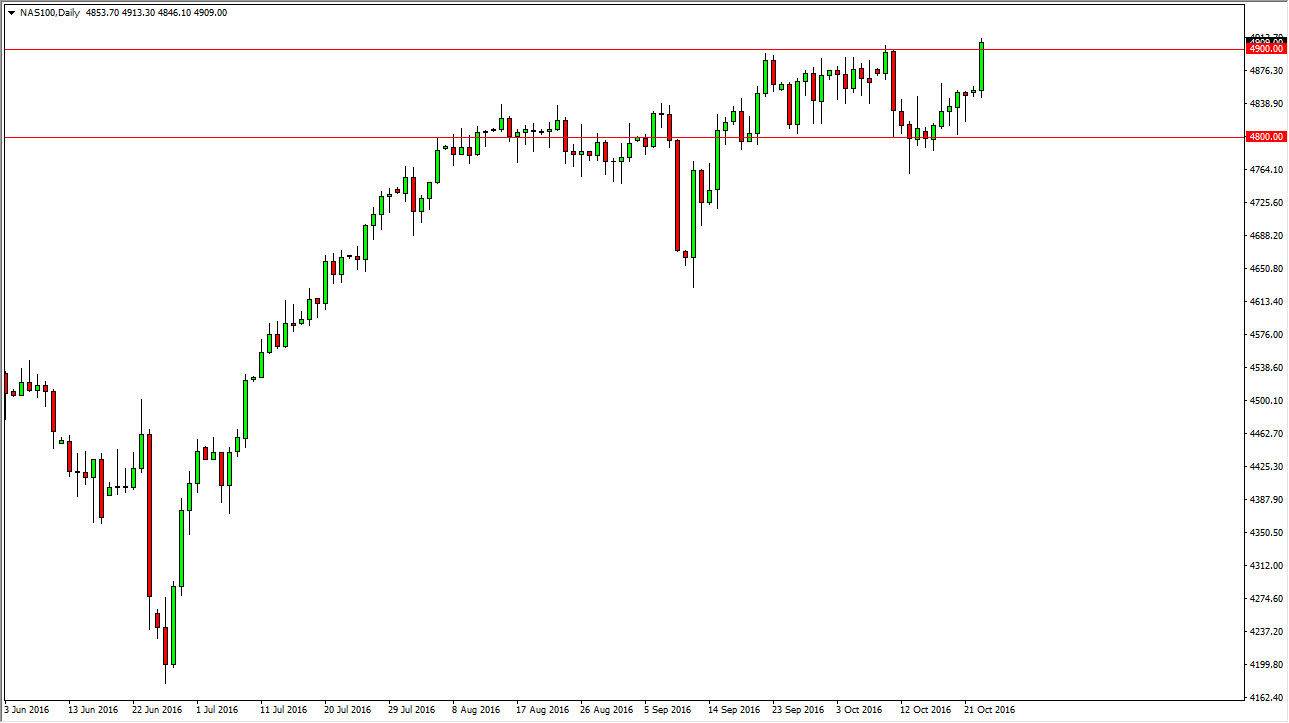

NASDAQ 100

The NASDAQ 100 broke higher during the course of the session on Monday, breaking above the 4900 level and showing signs of strength. The fact that we close towards the top of the candle at the end of the day also suggests that buyers are getting involved. With this, the market should continue to reach towards the 5000 level above which has been my longer-term target for some time. Pullbacks offer buying opportunities going forward, and I believe that the 4800 level below is essentially the “floor” in the market, and I think that it gives is plenty of confidence going forward, but I do recognize that the 5000 level above is going to be massively resistive, but more than likely we will eventually break above there as we have seen so much bullish pressure. Ultimately, it’s not until we break down below the 4750 level that I would consider selling, and at this point in time it does not look like it’s going to happen. With this, I remain bullish overall.