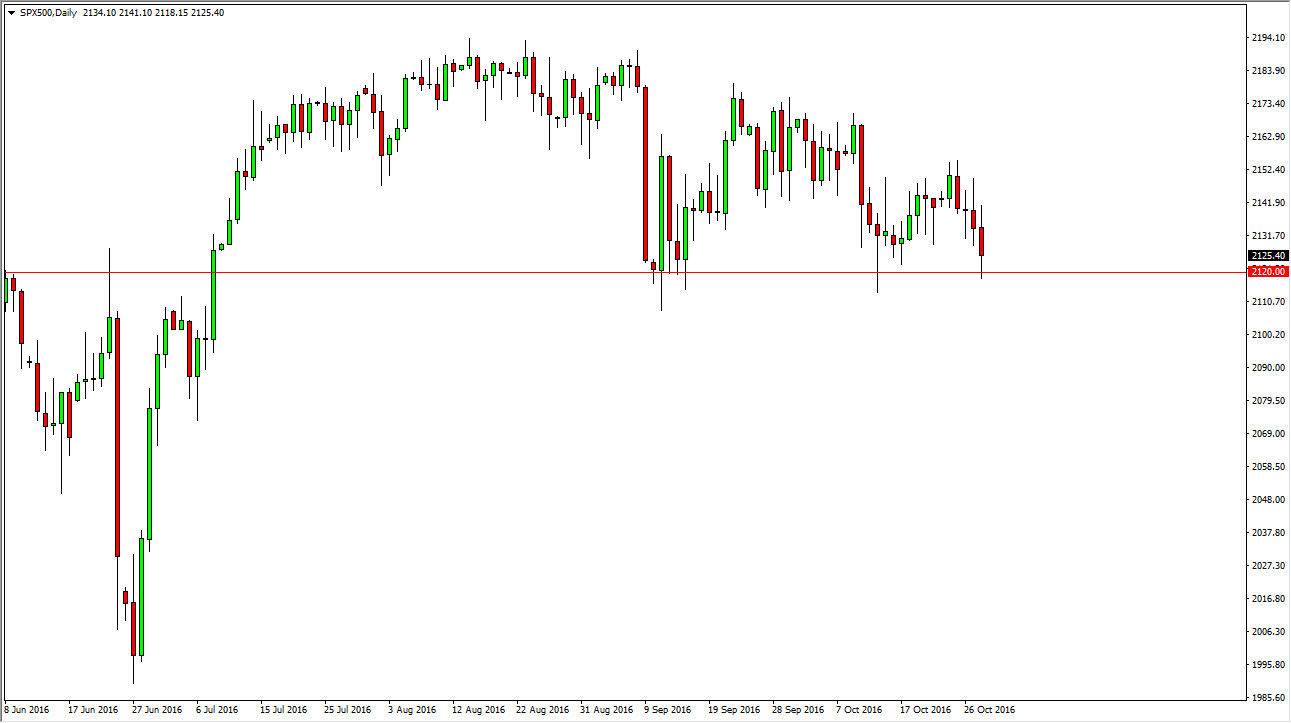

S&P 500

The S&P 500 went back and forth during the course of the session on Friday, testing the 2120 level for support. We did find it there, and as a result I feel that the market will probably try to bounce from here. Even if we break down a little bit, it’s likely that we will go down to the 2000 handle. Ultimately, this is a market that continues to find a lot of support just below and as a result I think that it’s only a matter time before we reach towards the 2150 handle or perhaps the 2175 handle. With this, I think the low interest rate environment will continue to support the S&P 500, and with that being the reality of the situation I cannot sell.

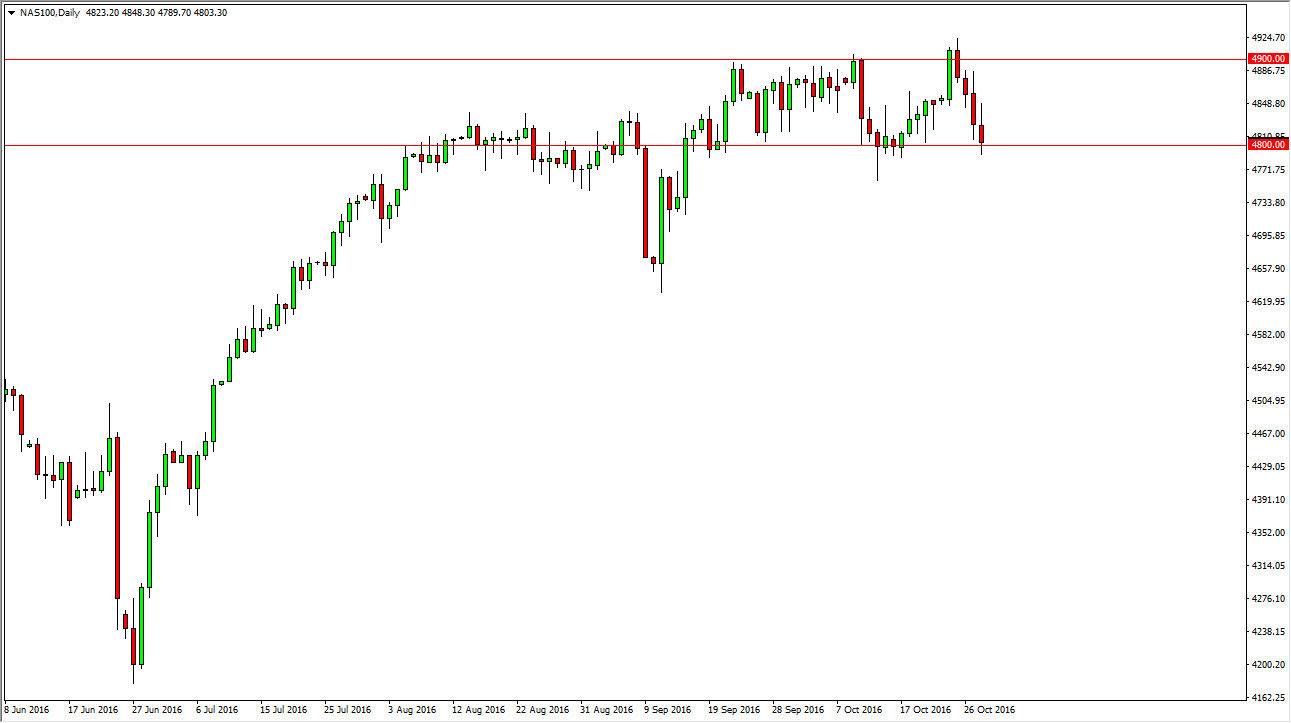

NASDAQ 100

The NASDAQ 100 initially rallied during the course of the session on Friday, but turned around to form a bit of a shooting star. The shooting star of course is a very negative sign, and if we can break down below the bottom of the range, the market could drop down to the 4750 level. A break down below there and then change the trend as far as I can see, at least for the short-term. Ultimately though, I believe that we will have some type of supportive candle and therefore it’s only a matter of time before we bounce and reach towards the 4900 level. A break above that level of course sends this market to my longer-term target of 5000, and I still believe that’s what will happen given enough time. With this, I am a buyer but I need to see a candle that tells me to start buying again, and we obviously don’t have that. With this, I will have to look for shorter-term charts more than likely to get my trade, but it would not surprise me at all if we continue the consolidation that we have been in.