USD/JPY

The US dollar initially rallied during the day on Tuesday, but turned back around to fall against the Japanese yen. With this being the case, looks as if we will continue to see quite a bit of volatility in this particular pair but I still believe there is more than enough support below to turn this market back around. After all, the Bank of Japan is still very interested in keeping this market afloat, as the Bank of Japan is worried about the effects of an overvalued Japanese yen to the economy. With that being the case, I think that every time we pull back, sooner or later the buyers will get involved and therefore I’m looking for supportive candle in order to start going long.

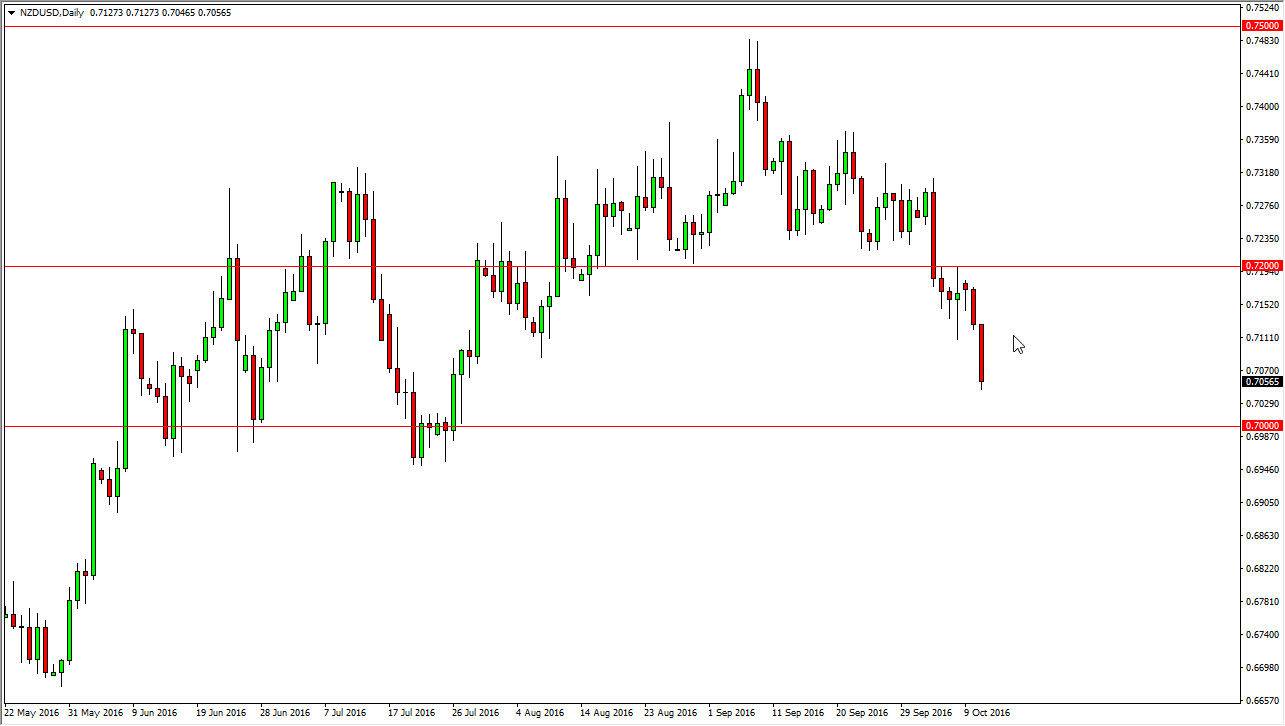

NZD/USD

The New Zealand dollar had a very negative session during the day on Tuesday, as we continue to see bearish pressure in general, and of course the lack of risk appetite when it comes to the commodity markets as well. With this, I think that the market is going to reach down to the 0.70 level rather quickly, and that any rally at this point in time will more than likely continue to see sellers of on signs of exhaustion offer short-term charts. Because of this, I have no interest in buying this pair and I do believe that it’s only a matter of time before the sellers get involved every time we rally. I think that the 0.72 level above is going to be the “ceiling” in this market, and although I recognize that the 0.70 level below is in a be supportive, I think that it’s only a matter of time before we break down below there. Once we do, things could get rather ugly for the New Zealand dollar. Ultimately, this is a market that cannot be bought in these particular conditions.