USD/CAD Signal Update

Yesterday’s signals were not triggered as the bullish price action took place well below the identified support level at 1.3060.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm New York time today.

Long Trade 1

Long entry after bullish price action on the H1 time frame following the next touch of 1.3060.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trades

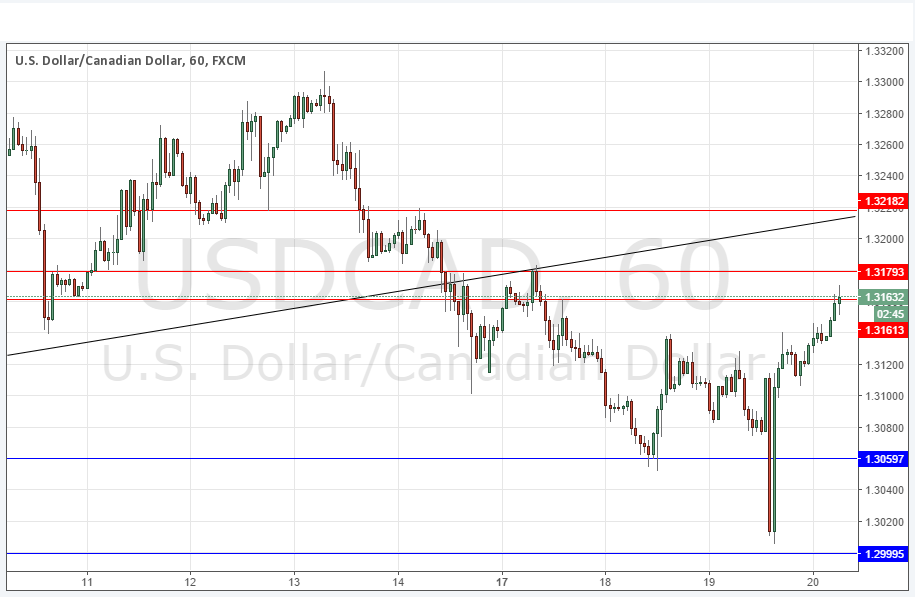

Short entry after bearish price action on the H1 time frame following the next touch of 1.3179 or 1.3218.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

Yesterday’s releases from the Bank of Canada sent the price down sharply close to the key support level at 1.3000, but the price bounced back strongly right away and is now higher still. The support and resistance levels have had to be adjusted slightly, but the fairly bullish picture remains unchanged from 24 hours ago.

The item that really stands out in the chart below is the trend line, which has proved to be crucial as both support and more lately as resistance. It is moving into a confluence with the horizontal resistance level at 1.3218 so that could be a great place to watch for a big reversal.

At the time of writing, although the action has been bullish, the price is bumping up into a resistant zone that starts at about 1.3161.

There is nothing due today regarding the CAD. Concerning the USD, there will be a release of Philly Fed Manufacturing Index and Unemployment Claims data at 1:30pm London time.