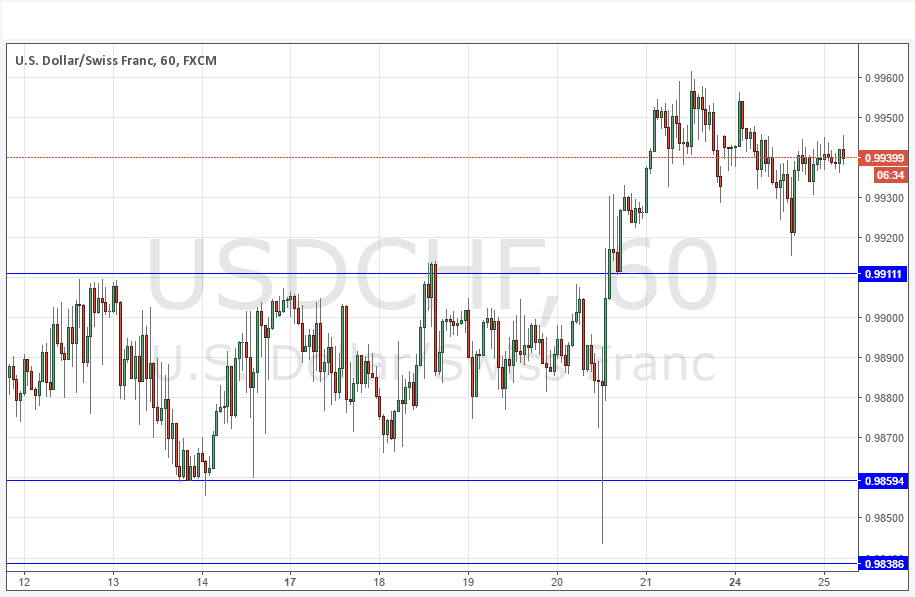

USD/CHF Signal Update

Last Thursday’s signals produced a nicely profitable long trade following the bullish pin candle which rejected the identified support levels at 0.9859. It would probably be wise to take more profit off the table from this trade if the price gets established below the new higher support level at 0.9911.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be entered before 5pm London time today.

Long Trades

Long entry after bullish price action on the H1 time frame following the next touch of 0.9911 or 0.9859.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry after bearish price action on the H1 time frame following the next touch of 1.0000.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

I wrote last Thursday that “there could be a fairly violent bullish breakout eventually all way to 0.9946.” and this is what took place. The price got a little higher than the half number at 0.9950 before falling back yesterday. It is too soon to tell but it looks as if the price may rise again although this pair does seem rather repressed even when bullish. It must be noted that although the long-term trend is bullish, this price area has been the upper limit of the trading range for a few months by now.

I still see a move up to 1.000 as more likely than a serious fall.

There is nothing due today regarding the CHF. Concerning the USD, there will be a release of CB Consumer Confidence data at 3pm London time.