USD/JPY Signal Update

Yesterday’s signals produced a long trade set-up following the doji bounce and bullish break up off the support level identified at 103.68, but it was a losing trade.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be taken between 8am New York time and 5pm Tokyo time, during the next 24-hour period.

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 103.33.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of the bearish trend line currently sitting at about 104.00.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

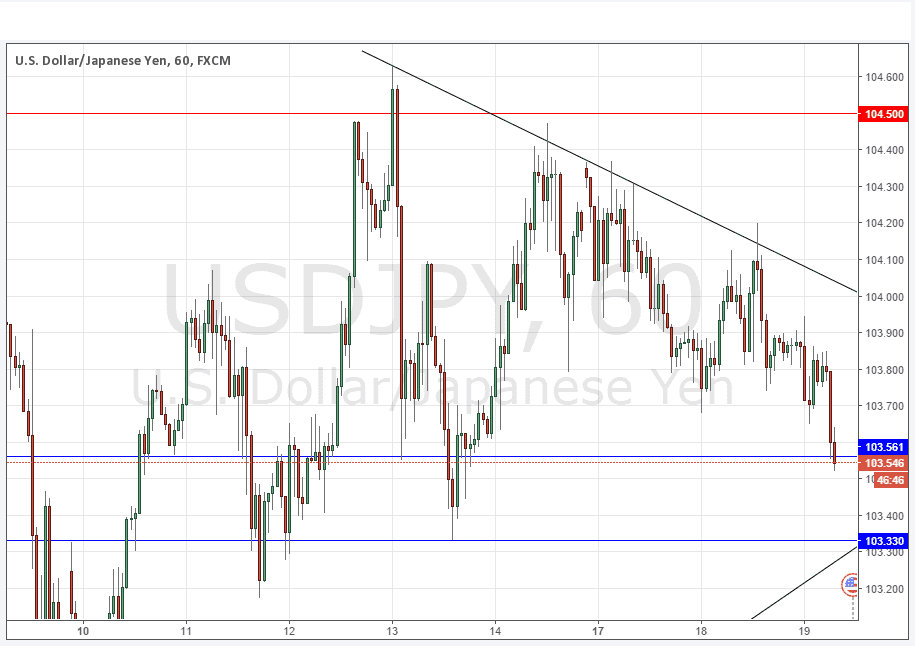

Although the long-term bearish trend came to an end some time ago, over the past week we have seen a bearish trend line develop – as shown in the chart below - which has acted to constrain the price and actually drive it down past some support levels.

The support level at 103.33 could be very interesting if reached any time soon as the there is an old, long-term supportive bullish trend line coming up and just about reaching confluence with that horizontal level now.

The longer-term picture looks to be one of consolidative, slightly choppy swings between about 102.00 and 106.00.

There is nothing due today regarding the JPY. Concerning the USD, there will be a release of Building Permits data at 1:30pm London time, followed by Crude Oil Inventories at 3:30pm.