Gold ended the week up $14.85 at $1266.71 on speculation that the Federal Reserve will hold off on monetary policy changes until after the U.S. presidential election, and the forward path in interest rates is going to be slower than the market forecasts. The U.S. central bank has been optimistic about the growth of the economy but has had to alter its plans several times. At the beginning of the year, the Fed projected it would raise rates four times in 2016.

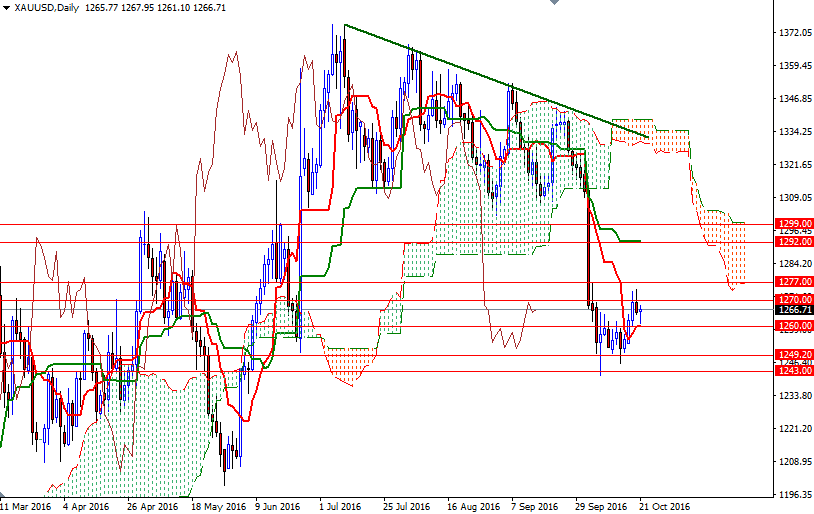

The U.S. dollar’s strength against other currencies has been pressuring the market but surging physical demand for bars and coins in Asia may limit price decline. Currently the technical outlook is mixed as the weekly, daily and 4-hour charts point to different directions. The XAU/USD pair is trading above the weekly Ichimoku cloud but on the daily time frame we are below the cloud and the 4-hourly cloud right beneath prices is showing some support. With tha in mind, we might see a range bound movement in the next couple of weeks.

The initial resistance resides in the 1272/0 region, followed by 1280/77 (a strategic camp which will allow the market to proceed to the 1288/6 zone). The market has to anchor somewhere above that in order to extend gains and challenge 1294/2, where the daily Kijun-Sen (twenty six-period moving average, green line) sits. On the other hand, if the bulls fail to push prices beyond and the market drops through 1260, prices will have a tendency to revisit 1255 and 1250/49. Eliminating this support could open up the risk of a move towards 1243/0. A daily close below 1240 would make me think that 1237, 1232.30 and 1225 will be the next targets.