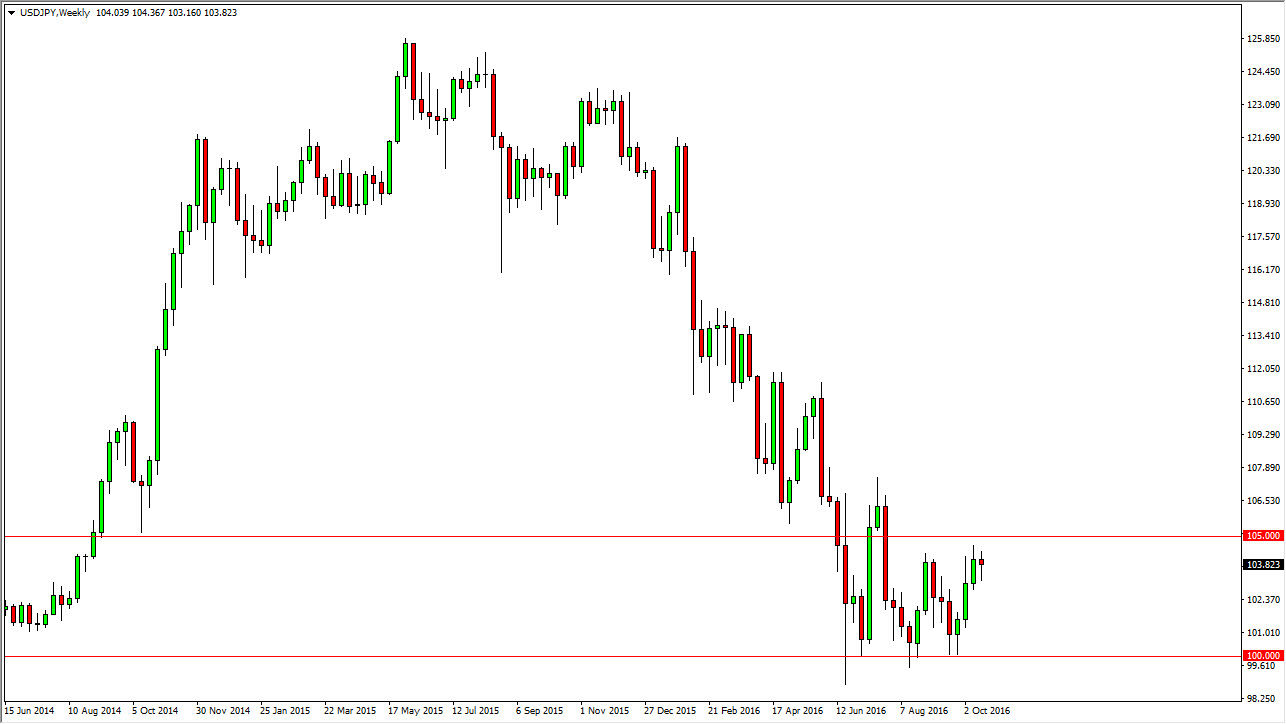

EUR/USD

The Euro initially when above the 1.10 level during the course of the week but found enough resistance above to turn things back around and fall significantly. We closed on Friday below the 1.209 level, and now I think we’re going to continue to see a grind lower. Short-term rally should continue to offer selling opportunities as the ECB looks even farther away from tapering off of quantitative easing than initially thought.

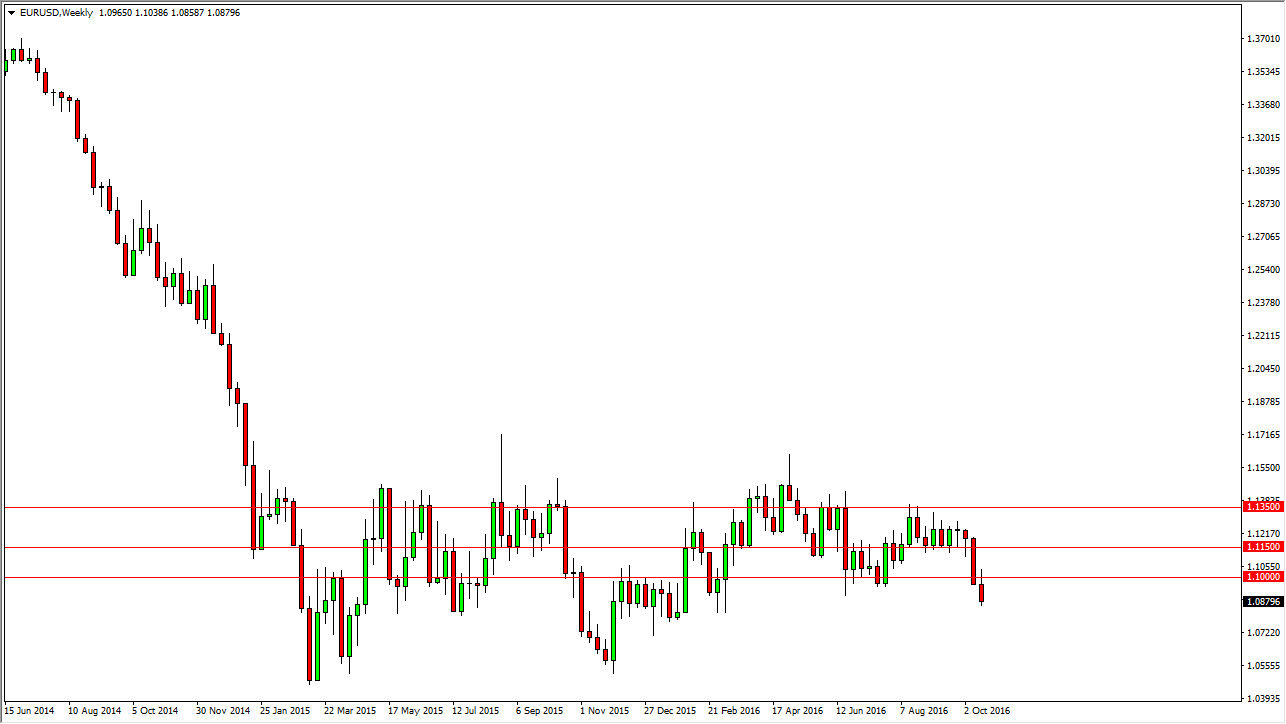

GBP/USD

The British pound initially tried to rally during the week as well but also gave up gains. We ended up forming a bit of a shooting star in the market, and as a result I think we’re going to continue to see bearish pressure in this market and rallies will offer selling opportunities. If we can break down below the 1.20 level on a daily close, the market should go much lower.

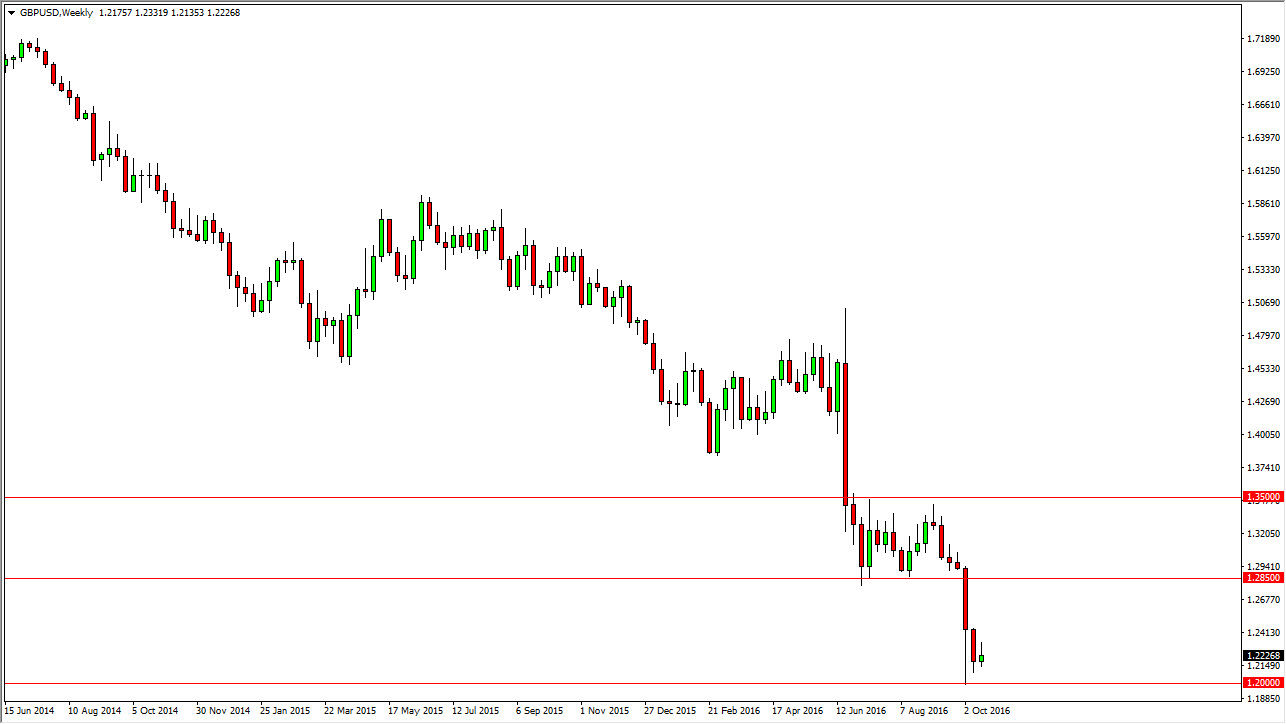

AUD/USD

The Australian dollar initially tried to rally during the week as well, but it found the 0.7750 level far too resistive yet again. Because of this, we ended up forming a shooting star for the weekly candle, which of course is a very bearish sign. However, we have formed a hammer during the previous week, so I think we’re going to stay within the consolidation area of 0.75 on the bottom and 0.7790 on the top.

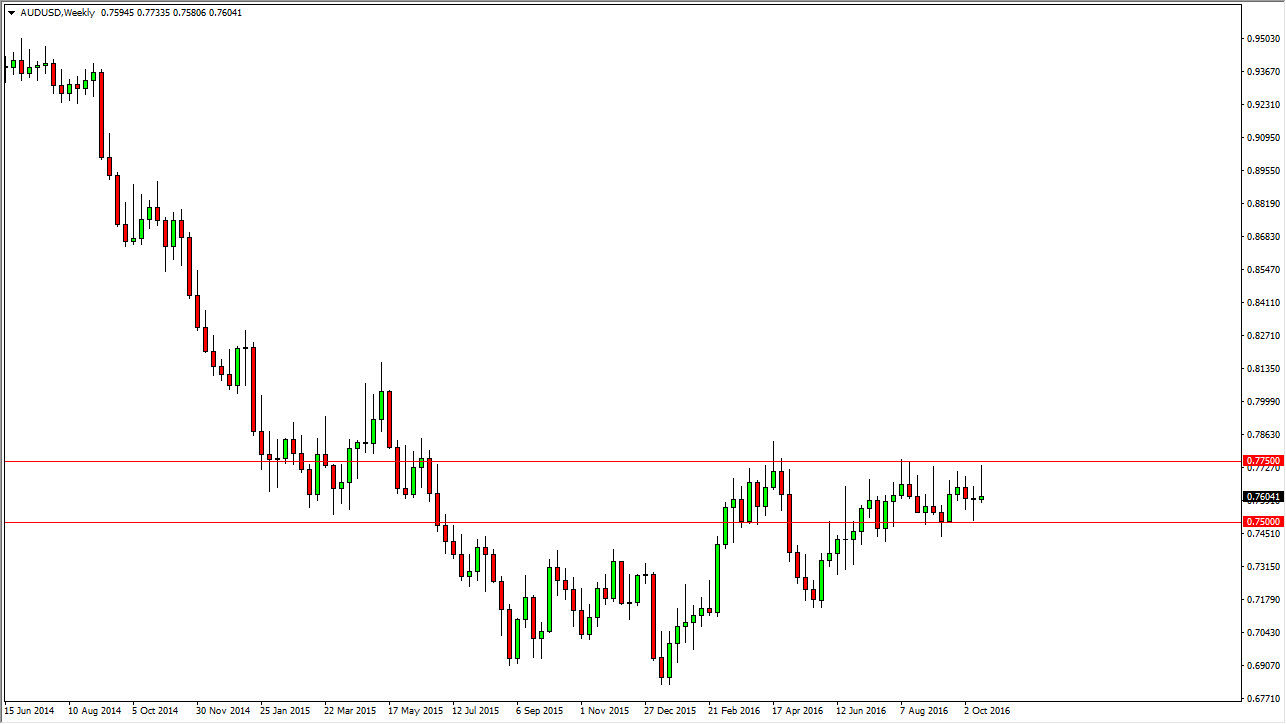

USD/JPY

The USD/JPY pair initially fell during the course of the week, but bounced enough to form a bit of a hammer. The hammer is pressing up against significant resistance, so I think we are going to get quite a bit of choppy trading during this coming week. I think the pullbacks will offer buying opportunities but we will probably have to attempt several times to break above the 105 level.