Gold

Gold markets initially fell during the course of the week, but turn right back around it exploded to the upside during the day on Friday. Breaking above the $1275 level is a bullish sign, and at this point time I believe that the market will continue to go much higher, perhaps reaching towards the $1300 level next. Look to short-term pullbacks and show signs of support as value.

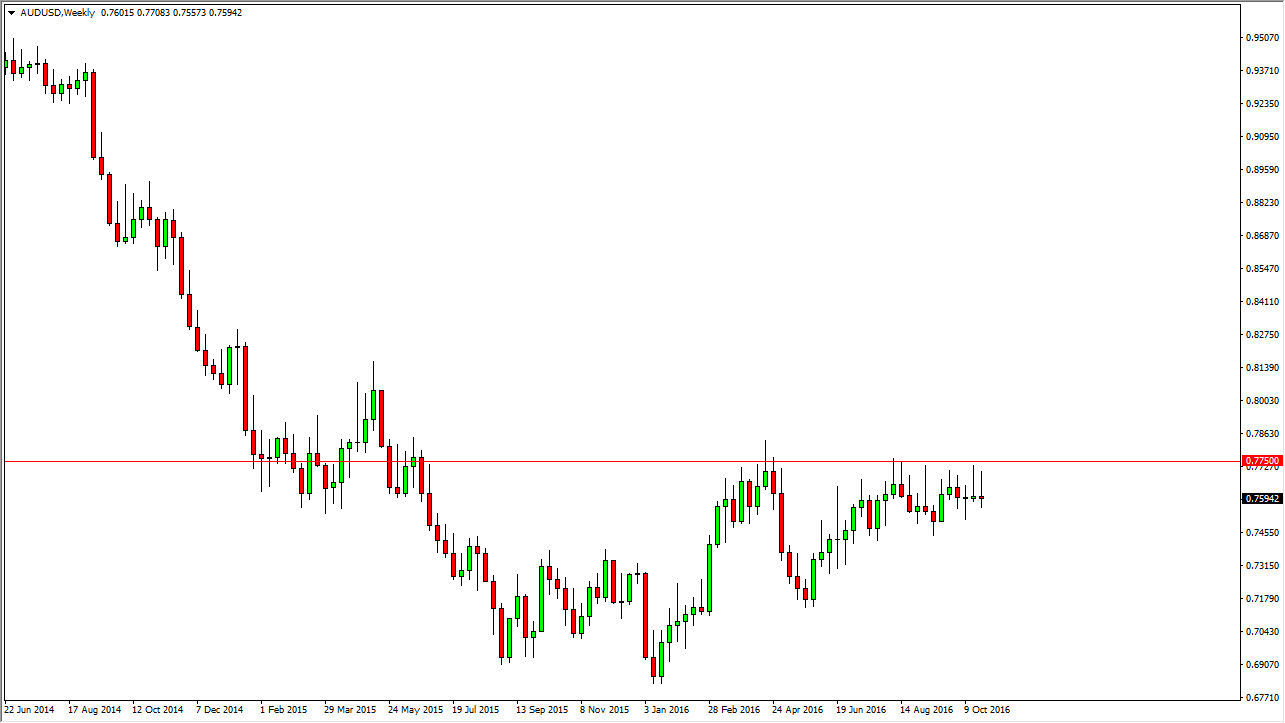

AUD/USD

The Australian dollar initially rallied during the course of the week but struggled as we get close to the 0.7750 level. Ultimately, this is a market that seems to be struggling every time we get near that area but I do recognize that if we break above there that would be an extraordinarily bullish sign. The short-term though, I suspect that every time we rally we will selloff for a small move.

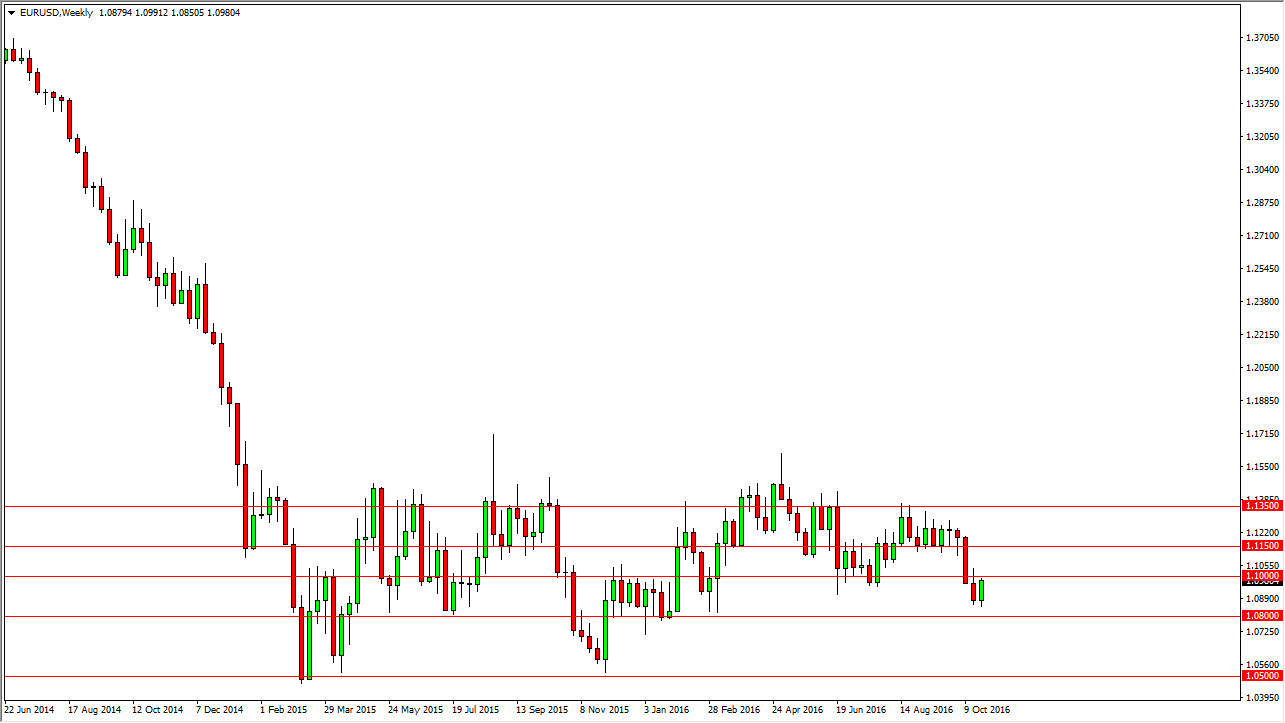

EUR/USD

The Euro bounced a bit during the course of the week, and reached towards the 1.10 level above. At this point in time, I suspect that this area has quite a bit of resistance again, and as a result it looks very likely that the sellers may reenter the market from a short-term perspective. I don’t really have a whole lot of faith in this market at the moment but I would be willing to take a short-term selling opportunity if exhaustion shows itself.

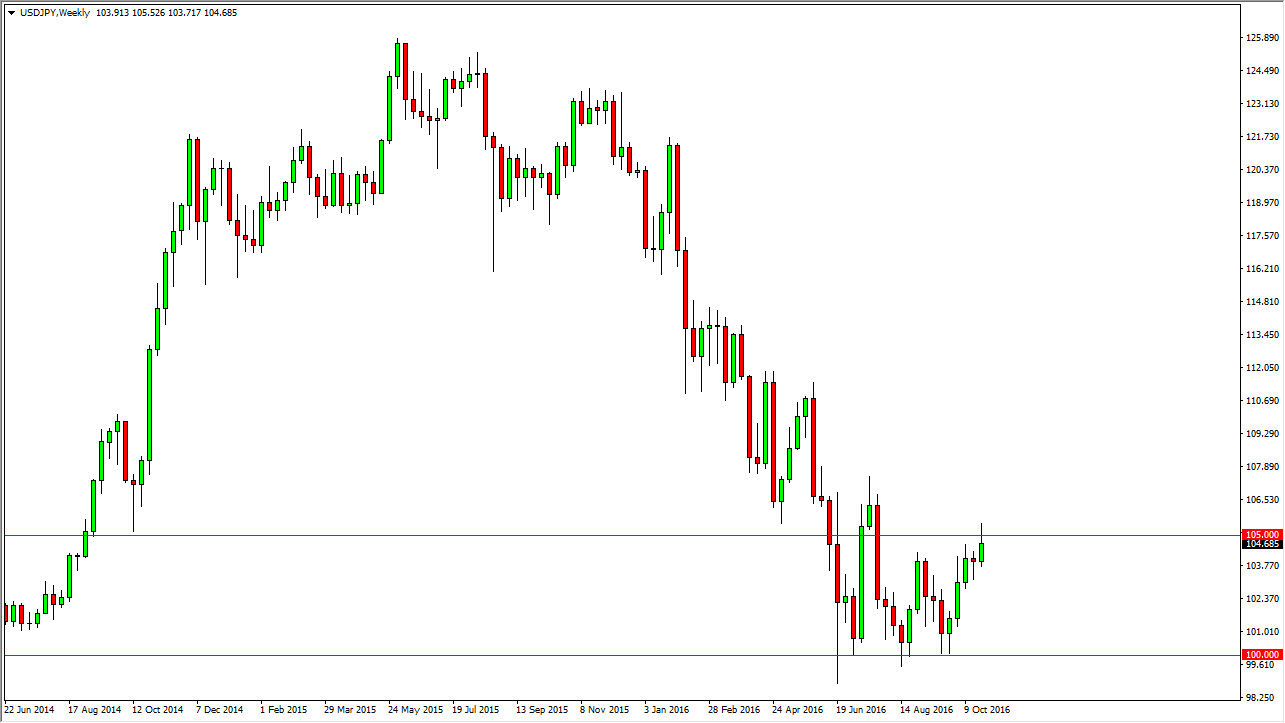

USD/JPY

The US dollar rallied during the course of the week, slicing through the 105 level. However, by the end of the week we ended up closing below there and it looks as if we are going to see quite a bit of trouble just above. At this point though, I do believe that the momentum is with the buyers so I would look at short-term pullbacks as potential value that you can start picking up again.