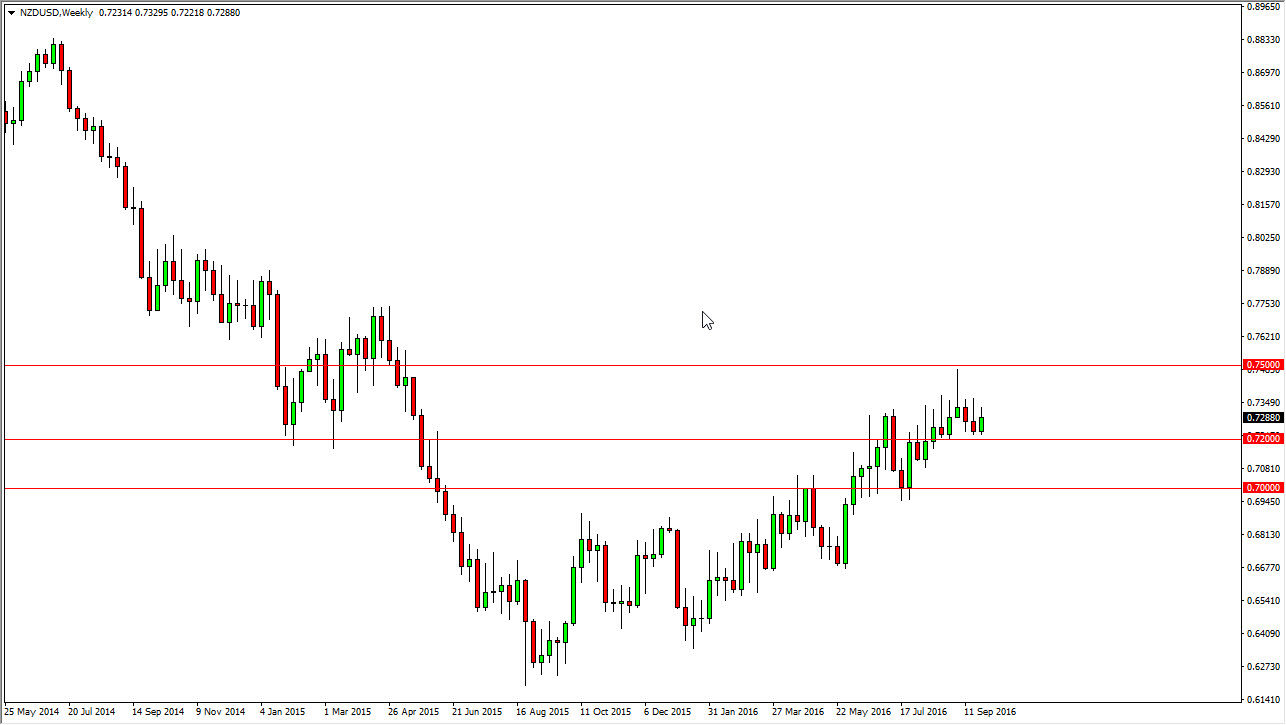

NZD/USD

The NZD/USD pair had a slightly positive week, but at the end of the day I think that this market is trying to roll over. What’s truly interesting for me is the fact that the New Zealand dollar ended up forming a shooting star for the month of September. With this being the case, once we break below the 0.72 level I’m going to start selling rapidly.

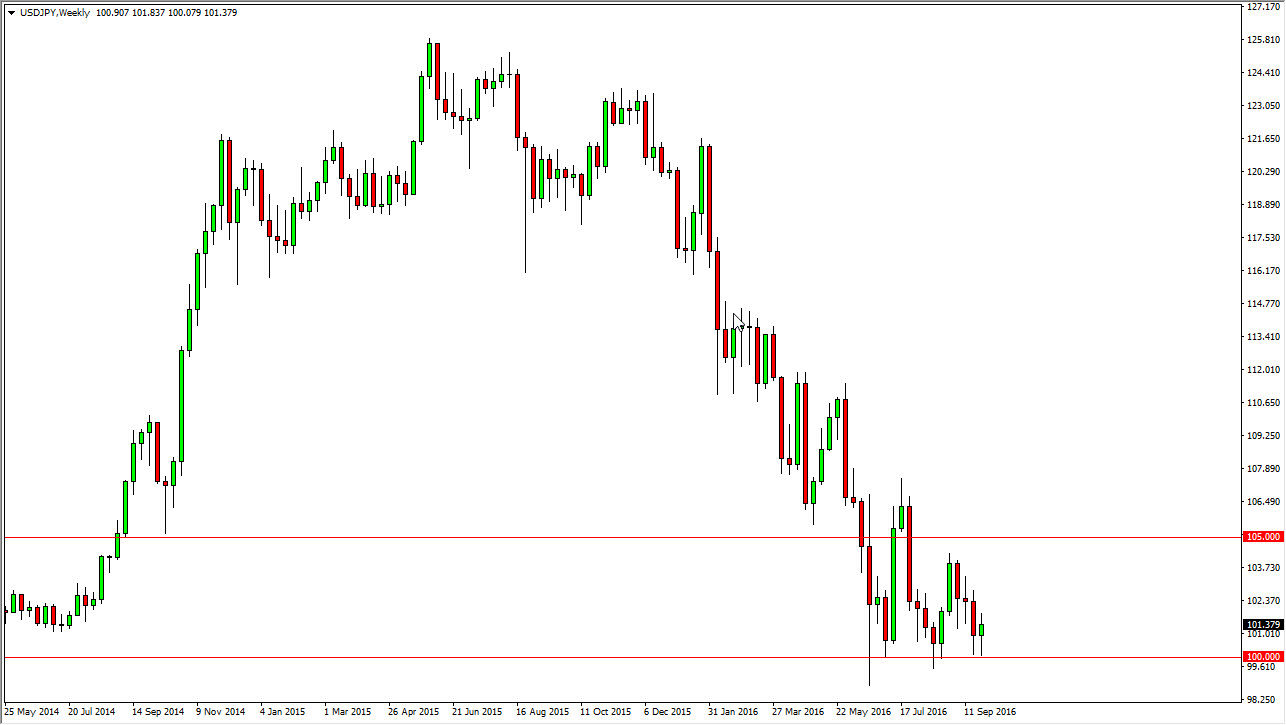

USD/JPY

The USD/JPY pair fell initially during the course the week but found enough support at the 100 level. That of course is an area that I feel that the Bank of Japan is trying to defend, and as a result I feel that every time we drop near that number, we will probably see buyers return. Because of this, I would be a buyer.

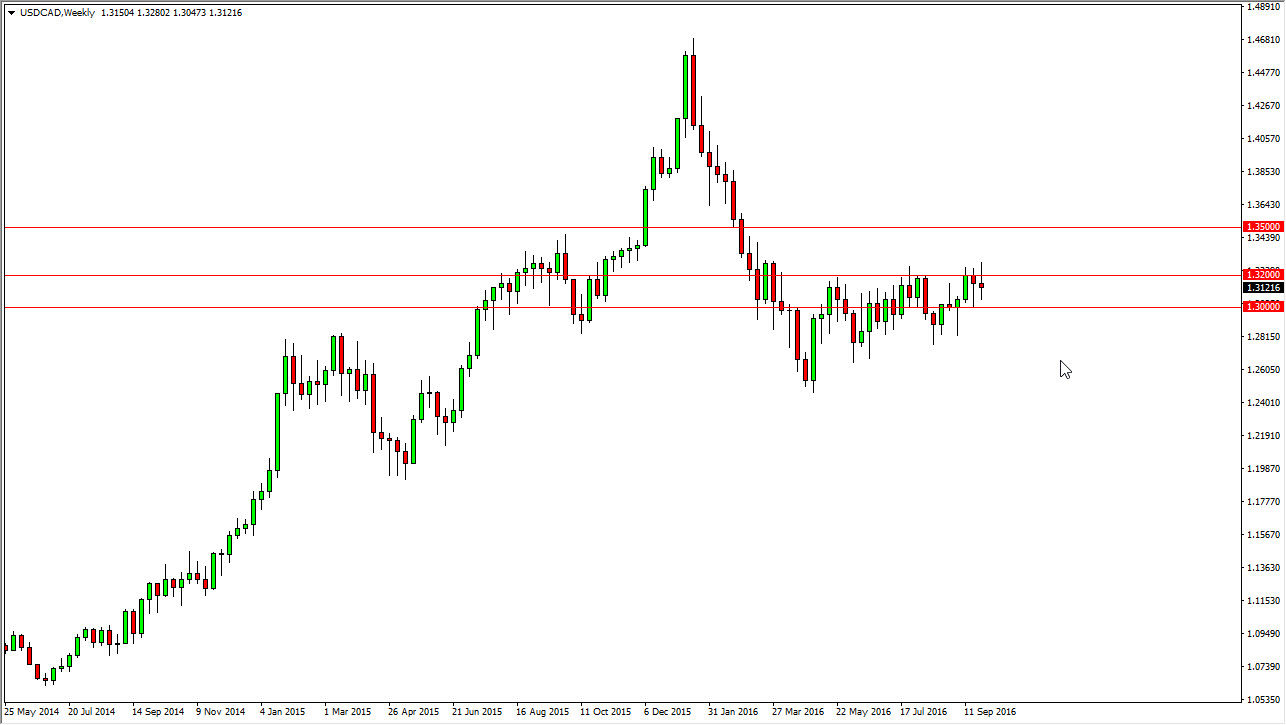

USD/CAD

The USD/CAD pair went back and forth during the course of the week, breaking above the 1.32 level, showing signs of real strength. However, we turned right back around to form a bit of a shooting star. Ultimately, this is a market that looks to be trying to find quite a bit of support at the 1.30 level, and they do prefer buying this market because I think we are forming a bit of an ascending triangle. If we can break above the top of the shooting star from this past week, at that point time I feel that we will go much higher.

EUR/USD

I still think this pair is an absolute disaster waiting to happen. What I mean by this is that there is no discernible trend at all other than to simply grind back and forth. Ultimately, I am not trading this particular market but I recognize that the 1.1150 level below is supportive, and the 1.1350 level is resistance. If we do break down below the 1.1150 level, the market should then reach down to the 1.10 handle. Having said that, I am just not interested.