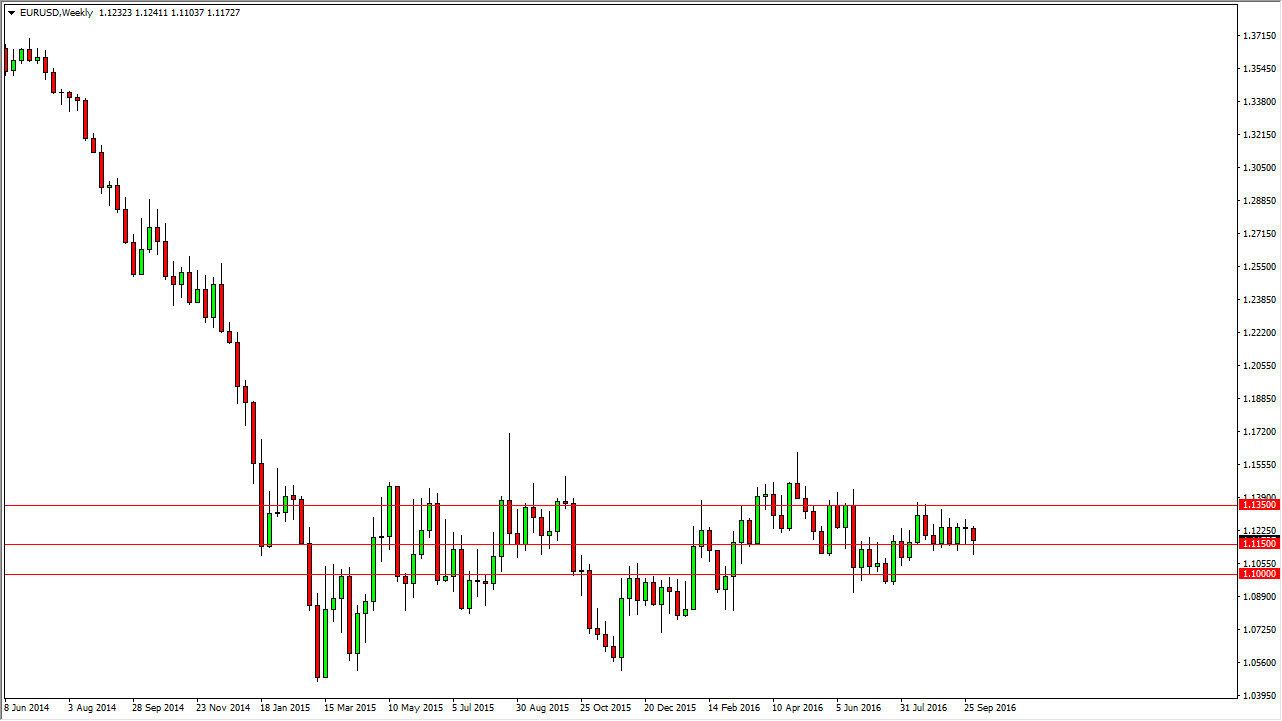

EUR/USD

The EUR/USD pair fell during a majority of the week, but ended up finding the 1.1150 level supportive enough to turn things back around. That being the case, I believe that we will continue to see negative pressure, and that short-term rallies will more than likely offer selling opportunities over the next several sessions.

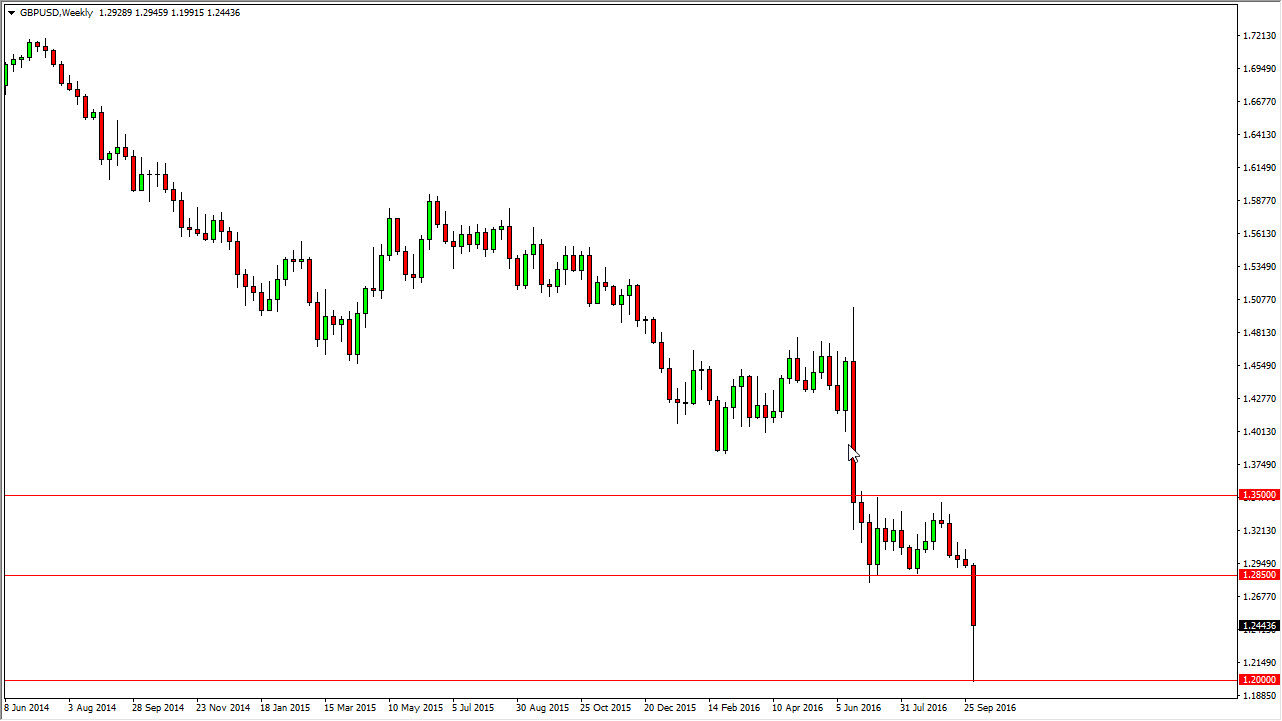

GBP/USD

The GBP/USD pair broke down rather significantly during the course of the week, more specifically on Friday as there was some type of an anomaly in the markets. The 1.20 level offered support, and was my longer-term target. However, we bounced off of that level significantly enough for me to expect a return to selling pressure sooner or later. This reeks of a thin market below, so having said that I feel that it’s only a matter of time before the exhaustion comes back into play, and as a result on those signs I will be selling.

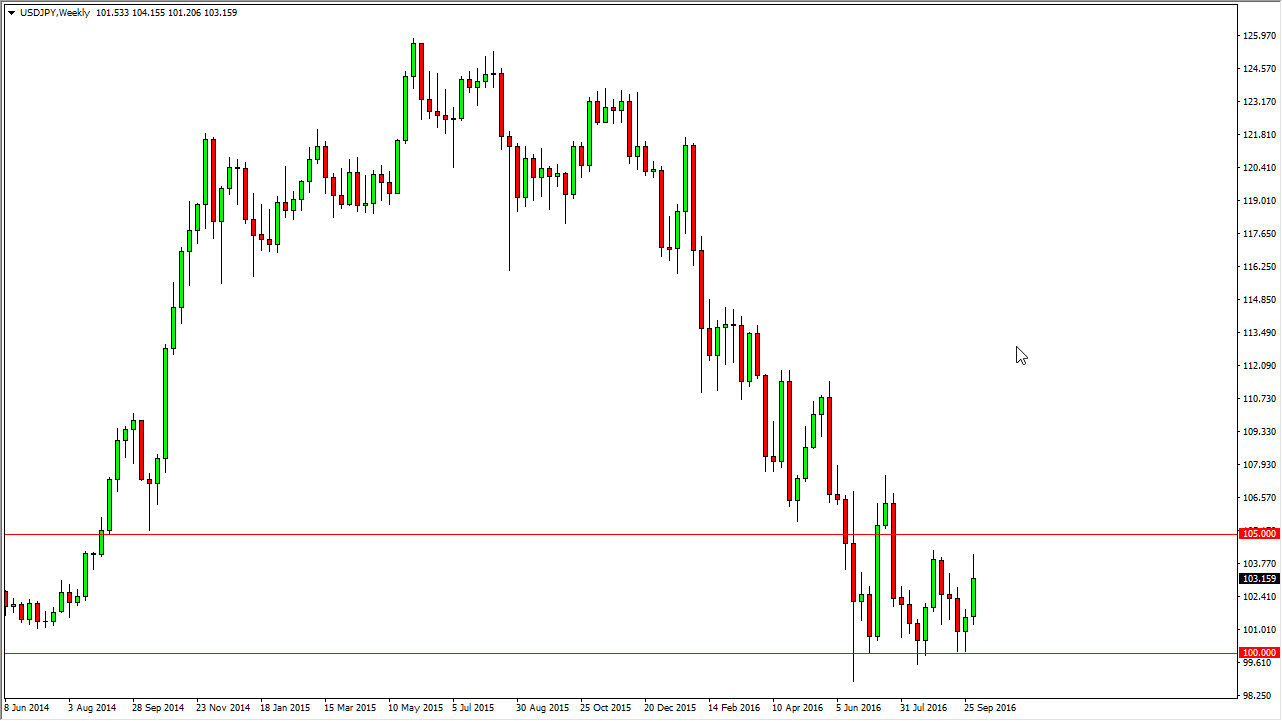

USD/JPY

The USD/JPY market broke higher during the course of the week, testing the 104 level. However, we did pullback a little bit so I feel that it’s only matter of time before the buyers come back every time we pulled back in this market. I believe the 100 level is essentially the “longer-term floor.” I also believe that we will eventually break above the 105 level, but it’s probably not happen this week.

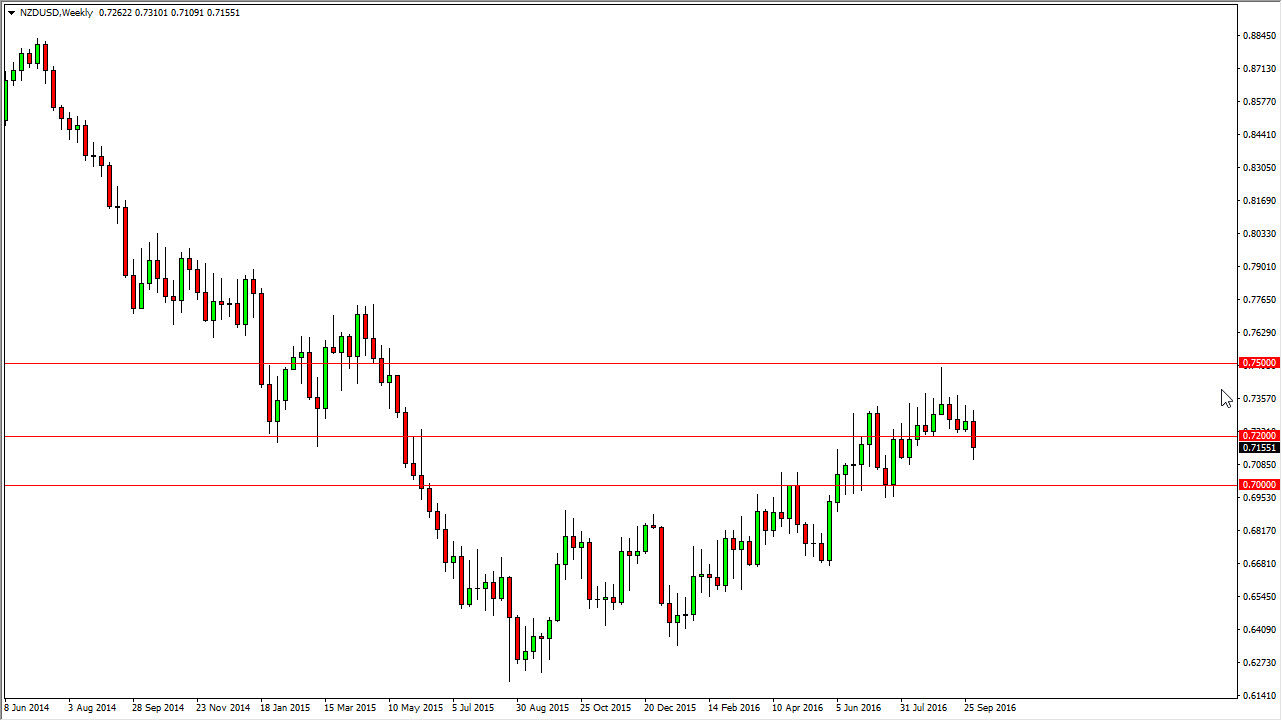

NZD/USD

The New Zealand dollar fell during the course of the week, breaking well below the 0.72 handle. I believe that we are going to grind slowly down to the 0.70 level below, and as a result I am a seller time and time again on signs of exhaustion on short-term charts. I’m not looking for anything major, and I do recognize that a move back above the 0.72 level could be slightly positive.