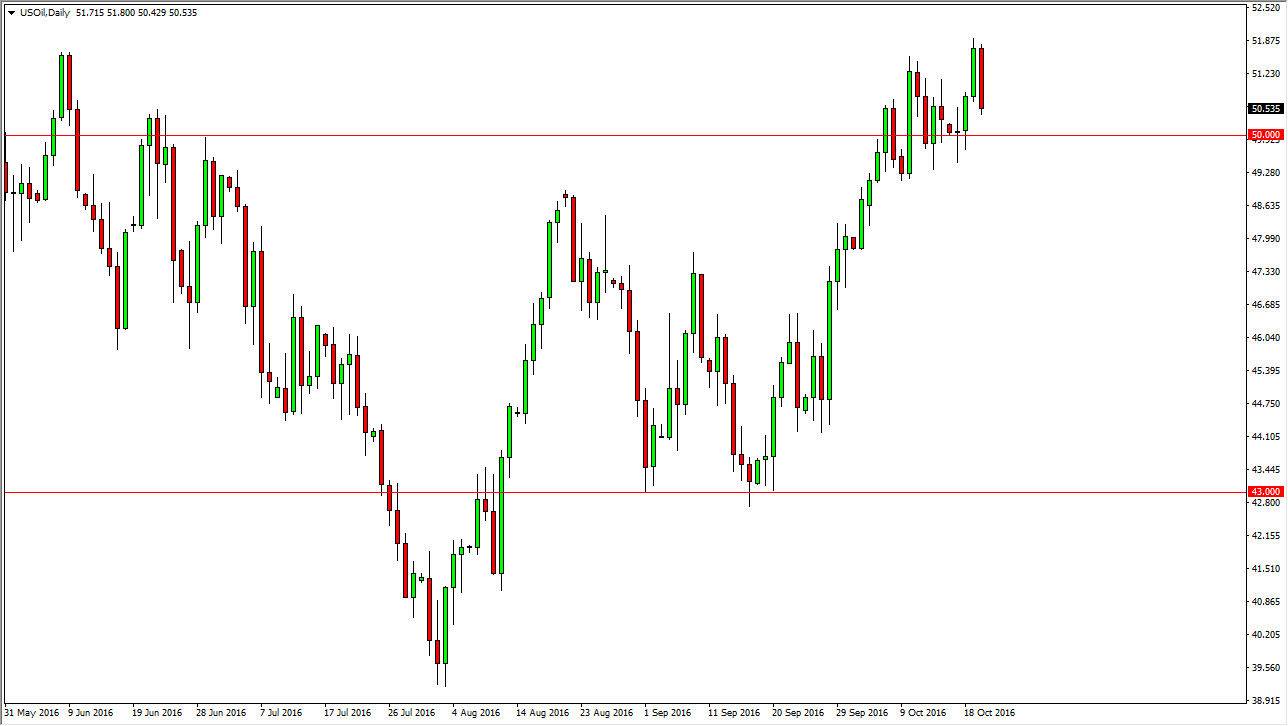

WTI Crude Oil

The WTI Crude Oil market fell during the course of the day on Thursday, as we continue to go back and forth in a very volatile manner. It appears that the $50 level below is going to be the beginning of fairly significant support, and that support could extend all the way down to the $49 level. With this being the case, I believe that it is only a matter of time before we see the buyers return. With this being the case, I feel that a supportive daily candle is reason enough to go long. On the other hand, if we break down below the $49 level I feel that the market will continue to go lower. However, it should be noted that it seems that the buyers overall seem to have control the market, so I would expect the bounce more than anything else.

Natural Gas

The natural gas markets fell during the day initially on Thursday but found enough support to turn things back around and form a bit of a hammer. Because of this, looks as if the market is ready to continue to grind into the upside. We have been overbought for some time, and as a result the pullback was very healthy. The $3 level below I believe is the absolute floor in this market, as the 50-day exponential moving averages hovering around that area, and it is a large, round, psychologically significant number.

If we can break above the top of the hammer, I believe that the market will continue to reach towards the $3.40 level above. That is a large number from longer-term charts, so I think that makes sense as a target. Ultimately, I believe that even if we fall from here it’s only a matter time before the buyers get involved so I’m plane either a break out above the top of the candle for the session on Thursday, or a bounce house it comes.