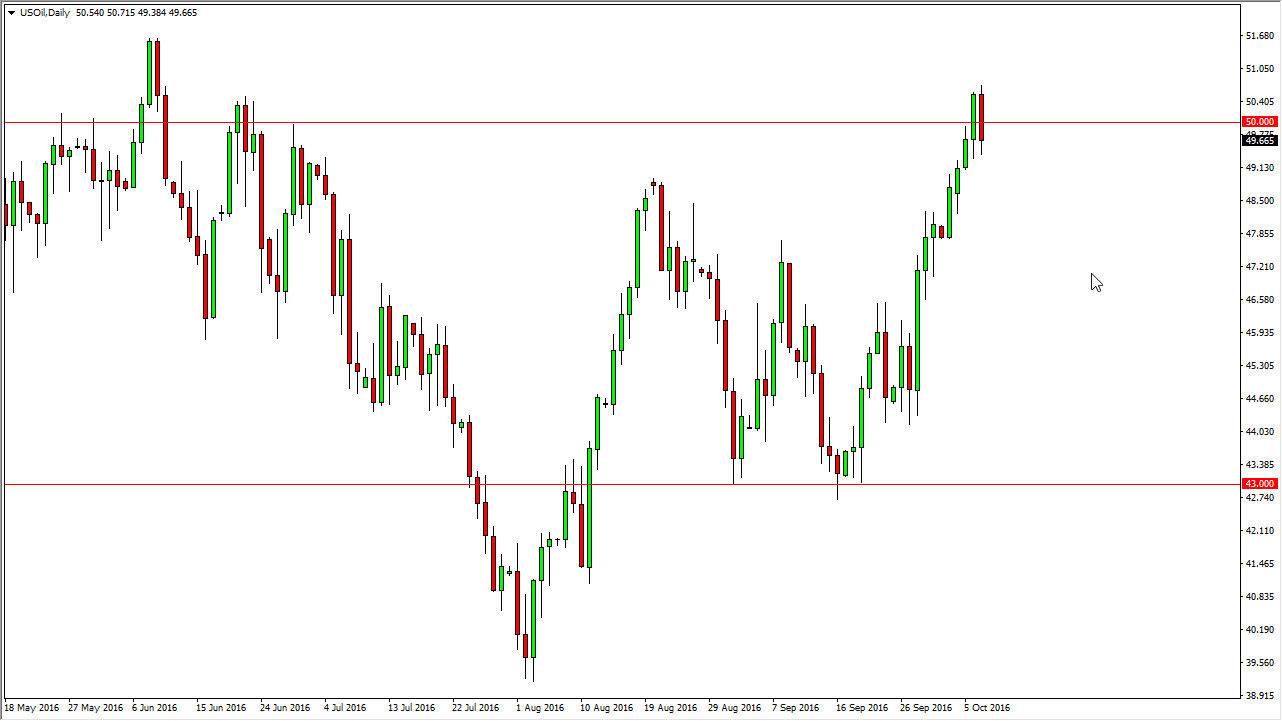

WTI Crude Oil

The WTI Crude Oil market fell a bit during the day on Friday as the jobs number disappointed. Also, the $50 region of course is massively resistive, so having said that I think that it makes sense that we would pull back a little bit from here. A supportive candle below should be a nice buying opportunity. I believe that the $49 level below is massively supportive, and I also believe that a break above the top of the candle for the session on Friday is reason enough to go long as well. Regardless, it’s hard to argue the fact that we are bit overextended at this point in time, as the market has shot straight up over the last couple of weeks.

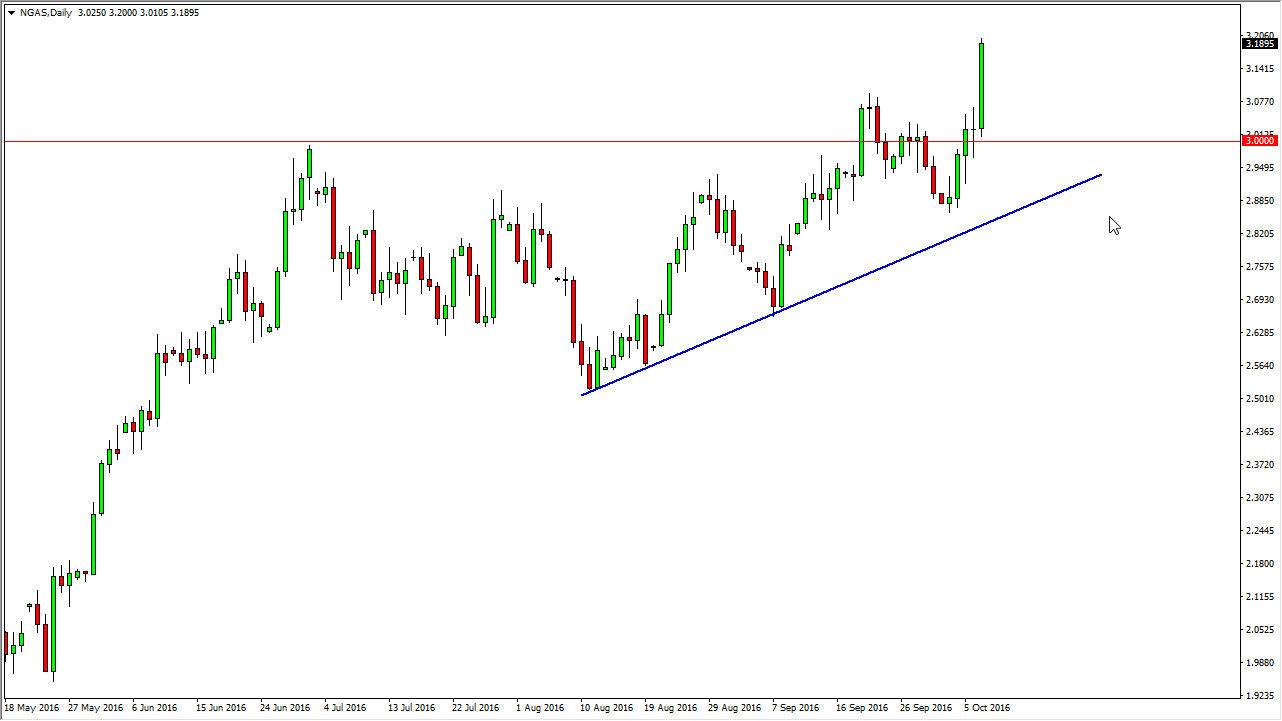

Natural Gas

Natural gas markets absolutely exploded during the course of the session on Friday, as the $3 level continues to offer quite a bit of support, and is essentially the “floor” in this market now that we have made a fresh, new high. I believe that we will then go to the $3.40 level above, which is the longer-term target as far as I can see anyway. After all, it’s been an area of great interest over the longer term, and with that being the case it makes sense that the market would then target that area for longer-term destination.

Pullbacks will have more than enough support below, and as long as we stay above the uptrend line that I have on the chart, I don’t have any interest whatsoever in selling this market as although I wonder about the longer-term feasibility of an uptrend, it certainly seems as if the buyers are in control at the moment. It’s not a matter of even necessarily agreeing with the overall trend, it’s more a matter of not trying to argue with the marketplace.