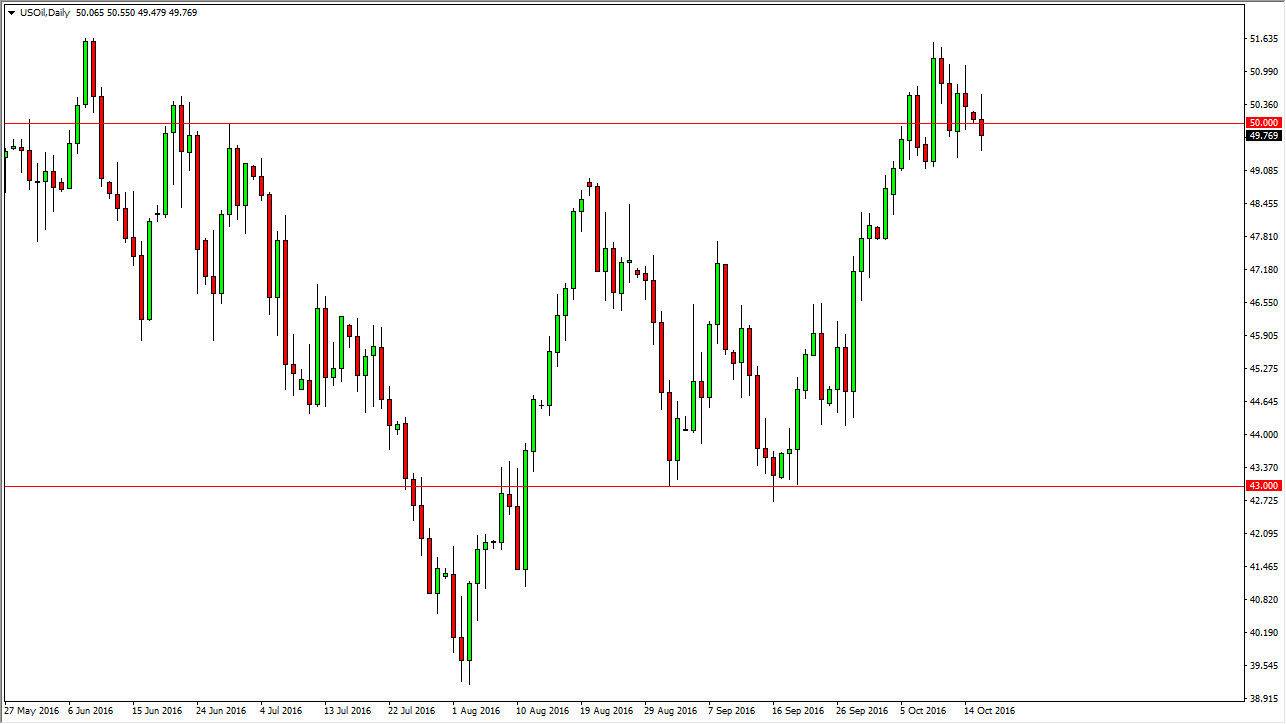

WTI Crude Oil

The WTI Crude Oil market went back and forth during the course of the session on Monday, showing a proclivity to bounce around the $50 level. At this point in time I believe that the markets will continue to go sideways overall, and with that being the case I feel that it’s only a matter time before we returned to the $50 level if we get a little too far in one direction or the other. I have no interest whatsoever in trying to place a larger position at the moment, I feel that there is plenty of support below the $49 level that we would have to break down significantly below there in order to start selling. If we break above the $51.50 level, then I would be willing to buy this market with a little bit more gusto. In the meantime, we are simply going back and forth.

Natural Gas

The natural gas markets went back and forth during the course of the session on Monday after initially gapping lower, and as a result it looks as if the market is trying to find plenty of support below in order to continue the longer-term uptrend. Any pullback at this point in time should be a move down to find support in order to continue the longer-term trend and move to the $3.40 level. The $3 level below is massively supportive and I believe that is essentially the “floor” in this market.

I think that way will continue to be a very volatile situation in this marketplace, and I believe that you will simply have to buy on the dips every once in a while, in order to continue to take advantage of what is the situation that we have in this market. I have no interest in selling though, because we have far too many reasons the think that the markets going to go higher lease in the short-term including the 50-day exponential moving average and of course the uptrend line.