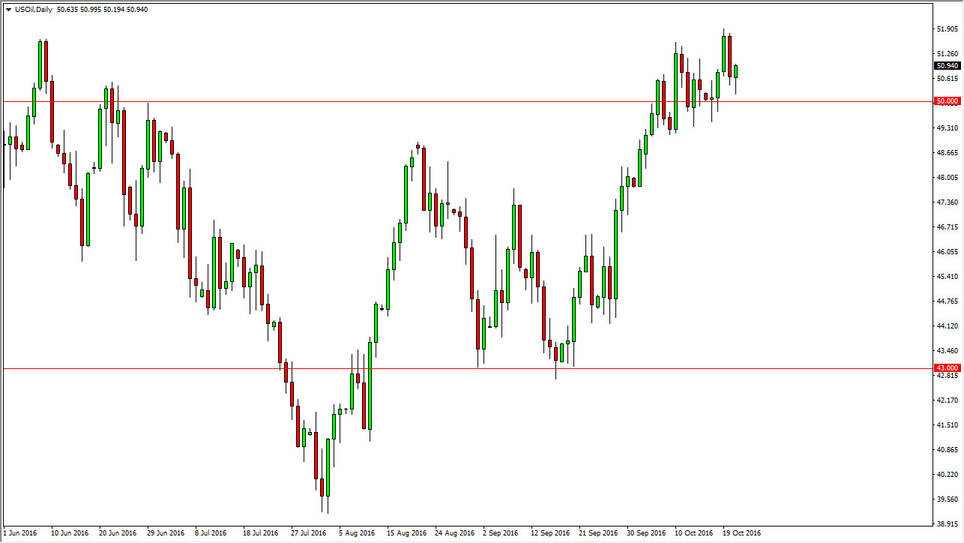

WTI Crude Oil

The WTI Crude Oil market initially fell on Friday, but found enough support at the $50 region to turn things back around and form a hammer. It certainly looks as if the buyers are returning again, and of course the $50 level has quite a bit of a psychological significance to it. We have been in an uptrend for a while now, so it looks as if we are going to continue to see bullish pressure take over. I think that every time we pullback you have to be thinking about buying, at least until we break down below the $49 level which doesn’t look very likely at this point in time. If we did, then I think the market could start to continue to go to the downside but at this point in doesn’t look like it’s anywhere near that.

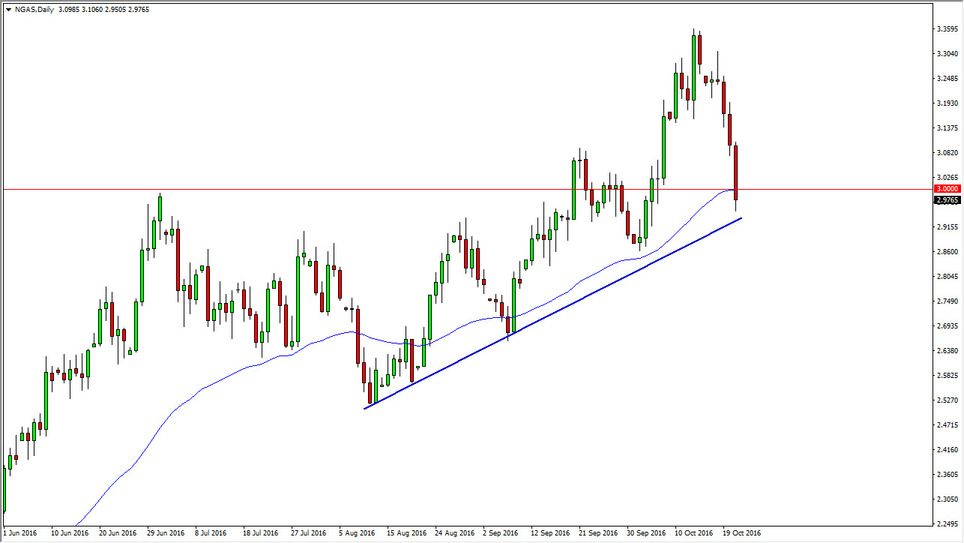

Natural Gas

The natural gas markets fell hard during the day on Friday, slicing through the $3 level. On top of that, we have sliced through the 50-day exponential moving average, and tested the uptrend line. Having said all of that, the uptrend line did hold, which of course is a fairly bullish sign or at least a stable one. With that in mind, I’m looking to buy this market on signs of support or an impulsive candle to the upside. Alternately though, if we broke down below the bottom of this uptrend line, I feel that the market could very well find its way down to the $2.70 level next.

Even though we have seen quite a bit of bearish pressure recently, the reality is that the markets are still in an uptrend. However, I would be the first to admit that being cautious is probably the way to go this point in time, and you may want to wait until you get a daily close that confirms either the weakness or the strength coming back into the marketplace.