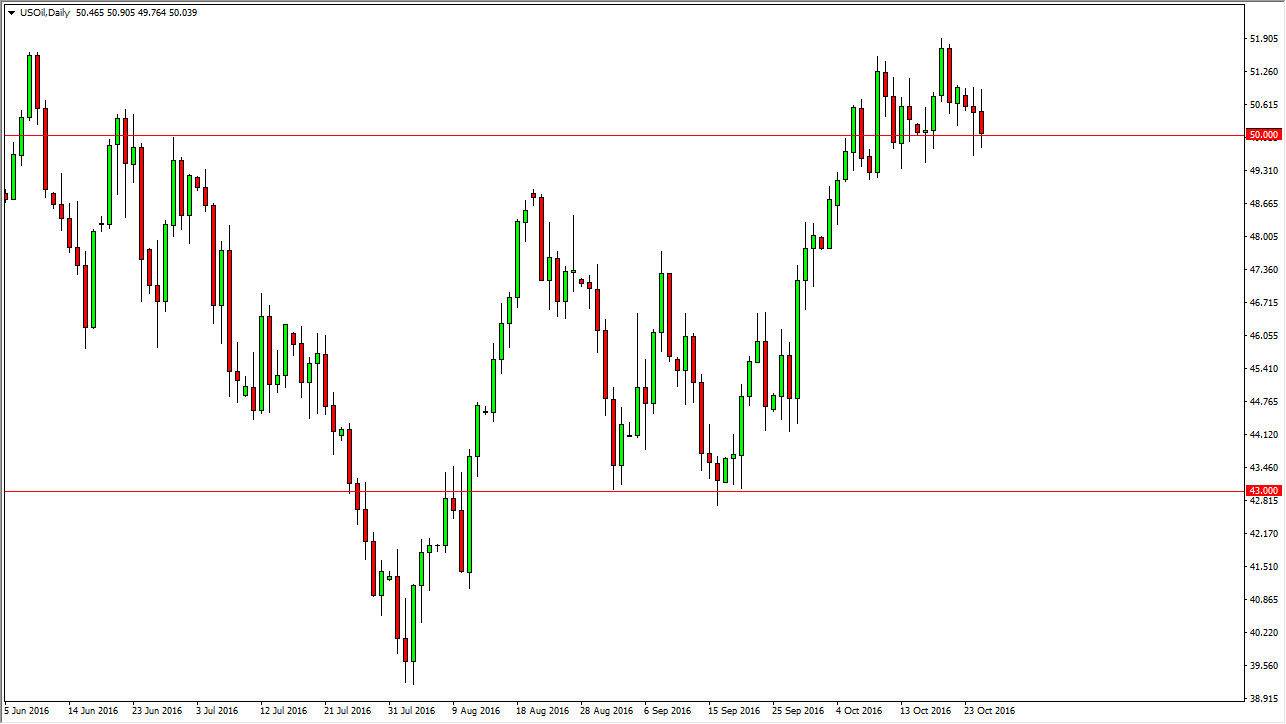

WTI Crude Oil

The WTI Crude Oil market went back and forth during the day on Tuesday but ultimately formed a slightly negative candle. The more important is the fact that the support area between the $50 level on the top and the $49 level on the bottom has held. Beyond that, you have to keep in mind that the Crude Oil Inventories announcement comes out of the United States today, and as a result we will more than likely find some type of volatility from that announcement. If we can break down below the $49 level, we should continue to go lower. On the other hand, we could get a bounce and if we break to the upside with any type of momentum, we could find the market reaching towards the $52 level yet again.

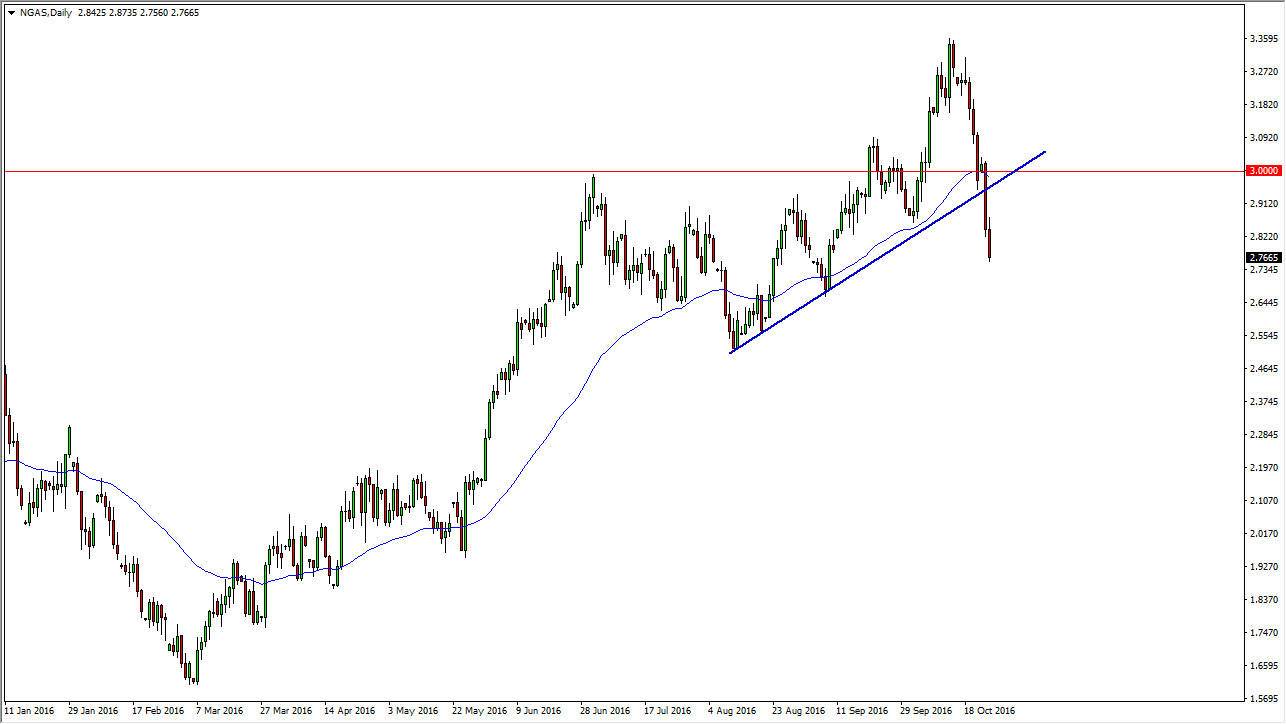

Natural Gas

The natural gas markets continue to look very soft, as we have completely fallen apart over the last 5 or 6 sessions. With this, I believe that every time we rally you have to think that it’s time to start selling, especially if we get some type of exhaustive candle above and near the previous uptrend line or the $3 handle. We are a bit oversold at this juncture, so a bounce would be very welcome news to those of us who are bearish. I think that a short-term rally that show signs of exhaustion is exactly what you want to see in order to go short yet again as this market looks like it can’t get out of its own way.

At this point in time, I think that the target the market will try to reach his $2.50 but it’s going to take some time to get there, because quite frankly we have sold off so rapidly I would anticipate that there would be at least one bounce, if not a couple.