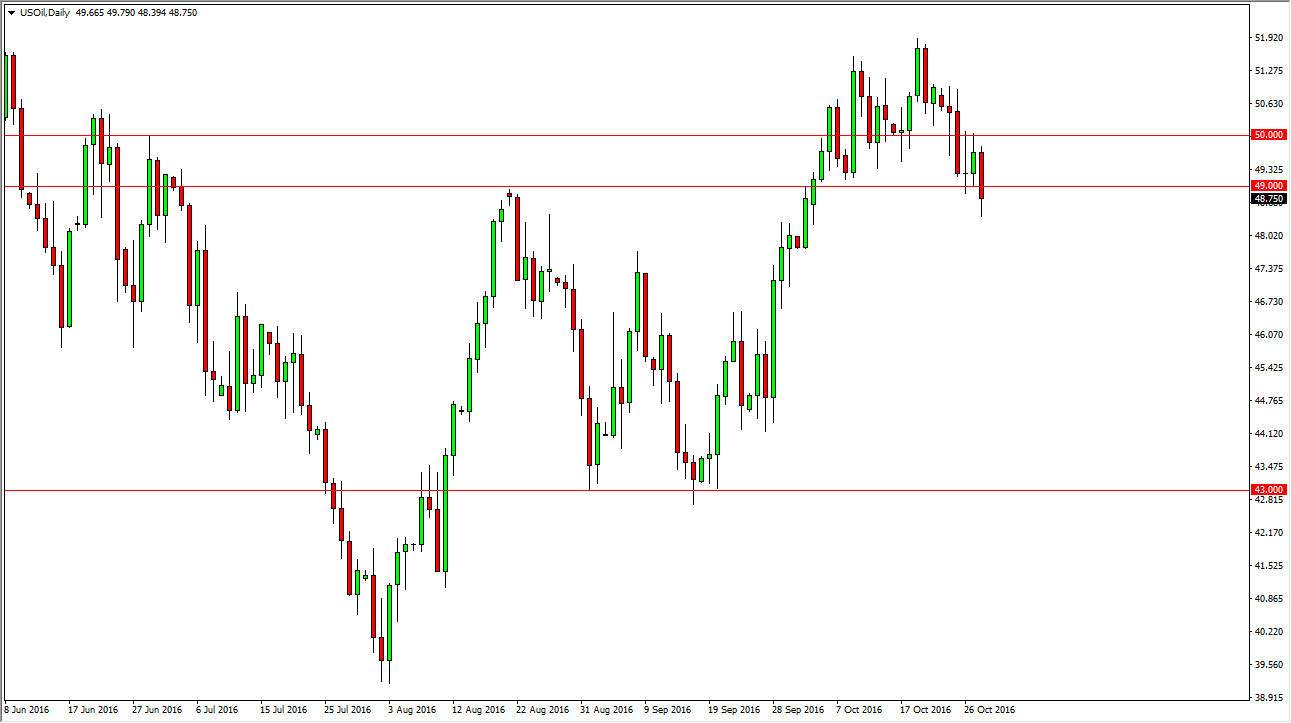

WTI Crude Oil

The WTI Crude Oil market finally broke below the $49 level during the course of the Friday session, and for me that’s a sell signal. I think we will reach down towards the $46 level eventually, and breaking down below here could be a sign that we are starting to roll over yet again. This is a market that I feel has quite a bit of negativity to it down the road, and perhaps traders are starting to pay attention to the oversupply issue that we will almost undoubtedly have. With that being the case, it’s likely that a break below the bottom of the candle for the Friday session should send sellers into the market again, and rallies at this point that show signs of exhaustion can also be selling opportunities. However, if we do turn around and break above the $50 level, I believe that buyers would come back into the fold.

Natural Gas

Natural gas markets of been a massive of the last several sessions as you can see, but during the Friday session we fell initially only to find support yet again at the 50-day exponential moving average and of course the $3 level. Because of this and the fact that we formed a hammer, I believe that the buyers are starting to take over again. There is a lot of noise in this market, see you will have to be able to deal with this type of volatility, but at this point in time, as long as we stay above the uptrend line that I have marked on the chart, it’s difficult to imagine selling this market. After all, the candle from Wednesday was absolutely brutal and resoundingly positive.

At this point, I feel that the $3.30 level will probably be the target, but if we do break down below the aforementioned uptrend line, we could find yourselves reaching back to the $2.75 level.