Today’s WTI Crude Oil Signal

Risk 0.75%

Trade can be taken after 2:30 PM GMT

Short Trade 1

Sell WTI Crude Oil at $48.90

Set stop loss at $50.10

Take profit at $46.50

Set stop loss to break even at $48.00

Long Trade 1

Buy WTI Crude Oil at $50.10

Set stop loss at $48.90

take 1/2 profit at $51.90

Set stop loss to break even at $51.90

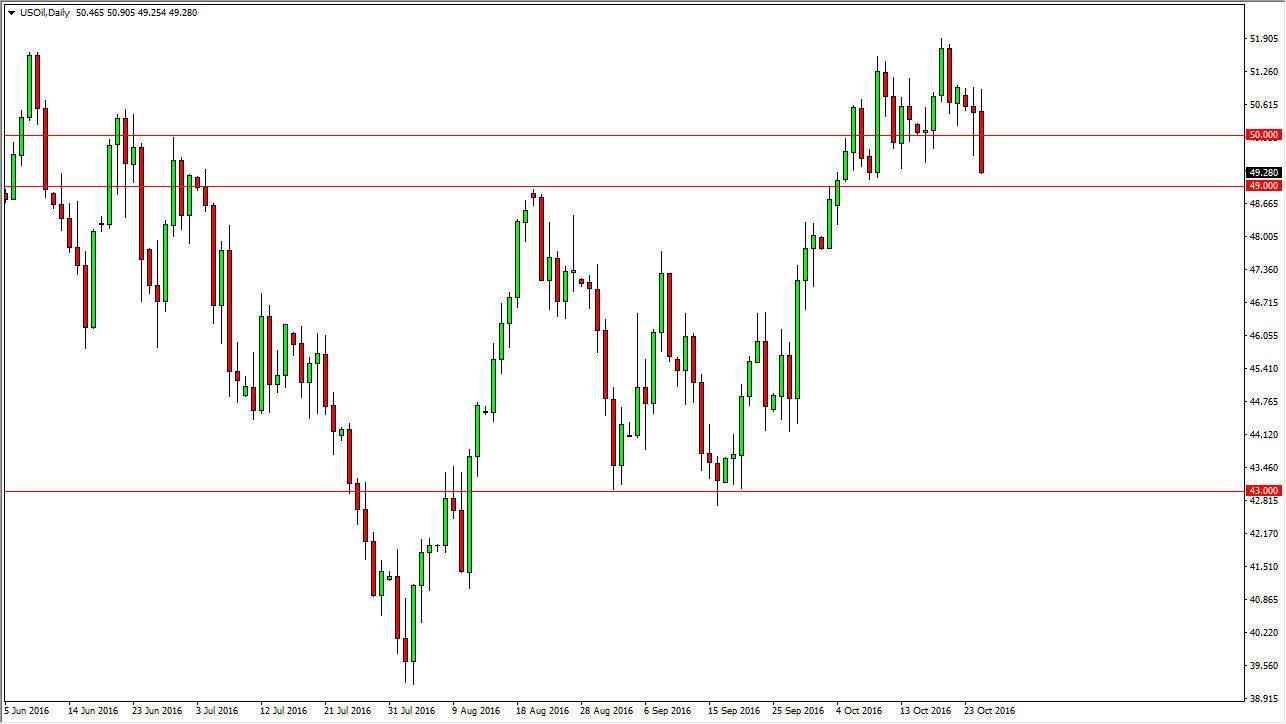

WTI Crude Oil Analysis

The WTI Crude Oil market initially trying to rally during the day on Tuesday, but fell rather significantly as we sliced through the $50 handle. There is still a significant amount of support all the way down to the $49 level, and of course we get the WTI Crude Oil Inventories number coming out at 2:30 PM GMT. If we get a less than expected number, presently believed to be 800,000 barrels, it would be a sign of demand picking up, and should be bullish for this market. On the other hand, if we break down below the $49 level and get a larger build of inventory than anticipated, this market really could start to go lower.