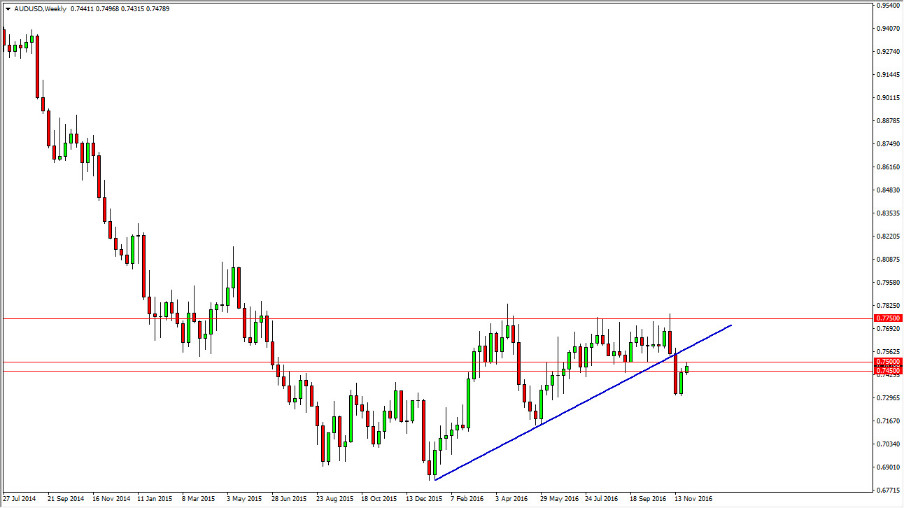

The Australian dollar has had a very volatile last several weeks, and because of this I think we will continue to see quite a bit of pressure in both directions. However, I believe that eventually the sellers will win and it’s in this market much lower. This is predicated upon the fact that the US dollar is stronger in general anyway, and of course the gold markets have fallen quite a bit. I think that if we can pull back below the 0.7450 level, we will almost have to test the 0.73 level underneath that. A break down below there really sends this market lower, perhaps down to the 0.70 level after that.

Gold and its influence

Gold markets of course have a massive influence on the Australian dollar in general, and they look very vulnerable at the moment. We have broken down below the 1200 level, which was a massive support barrier. Ultimately, I think gold markets will fall to the $1100 level and that should send the Aussie looking for the 0.70 level and then possibly even lower levels than that. You have to keep in mind that Australia is completely beholden to gold as far as Forex traders are concerned and also the Asian markets. With Asia looking a bit mixed at the moment, it’s likely that we will continue to see the Aussie be very volatile and deal with quite a bit of uncertainty.

The Federal Reserve looks likely to raise rates sooner rather than later, and simultaneously the Reserve Bank of Australia does look anywhere near ready to do so. Because of this, currency traders will continue to be attracted to the downside of this market. If we managed to break above the uptrend line that I have on this weekly chart that accompanies this article, at that point in time I think the market could rally to the 0.7750 level. Other than that, I have no interest in buying.