AUD/USD Signal Update

Yesterday’s signals were not triggered as none of the key levels were ever hit.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be taken from 8am New York time until 5pm Tokyo time, over the next 24-hours period only.

Short Trade 1

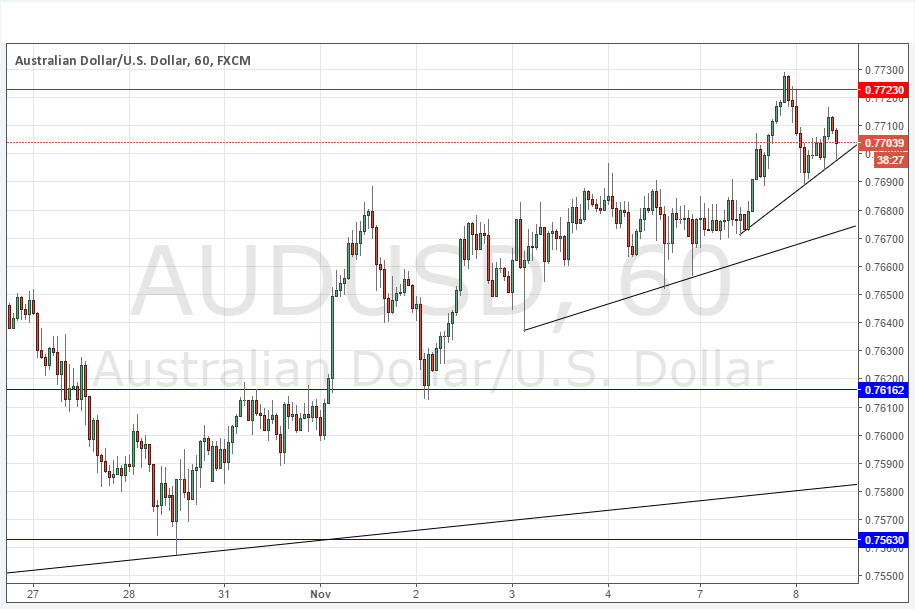

* Go short following some bearish price action on the H1 time frame immediately upon the next touch of the bearish trend line currently sitting at around 0.7723.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trades

* Go long following some bullish price action on the H1 time frame immediately upon the next touch of 0.7616 or 0.7563.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

AUD/USD Analysis

The AUD is starting to look like one of the strongest global currencies, even with good relative strength in the U.S. Dollar which is the other side of this pair. The chart below shows we have drawn higher and higher bullish trend lines, all of which have held. If there is a reason for the bullishness, it would be the prospect of a Clinton victory being good for risk currencies such as the AUD, it is also in a long-term upwards trend which will make traders more confident about buying it. The AUD generally might be a good buy during the near future.

There is nothing due today regarding either the AUD or the USD, except the U.S. Presidential Election.