AUD/USD Signal Update

Last Monday’s signals might have produced a profitable long trade following the bullish rejection of the support level identified at 0.7450.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be entered between 8am New York time and 5pm Tokyo time, over the next 24-hours period.

Short Trades

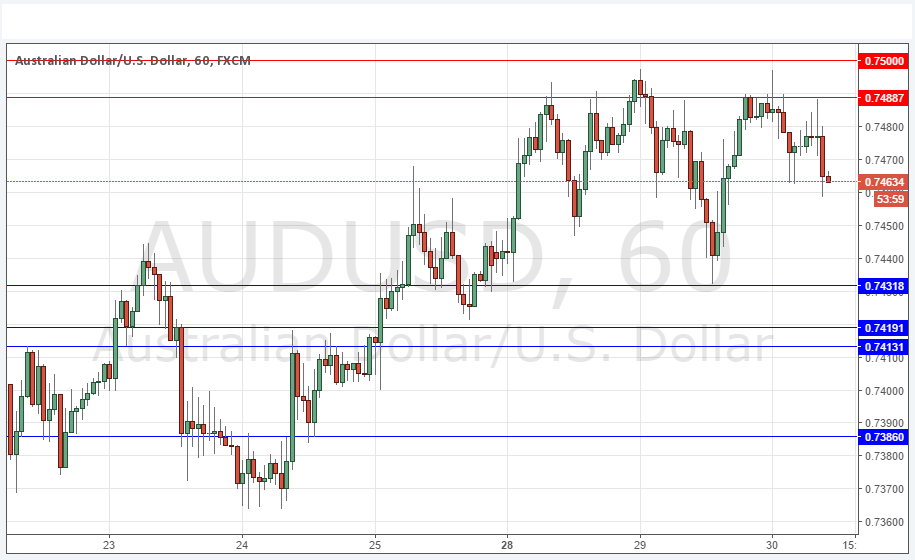

Go short following some bearish price action on the H1 time frame immediately upon the next entry into the zone between 0.7489 and 0.7500.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trades

Go long following some bullish price action on the H1 time frame immediately upon the first touch of 0.7432, 0.7419 or 0.7413.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

AUD/USD Analysis

The AUD has been one of the stronger currencies or recent weeks, but the area around the psychologically key level at 0.7500 is proving to be just too strong for this pair to break. However, there is keen buying when the price gets below 0.7450, so if the USD does suffer a major deep pull back in the near future, we are quite likely to see enough bullishness to break 0.7500 although it will probably be well defended.

Concerning the USD, there will be a release of the ADP Non-Farm Employment Change at 1:15pm London time, followed later by Crude Oil Inventories at 3:30pm. Regarding the AUD, there will be a release of Private Capital Expenditure data at 12:30am.