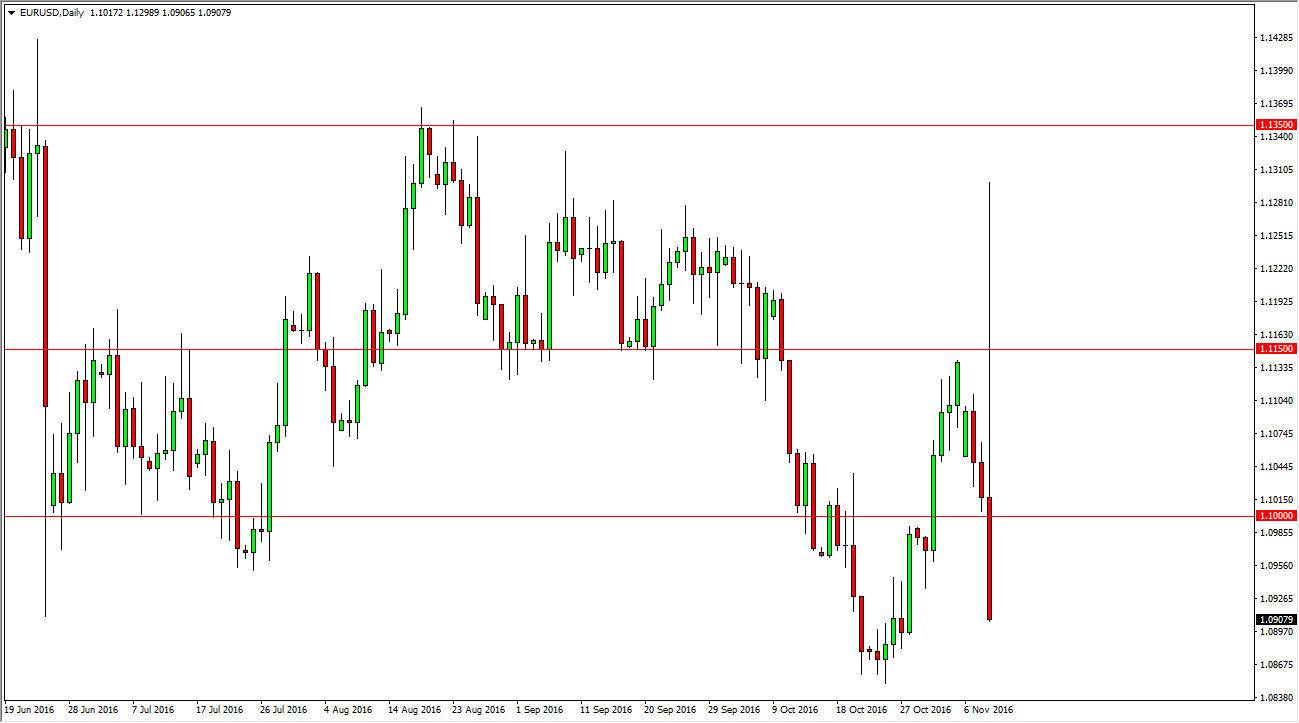

EUR/USD

The Euro initially rallied during the day on Wednesday, reaching all the way to the 1.13 level above. This was in reaction to the surprise selection of Donald Trump as the president of the United States, and can’t the market well off guard. However, you can see that we turn right back around and formed a massive hammer. It looks as if traders are starting to focus on the fact that the US environment for business could very well be strong and Donald Trump is known as wanting higher interest rates. This could put pressure on the Federal Reserve to start hiking soon. A break down below the 1.08 level below would send this market down to the 1.05 level given enough time. This is one of the most bearish candles I’ve ever seen in my 10 years of trading, and as a result I am very bearish and I believe that short-term rallies offer selling opportunities again and again.

GBP/USD

The British pound initially tried to rally during the day on Wednesday, but found the area above the 1.25 level to be massively resistive, so we ended up falling to form a shooting star. The shooting star is very negative, and I believe that we will continue to go lower, perhaps reaching to the 1.22 handle below. A break above the top of the shooting star is a very nice buying opportunity in my estimation, but just for the short-term. I think that we will find the 1.2850 level to be far too resistive to continue going higher. Ultimately, this market will probably continue to reach towards the 1.20 level below. That is a massive support level that should continue to offer quite a bit of trouble for sellers, but I do think eventually we will break down below there based upon what we are seeing in the US dollar in general.