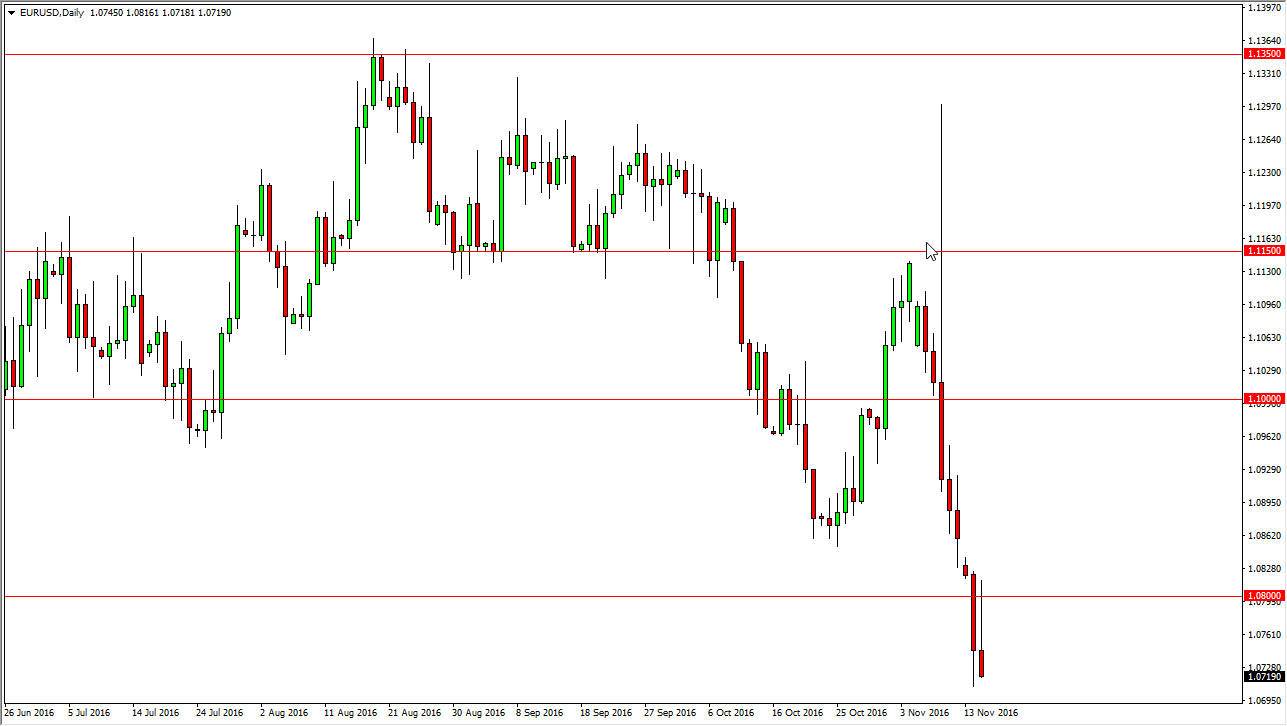

EUR/USD

The EUR/USD pair rallied initially on Tuesday, but found the 1.08 level above to be far too resistive. Trade around to form a shooting star of course is a negative sign, and I believe that the selloff of the Euro continues. However, this is a market that has been a bit oversold so you may have to look to short-term charts for rallies that can be sold. Even if we break above the top of the shooting star, I still believe that there is quite a bit of resistance above. Given enough time, I believe that the market is reaching down to the 1.05 level, which has been massive support on the longer-term charts. With all of the concerns about the European Union at the moment, it is no surprise to me that we continue to see the US dollar strengthen against the Euro itself.

GBP/USD

The British pound fell on Monday, but did see a little bit of support near the 1.24 level. At this point, it looks as if the British pound is trying to rally, but it is a very volatile market. I have no interest whatsoever in trying to sell this market, nor do I have any interest in buying it. At least not at the moment. I think that any rally above will sooner or later form an exhaustive candle that we can search selling. On the other hand, if we break down below the 1.2350 level, I feel that the British pound could drop to the 1.21 handle, and then eventually the 1.20 level underneath there. That level should be massively resistive, but could give way, and if it does that would be very negative. I think at this point in time, it’s probably best to stand on the sidelines when it comes down to the British pound in general, as there so much to take in after the exit vote.