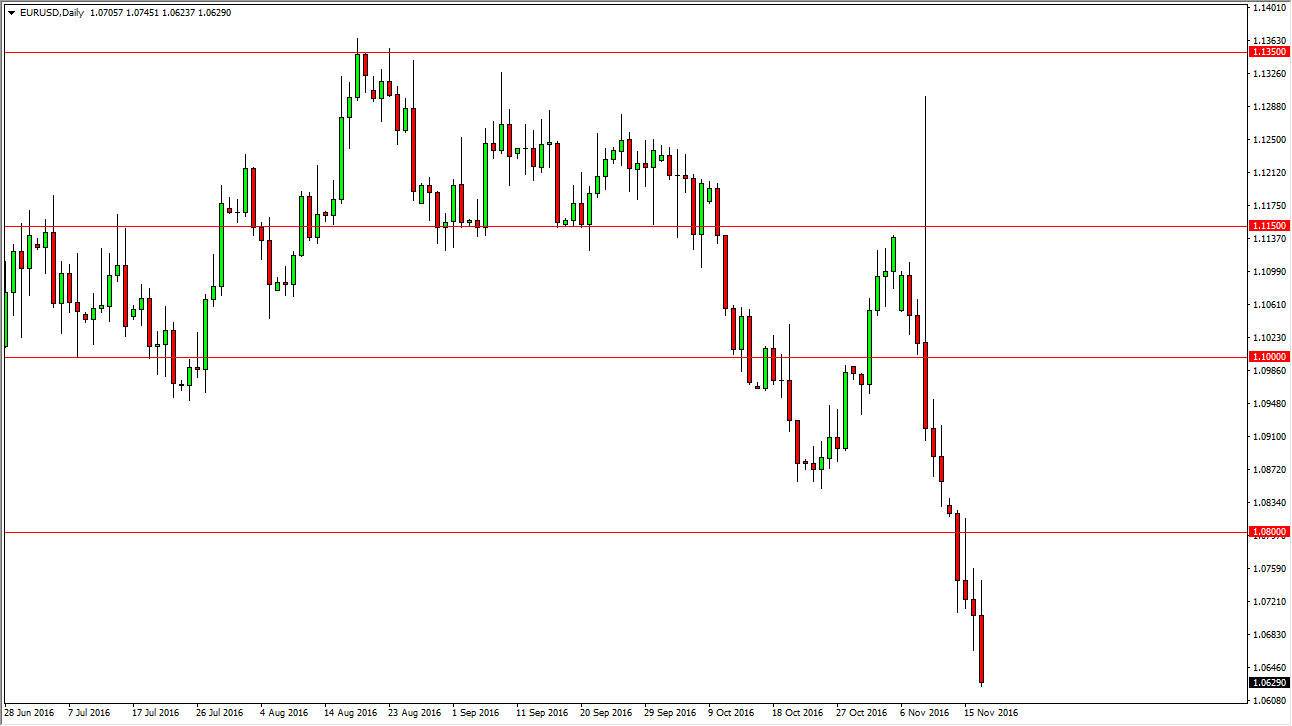

EUR/USD

The Euro continues to slide as the Thursday session initially saw buyers enter the market, and then the market roll over completely. It looks like the 1.05 level being tested is all but a foregone conclusion at the moment, but with the overextension of the selling pressure, I prefer to see short-term rallies that I can sell on signs of exhaustion. I think that the 1.08 level above is essentially the absolute “ceiling” of the market at the moment, and I have no interest in buying. I do recognize that we will probably bounce significantly off the 1.05 level as it is such a large, round, psychologically significant number and has been so supportive in the past. However, I think that the situation in this market is getting rather dire, and I fully anticipate that we will break down below that level and reach parity given enough time.

GBP/USD

The British pound try to rally on Thursday but found the 1.25 level to be far too resistive to overcome. Because of this, we ended up forming a shooting star which is a very negative candle. However, I also recognize that there is a lot of support just below so I think what we are going to see is general choppiness going forward, with a slightly downward bias. If we can break down below the 1.2350 level I feel that we will reach to the 1.21 handle given enough time, and then eventually the 1.20 level. Have no interest in buying the British pound at this point, think there’s far too many issues with it currently and I certainly wouldn’t be buying it against the US dollar which of course is the most favored currency in the Forex world recently as well. Because of this, I remain short but still need to deal with a bit of volatility.