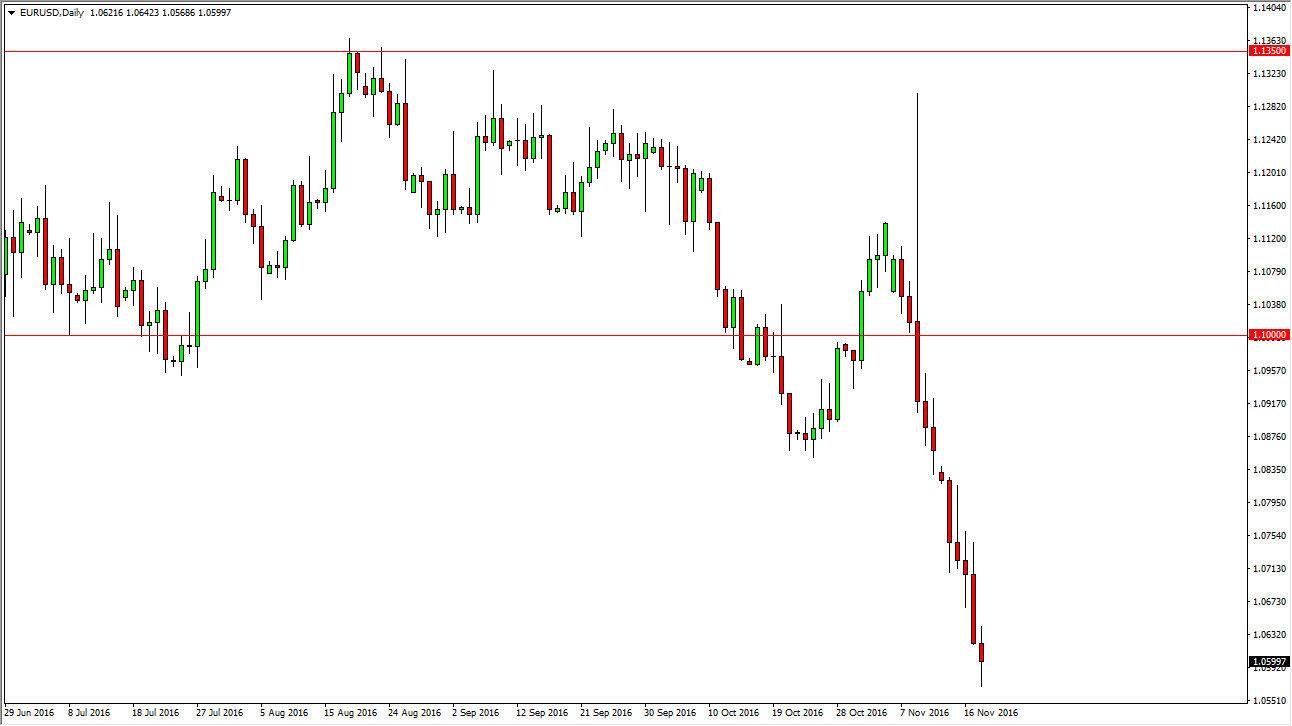

EUR/USD

The Euro continues its descent against the United States dollar, as we are now obviously reaching towards the 1.05 level. Having said all of that, the market did bounce a bit towards the end of the day on Friday as traders took profit. I think that a bounce could be coming but that bounce should only offer selling opportunities as the Euro has been so soft. The US dollar is without a doubt the favored currency around the world right now, so I do think that it’s only a matter time before we break down. Once we break below the 1.05 level, there isn’t going to be too much to stand in the way of the Euro trading it parity. I have no interest in buying, as I believe the issues in the European Union continue to cause problems.

GBP/USD

The British pound fell on Friday as well, testing the 1.23 handle during the day. We did bounce a little bit towards the end of the session, so at this point I think the easiest trade to take would be a break down below the bottom of the range for the day, as it should signal that we’re going to continue to go lower, perhaps reaching down to the 1.21 handle. I think there is a massive amount of support between the 1.21 handle and the 1.20 handle below there, so it won’t necessarily be an easy thing to do, that is breaking down. However, if we do break down below the 1.20 level I feel that the next target will be the 1.15 handle as it has been so prominent on the monthly charts as support.

Any rally at this point in time should be a selling opportunity as we continue to see exhaustion time and time again. The US dollar is favored over most currencies around the world and with all of the uncertainty around the British economy, I cannot think that the British pound would be any different.